Tron Price Forecast: TRX founder Justin Sun announces collaboration with Solana Blockchain

- Tron price edges slightly down around the $0.23 level on Wednesday after rallying nearly 12% in the last two days.

- TRX founder Justin Sun announces the upcoming expansion with Solana blockchain.

- The technical outlook suggests a rally continuation, targeting the $0.27 mark.

Tron (TRX) price edges slightly down, trading at $0.23 on Wednesday after rallying nearly 12% in the last two days. The recent announcement by TRX founder Justin Sun regarding Tron's upcoming expansion with the Solana blockchain has sparked excitement and fueled the current rally. The technical outlook suggests a rally continuation, targeting the $0.27 mark.

Justin Sun announces collaboration with Solana blockchain

Tron founder Justin Sun announced on Tuesday that the TRX token will soon be on the Solana blockchain. This news has generated excitement in the crypto community, causing TRX to surge nearly 8% that day, anticipating wider adoption of the TRX on Solana, interoperability, faster transactions, and attracting interest from investors and traders.

Integrating Solana could unlock new possibilities for decentralized finance (DeFi) applications and non-fungible tokens (NFTs), making TRX more attractive to developers and users. This could lead to increased liquidity and broader adoption of the TRX token.

TRX will be soon on solana. Ready to buy and collaborate

— H.E. Justin Sun (@justinsuntron) March 18, 2025

Tron Price Forecast: Bulls aim for $0.27 mark

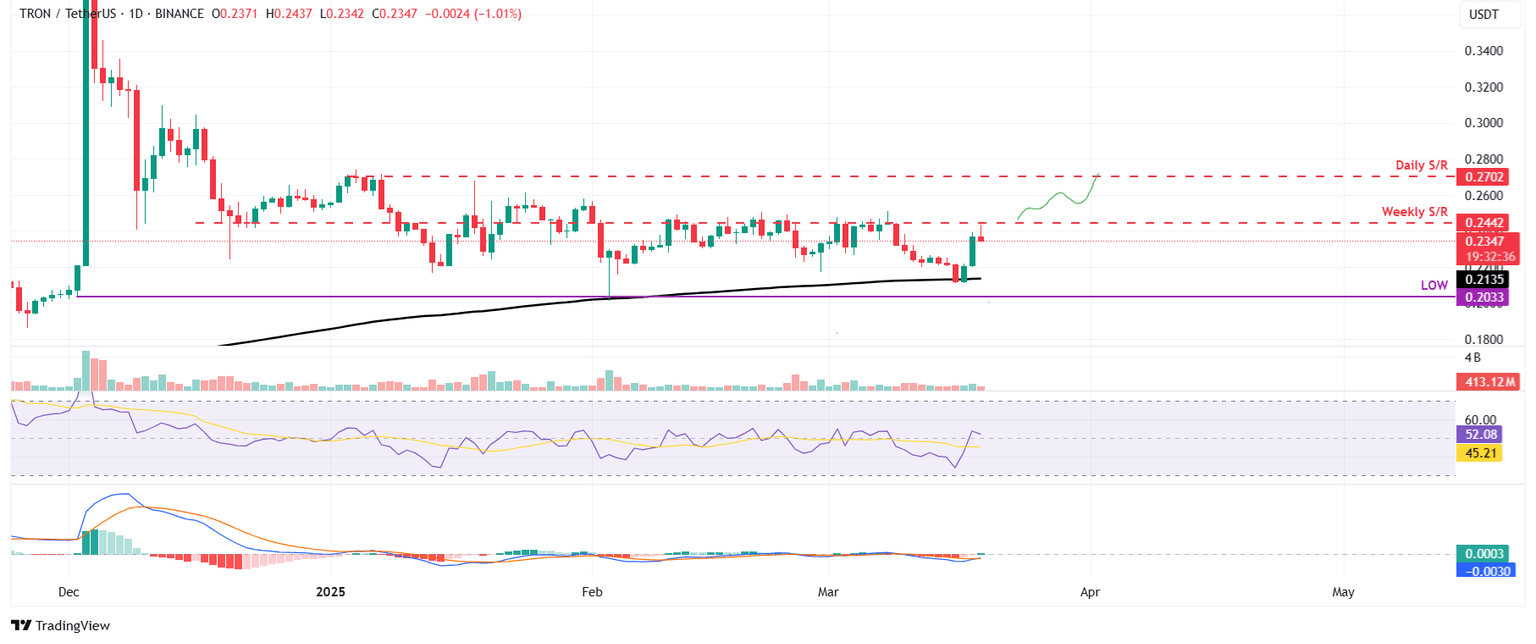

Tron price retested and found support around the 200-day Exponential Moving Average (EMA) at $0.21 on Monday and rallied 7.43% the next day. At the time of writing on Wednesday, it faces rejection from its weekly resistance level at $0.24 and trades around $0.23.

If TRX breaks and closes above its weekly resistance at $0.24, it could extend the rally to retest its next daily resitance at $0.27.

The Relative Strength Index (RSI) on the daily chart reads 52, above its neutral level of 50, indicating bullish momentum. The Moving Average Convergence Divergence (MACD) indicator also flipped to a bullish crossover on Wednesday, giving buy signals and suggesting a bullish trend ahead.

TRX/USDT daily chart

However, if TRX fails to find support around the 200-day EMA at $0.21 and closes below it, Tron could extend the decline to retest its December 2 low of $0.20.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.