Tron outperforms Ethereum and Polygon on this front but still fails to chart new 2023 highs

- Tron has observed significantly higher daily active users; 1.7 million across the chain against the likes of Ethereum, BNB chain and many others.

- Consequently, the number of on-chain transactions also exceeds Ethereum by nearly seven times.

- Tron price is still struggling to observe decent gains, trading at $0.066 even as Bitcoin price crosses $30,000.

Tron has established itself as a core Decentralised Finance (DeFi) chain and has also managed to do the unthinkable by surpassing Ethereum in some ways. However, beyond the usage of Tron’s native token, TRX is still struggling to leave a positive mark on the chart.

Tron leads in daily active user count

Tron has emerged as a capable DeFi chain with over $5.5 billion in total value locked (TVL) across its 17 protocols. In comparison, Arbitrum, with over 280 protocols, has only $3 billion in TVL, while Binance’s BNB Chain has only $6.5 billion locked with nearly 580 protocols.

The appeal that it generates in the DeFi market has pushed its adoption significantly in the spot market as well. As per analysis, the daily active users on Tron sit at 1.7 million, outshining the likes of Ethereum, BNB chain and Polygon, with each having 317,000, 1.1 million and 387,000 daily active users, respectively.

Tron daily active users

However, the chain’s exceptional performance is not limited to simply gaining the attention of the users but also to their participation in the network. On-chain data noted that the daily transactions on the network sit at a little over 1 million for Ethereum, while Tron processes close to 7.7 million transactions. But even though the chain usage is garnering the attention and presence of the users, it is not reflected in the asset’s price action.

Tron daily transactions

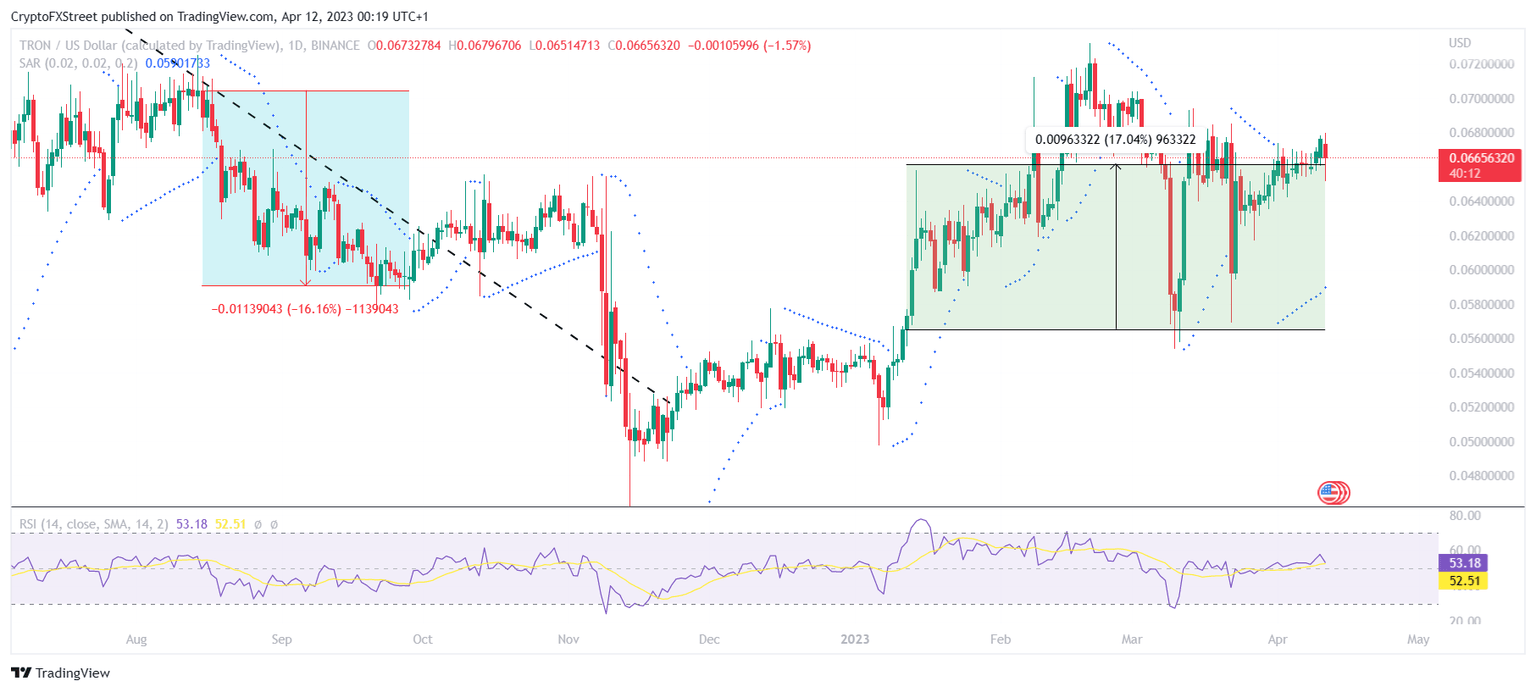

Tron’s native token, TRX, in the last three months, has only noted an increase of 17.04% in its price, which is significantly lower in comparison to ETH. The world’s second-biggest cryptocurrency breached the $1,900 mark for the first time in eight months and charted a new year-to-date high following a 43% rally.

TRX/USD 1-day chart

One reason behind this could be the purpose of the cryptocurrency, which limits its real-world use cases. TRX is used only on the Tron network to pay the content creators, consequently gaining no attention apart from this and trading. Ethereum, on the other hand, is used as a payment system for verifying transactions, justifying its presence and movement on wallets.

Moreover, TRX mostly sits in wallets until a major event occurs, such as the FUD of Tron founder Justin Sun’s arrest in Hong Kong earlier on April 11. Even then, the intra-day trading hours’ volatility was minimal, as noted in the 2% decline of the cryptocurrency.

Thus while Tron might be winning in terms of usage, Ethereum is winning in terms of use cases and demand which, at the end of the day, impacts the value of the entire network.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.