Top Gainers: Starknet, Zcash, Artificial Superintelligence Alliance drive crypto recovery

- Starknet ticks higher for the third straight day by 10% on Thursday, with bulls aiming for a Pivot Point breakout.

- Zcash approaches the $700 mark after an 8% rise on Wednesday as momentum indicators remain mixed.

- Artificial Superintelligence Alliance exceeds the 200-period EMA and a resistance trendline on the 4-hour chart, aiming for further gains.

Starknet (STRK), Zcash (ZEC), and Artificial Superintelligence Alliance (FET) are outpacing the short-term recovery in the cryptocurrency market, posting double-digit gains over the last 24 hours. The privacy coins and Artificial Intelligence (AI) token regain strength, aiming to extend the recovery further.

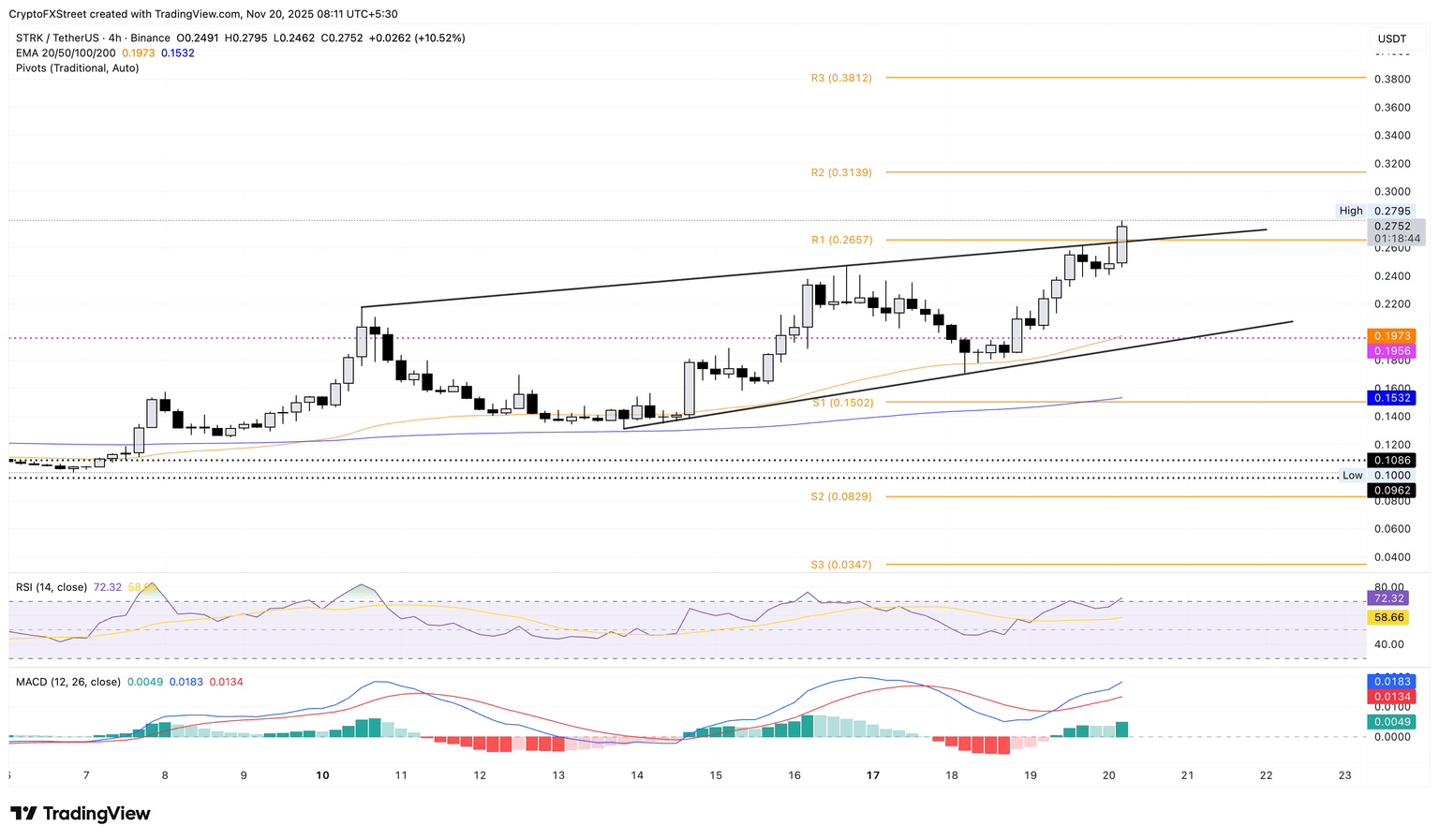

Starknet prepares for a potential breakout rally

Starknet edges higher by 10% at press time on Thursday, extending the 21% rise from the previous day. The zero-knowledge-based Ethereum layer-2 recovery exceeds a local resistance trendline on the 4-hour chart, marking the highest trading price since February 2.

The privacy coin trades above the R1 Pivot Point at $0.2657 on the same chart, as the Relative Strength Index (RSI) at 72 enters the overbought zone, indicating strong buying. If STRK holds a decisive close above $0.2657, it could target the R2 Pivot Point at $0.3139.

Corroborating the upside, Moving Average Convergence Divergence (MACD) extends the uptrend with rising green histogram bars suggesting a rise in bullish momentum on the 4-hour timeframe.

If STRK fails to hold the momentum, it could retest the 50-period Exponential Moving Average (EMA) at $0.1973.

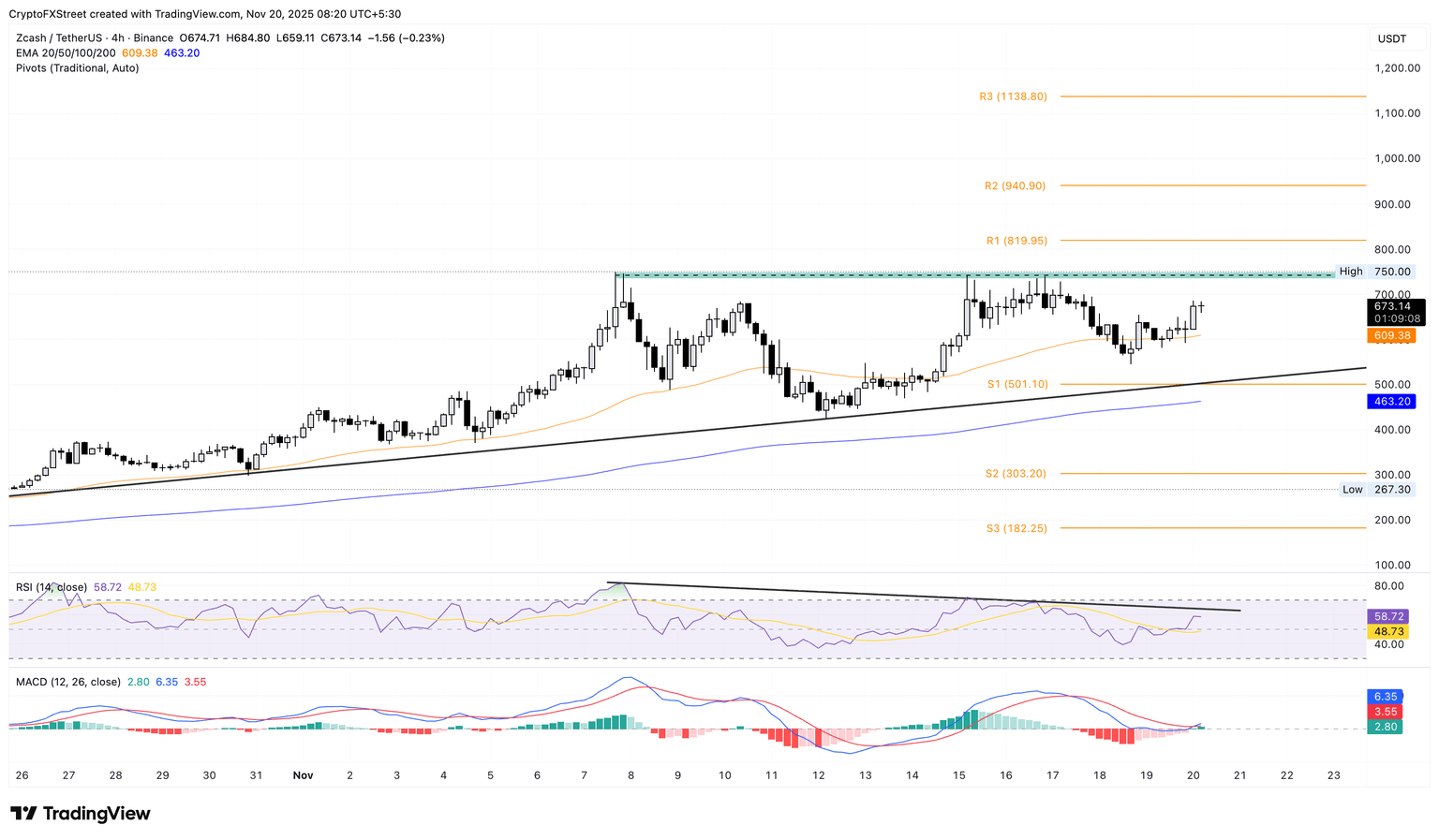

Zcash recovery aims to rechallenge the $750 resistance

Zcash trades above $670 at the time of writing on Thursday, extending a rebound from the 50-period EMA on the 4-hour chart towards the $700 mark. However, the critical resistance for the privacy coins lies higher at the $750 supply zone, which has remained intact since November 7.

The upswing in ZEC prices marks a trend shift with the MACD crossing above its signal line, indicating renewed bullish momentum. However, the declining RSI, currently at 58, reflects underlying weakness in buying pressure.

If ZEC flips before crossing $700, it could test the 50-period EMA at $609 or the S1 Pivot Point at $501 if the correction extends.

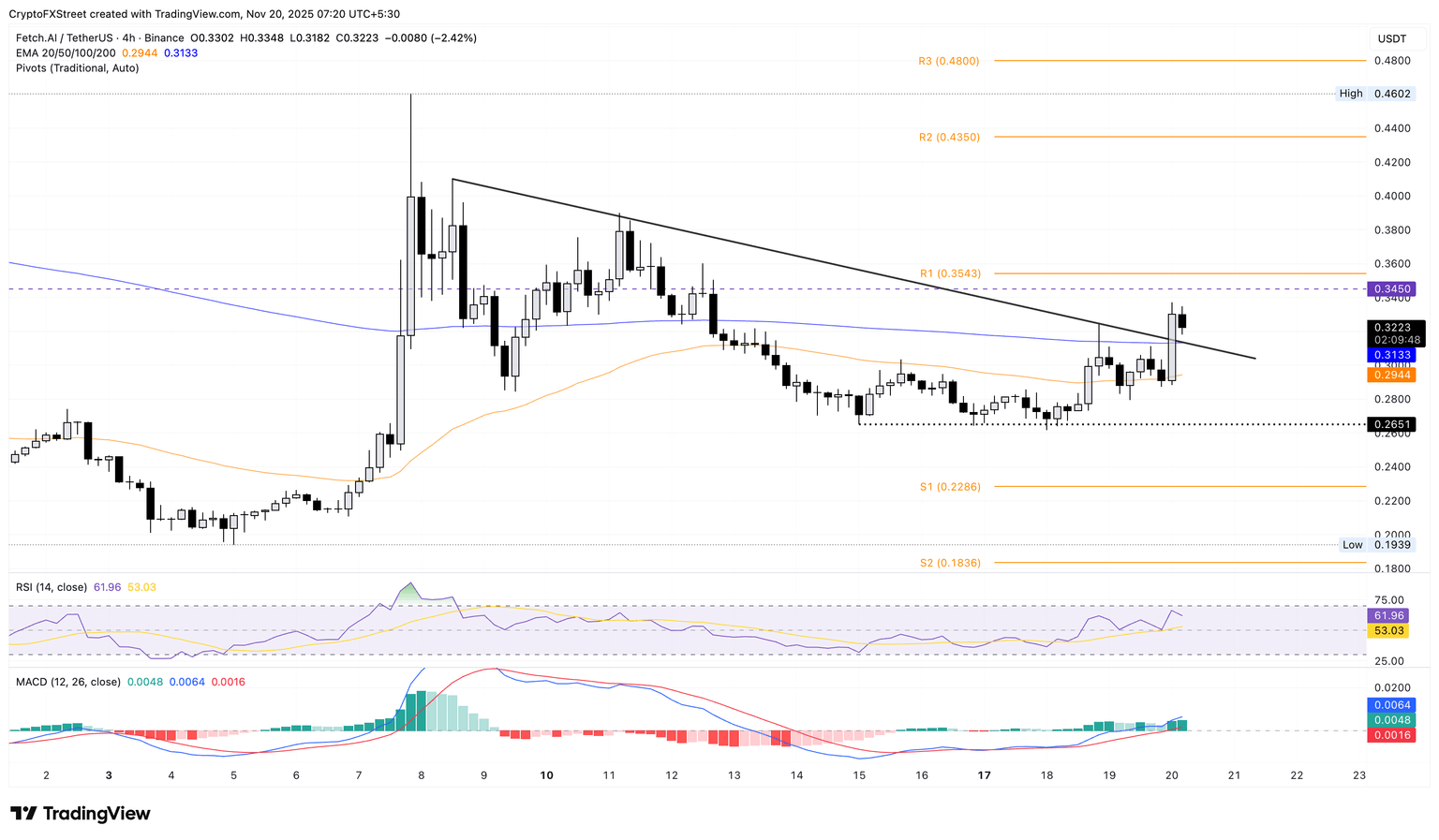

Artificial Superintelligence Alliance remains vulnerable in a retest

Artificial Superintelligence Alliance token drops 3% by press time on Thursday, after recording 10% gains on the previous day. Still, the intraday pullback could be a retest of the resistance trendline breakout on the 4-hour chart, formed by connecting the highs on November 8 and 18.

A potential post-retest rebound in FET could target the R1 Pivot Point at $0.3543.

The momentum indicators on the 4-hour chart indicate bullish strength, as the MACD rise remains steady, with successively higher green histogram bars. Additionally, the RSI at 61 approaches the overbought zone with a fluctuating uptrend as buying pressure rises.

On the flip side, if FET slips below the 200-period EMA at $0.3133, it would nullify the trendline breakout, risking the 50-period EMA at $0.2944.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.