Top 3 price prediction Bitcoin, Ethereum, Ripple: Some roads lead to the moon, hysteria to hell

- The market goes into a non-logical mode and blurs the bullish route.

- People turn their backs on the crypto market just when the industry is embracing it.

- Technically, we are still waiting for a strong movement to shake up the current general atony.

The mood of the crypto market in these last hours moves between fear and depression, a journey that also involves stops at anxiety and doubt.

According to a recent study, the number of Google searches on Bitcoin and Ethereum has plummeted and dropped more than 94% in the week.

The crypto market has always been hyper-reactive to the price movements, with uncontrolled euphoria followed by disorderly panic, unreasoned hopes with senseless despair.

Now it is happening again, but from a trader's point of view, it is powerfully striking that despite this intense pessimism floating in the atmosphere, prices remain more than 100% above the lows of a year ago.

There are also bearish arguments based on opposite sentiment strategies due to the high number of bullish positions and also bearish targets for Bitcoin in the $5,000 zone.

But it's not all bad news.

As general public interest has declined this year, the number of developers involved with projects based on blockchain technology, mainly in Ethereum, has increased.

Moreover, almost at a daily rate, we have news about the involvement of governments and central banks in new projects on national electronic currencies and new regulatory proposals.

If it were not for the crypto hysteria evident in the media, mine first, I would say that the matter is not as bad as some would have us believe.

The ones that have the potential of the blockchain universe very clear are the Chinese politicians and industry leaders. The global giant certainly does not support anonymous cryptocurrencies, even though a whopping 66%! of the hash rate installed in the Bitcoin network is concentrated behind the Great Wall.

The Chinese government declared that they believe in the blockchain revolution and that they want to lead this new revolution, and for now, it seems that only Europe is reacting from the institutional point of view.

In the US, the legislative initiative remains in the hands of each state of the union. The Federal Government attacks Facebook aggressively for its Libra project and the advances in favor of the adoption of the new technology come from the private sector.

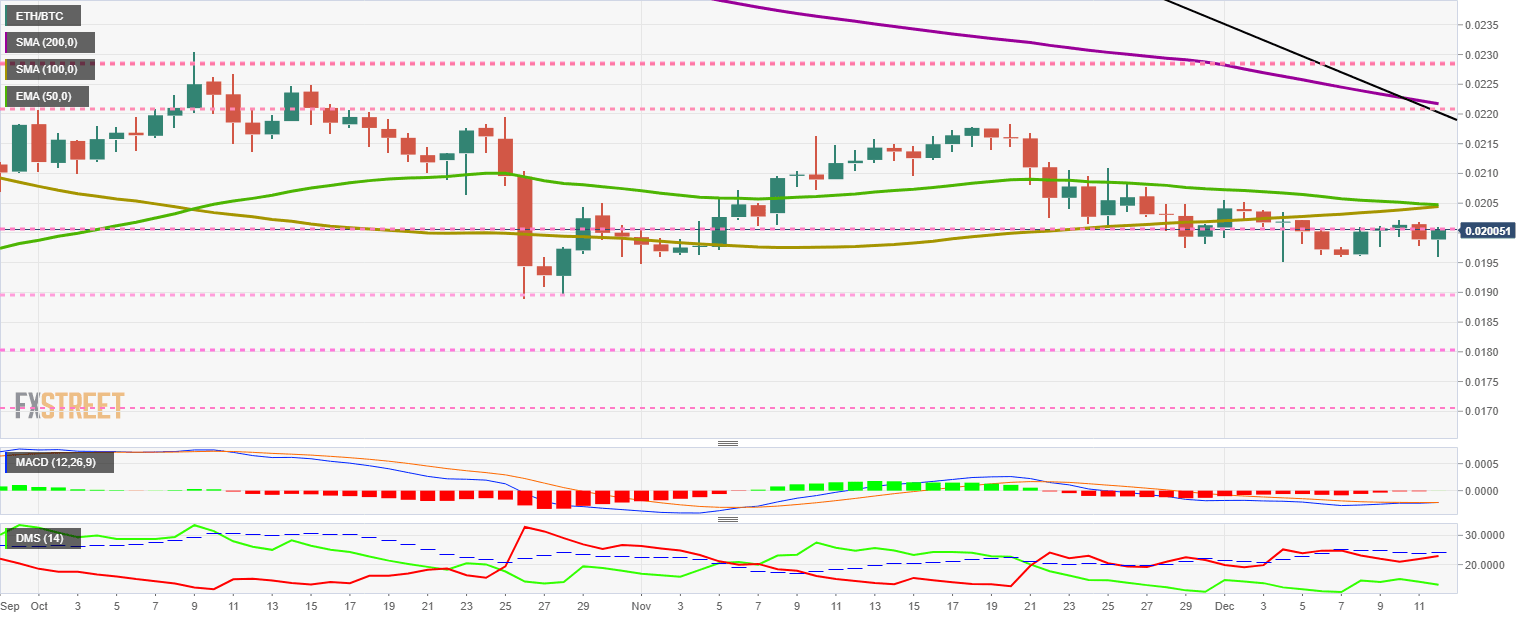

ETH/BTC Daily Chart

The ETH/BTC cross is currently rising above 1% and reaches the price level of 0.020051.

I have already stated in several articles my conviction that the next bull market of the cryptomarket will be led by the bullish movement of the ETH/BTC pair.

Earlier this week, I highlighted a necessary short-term move in this pair, so I will pay special attention to the cross between Ethereum and Bitcoin in the upcoming hours and days.

Above the current price, we can find two major obstacles. The first is at the price level of 0.0205, where the SMA100 and the EMA50 pass. The next key level is at 0.0222, where the SMA200 and the long term bearish line converge. Finally, and only above the resistance level of 0.0227, the ETH/BTC pair would move up very strongly.

Below the current price, the risks are obvious. The first support level is at 0.019, then the second at 0.018 and the third one at 0.017.

The MACD on the daily chart begins to show a full bullish cross, with a profile that augurs that the move will not be fast.

The DMI on the daily chart shows the bears recovering but not getting past the ADX line again, which takes away credibility from the bearish side. The bulls also do not increase their strength, so it seems that indecision is the guide of the current moment.

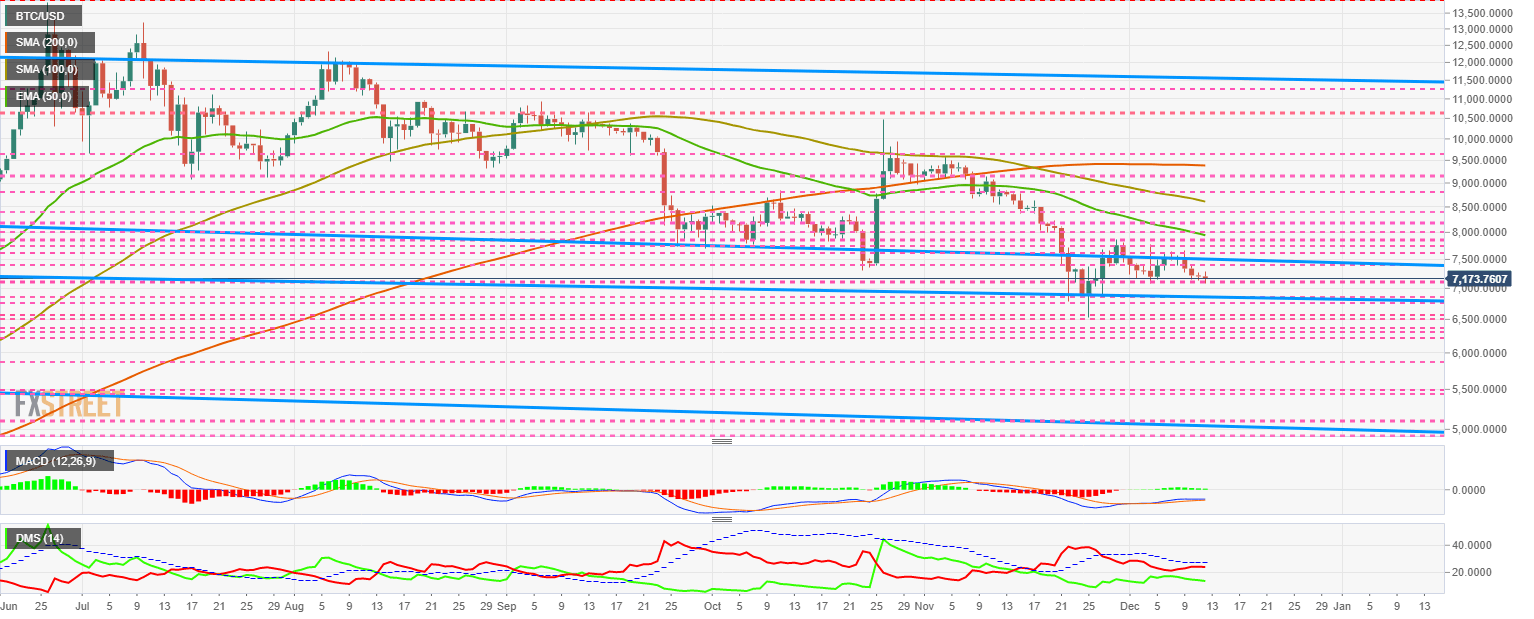

BTC/USD Daily Chart

The BTC/USD pair is currently trading at the price level of $7,173 and holds at the support level of $7150.

Above the current price and speaking exclusively of critical levels, the first resistance level is at $7,500, then the second at $7,930 and the third at $8,640.

Below the current price and speaking of crucial levels, the first support level is at $6,840, then the second at $6,500 and the third one at $5,000.

The DMI on the daily chart shows bulls very well positioned to attack bear leadership.

The market is playing on paths that start together but end in opposite directions.

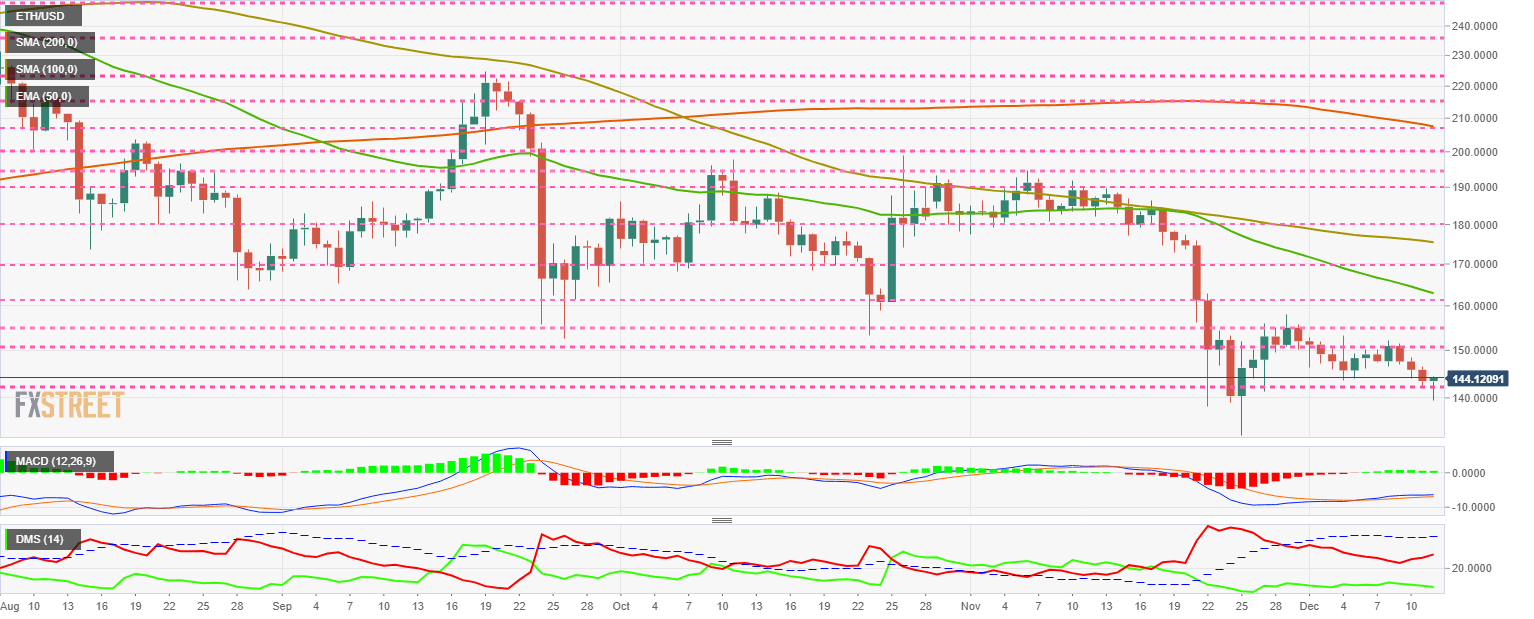

ETH/USD Daily Chart

The ETH/USD pair is currently trading at the $144.12 price level and it is recovering from bad times early in the day. At this point, he draws the figure of a hanging, a typical technical turning figure.

Above the current price, the first major resistance level is at $155, then the second at $161 and the third one at $175.

Below the current price, the first critical support level is at $130, then the second at $125 and the third one at $120.

The DMI on the daily chart shows the bulls at the same lows as in recent weeks. The bears, on the other hand, gain strength again and get an excellent bullish profile, dominating the pair with ease.

XRP/USD Daily Chart

The XRP/USD pair is currently trading at the $0.2205 price level and recovers some of the losses early in the day.

Above the current price, the first resistance level is at $0.23, then the second at $0.245 and the third one at $0.255.

Below the current price, the first support level is at $0.21, then the second at $0.19 and the third one at $0.17.

The MACD on the daily chart shows the best bullish profile among the TOP 3. It has retained the slope and openness between the lines, so a change in the market that would bring in fresh money would be very positive for the XRP/USD pair.

The DMI on the daily chart shows the bulls at their lowest level since the last week of November, without any upward reaction. The bears gain a bit of momentum and stay a long way ahead of the buyer side.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Author

Tomas Salles

FXStreet

Tomàs Sallés was born in Barcelona in 1972, he is a certified technical analyst after having completing specialized courses in Spain and Switzerland.