Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Crypto markets set to recover after recent flash crash

- Bitcoin price recovery is in effect and suggests it could extend up to $53,687.

- Ethereum price eyes retest of $4,500 and $4,660 as markets recovery after December 4 flash crash.

- Ripple price locks in on the $1 psychological level as it hovers around $0.688.

Bitcoin price is currently consolidating after a minor recovery from the brutal sell-off on December 4. The recent uptick in buying pressure has pushed BTC higher, and altcoins have followed suit. Going forward, investors can expect Ethereum, Ripple and others to continue heading higher.

Bitcoin price vies to climb

Bitcoin price dropped from roughly $57,000 to nearly $40,000 less than a day, starting December 4. This flash crash pulled the entire market down, causing liquidations across the board. However, investors were quick to buy the dip, leading to quick recovery to $46,700.

While this short-term uptick is currently stabilizing around $49,010, investors can expect a further climb in BTC price to the first critical hurdle at $53,687. This move would constitute a 10% upswing.

Beyond which are a lot of underwater investors, with a majority of them hovering around the $60,000 psychological level. Therefore, the upside for BTC remains capped at roughly $53,000.

BTC/USD 4-hour chart

If Bitcoin price fails to produce a higher high above $48,950 and makes a run for the $50,000 psychological level or higher, it will indicate that the buyers are exhausted. In this case, if the big crypto produces a lower low below $46,698, market participants can expect the Bitcoin price to retest $40,867.

A breakdown of this barrier will invalidate the bullish thesis.

Ethereum price holds up

Ethereum price sliced through the $4,000 psychological level and retested the $3,400 barrier. Due to the quick buying pressure, ETH recovered to $3,890 and is currently trading at $4,170. Investors can expect the smart contract token to continue its upswing toward the $4,500 hurdle after a 6% ascent.

In some cases, Ethereum price could extend to retest the $4,659 resistance level, representing a 12% climb from the current position.

ETH/USD 4-hour chart

While things are looking up for Ethereum price, a breakdown of the $3,890 support level will trigger a 12% crash to $3,400. A lower low below this foothold will invalidate the optimistic narrative for Ether.

Ripple price struggles below vital barriers

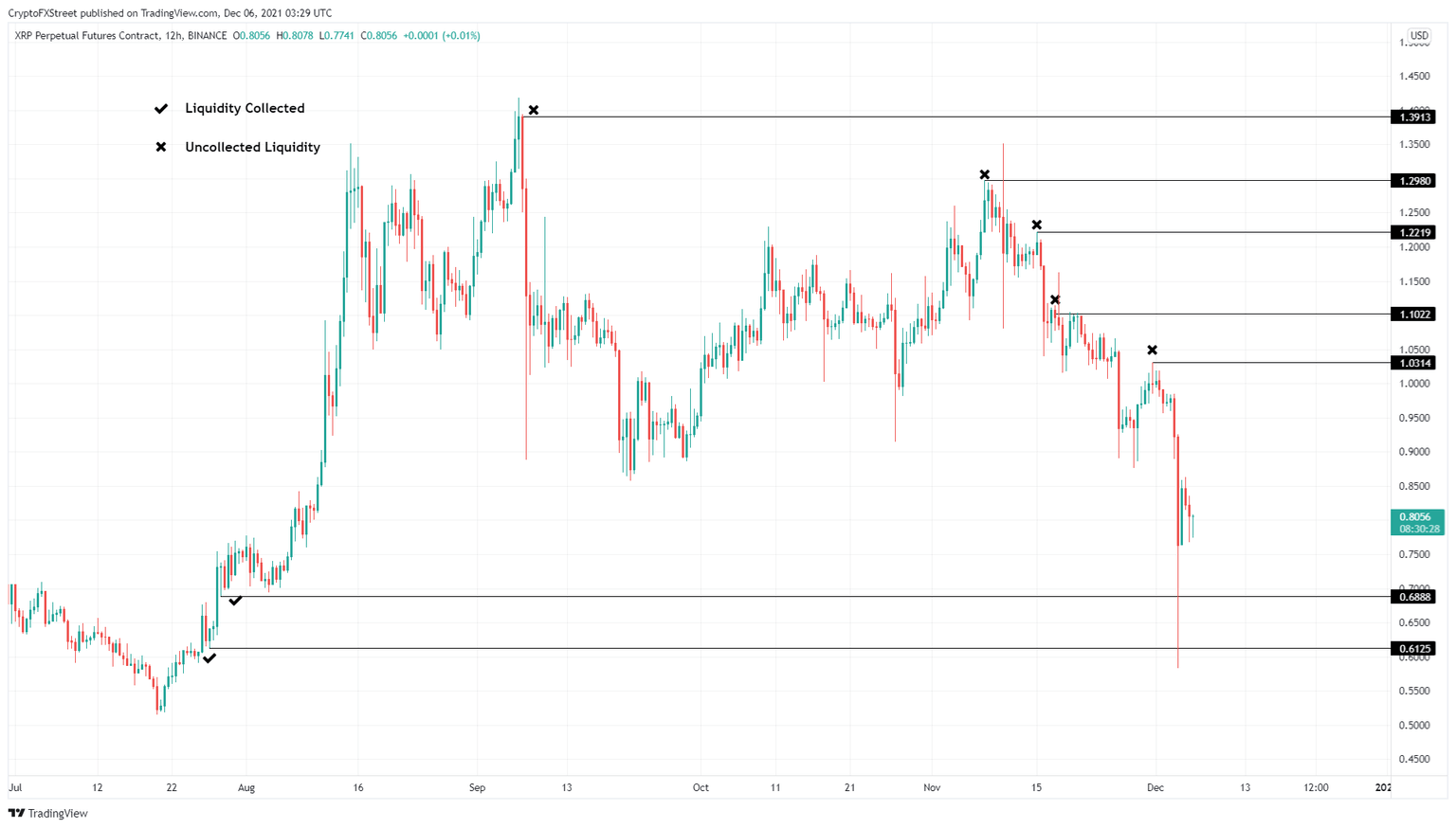

Ripple price sliced straight through the $1 psychological level and produced a swing low at $0.583 as the cryptocurrency markets took a dive on December 4. While this initial downswing was steep, recovery is currently in progress.

So far, XRP price has climbed to $0.789 and eyes to keep this going. Investors can expect the remittance token to rally at least 30% before it retests the $1 psychological level and heads to collect the liquidity resting above the immediate resistance barrier at $1.03.

XRP/USD 12-hour chart

On the contrary, if Bitcoin price fails to rally and proceeds to crash again, investors can expect Ripple price to follow suit. In this situation, the XRP price could revisit the $0.688 support level. However, a breakdown of the $0.613 demand barrier will create a lower low and invalidate the bullish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.