First Mover Asia: Bitcoin, altcoins regain ground after early weekend spiral; trading volume levels off after an intense Saturday

Investors, who have been spooked by the omicron variant of the COVID-19 virus, are awaiting the opening of equity markets on Monday.

Good morning. Here’s what’s happening this morning:

Market moves: Investors bought up bitcoin quickly after Saturday’s sharp sell-off. Trading volume spiked on Saturday, although by Sunday it had leveled off as traders await Monday’s opening of equity markets.

Technician’s take: BTC buying has been weak despite short-term oversold signals. ETH is also taking a breather and has not yet confirmed a breakout relative to bitcoin.

Prices

Bitcoin (BTC): $49,179 +0.2%

Ether (ETH): $4,153 +1.4%

Markets

S&P 500: $4,538 -0.8%

Dow Jones Industrial Average: $34,580 -0.1%

Nasdaq: $15,085 -1.9%

Gold: $1,784 +.06%

Market moves

Bitcoin slowly recovered to the $49,000 level over the weekend after dropping nearly $10,000 in roughly an hour to as low as around $42,000 early Saturday. The precipitous decline came in response to a broader sell-off across financial markets, which have been spooked by the omicron coronavirus variant.

Saturday’s sudden decline marks bitcoin’s biggest price drop since a May sell-off when bitcoin slumped from over $43,000 to under $32,000 over a 24-hour period, a nearly 27% decline.

BTC/USD pair four-hour price chart on Coinbase. Source: TradingView

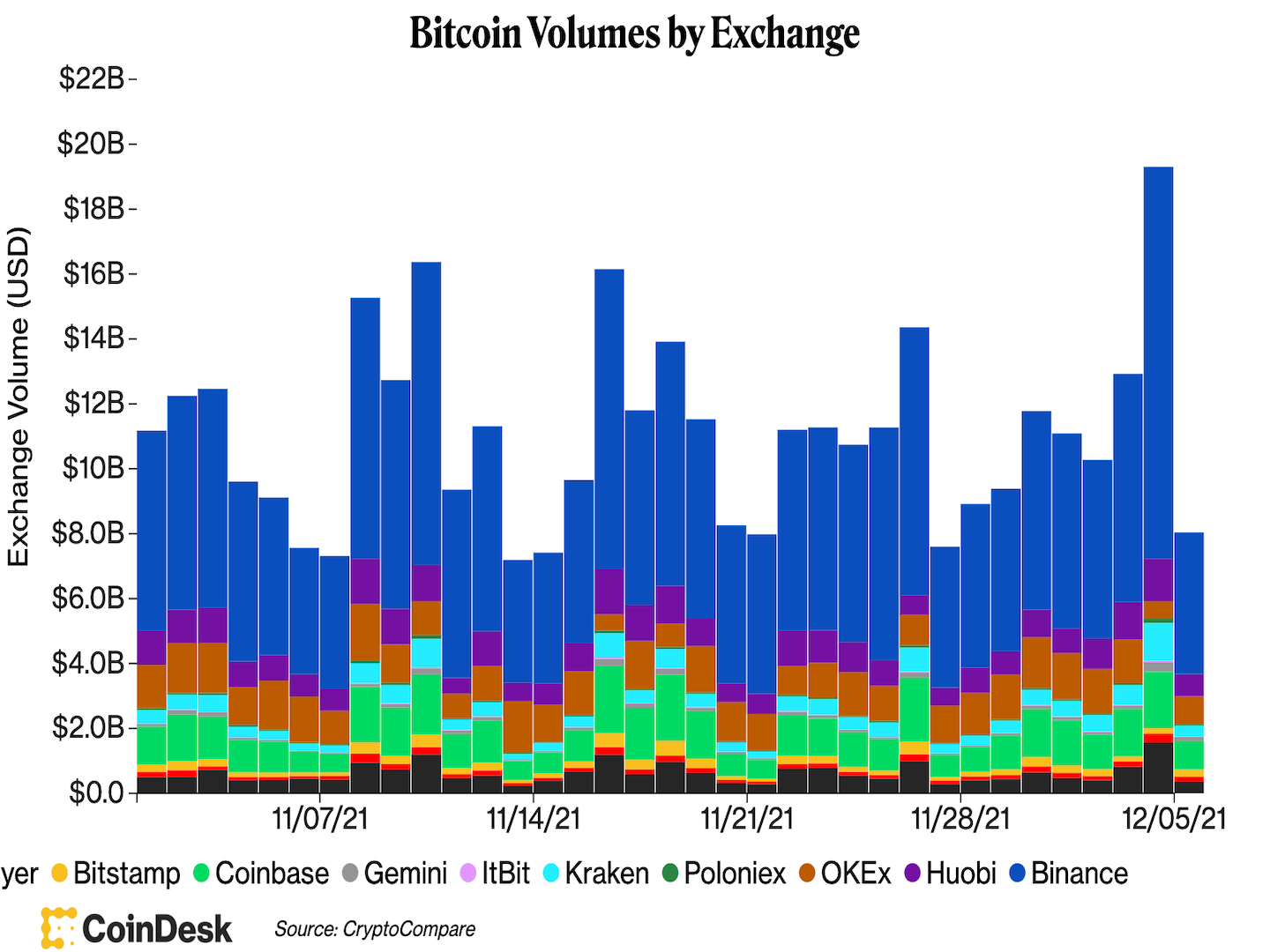

The trading volume of roughly $20 billion on Saturday across 11 major centralized exchanges reached high levels, according to data compiled by CoinDesk, although by Sunday the volume had dropped sharply as traders and investors await the opening of traditional markets.

Source: CoinDesk/CryptoCompare

But unlike the aftermath of the May drop, investors this time have bought up bitcoin quickly. Some, including El Salvador, announced that they have bought “the dip” following the price slump. At the time of publication, bitcoin was trading at $49,179, 0.2% in the past 24 hours, according to CoinDesk data. Ether was at $4,153, up 1.4%.

Other cryptocurrencies also fell sharply on Saturday. But many of these altcoins, led by ether, have been showing more resilience compared to bitcoin. Over the past week, ether’s price was down 3.7% versus bitcoin’s 14.6% drop-off. How cryptos perform in the days ahead is difficult to predict.

Technician’s take

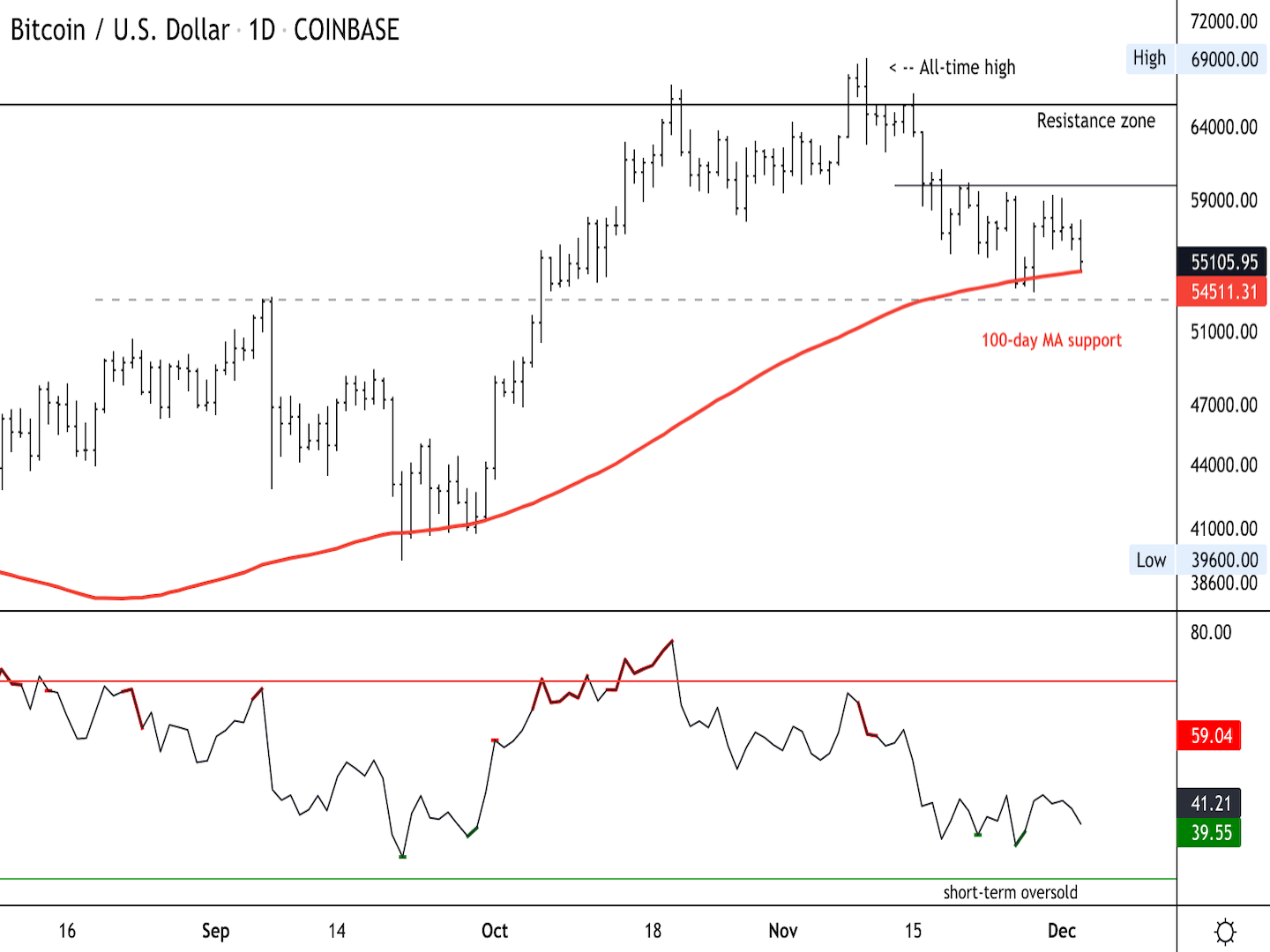

Bitcoin Drops Below $56K as Momentum Slows, Support at $53K

Bitcoin daily price chart (Damanick Dantes/CoinDesk, TradingView)

Prior to early Saturday’s massive sell-off, Bitcoin (BTC) sellers were active the previous day, pushing the cryptocurrency toward the bottom of its weeklong price range. Lower support at about $53,000 could stabilize the current pullback.

Upside momentum was starting to slow on the daily and weekly price charts, which means upside could be limited toward $60,000 resistance. For now, the intermediate-term uptrend remains intact given the upward sloping 100-day moving average.

Further, the relative strength index (RSI) on the daily chart was just below neutral territory, although buying was weak following an oversold reading on Nov. 26.

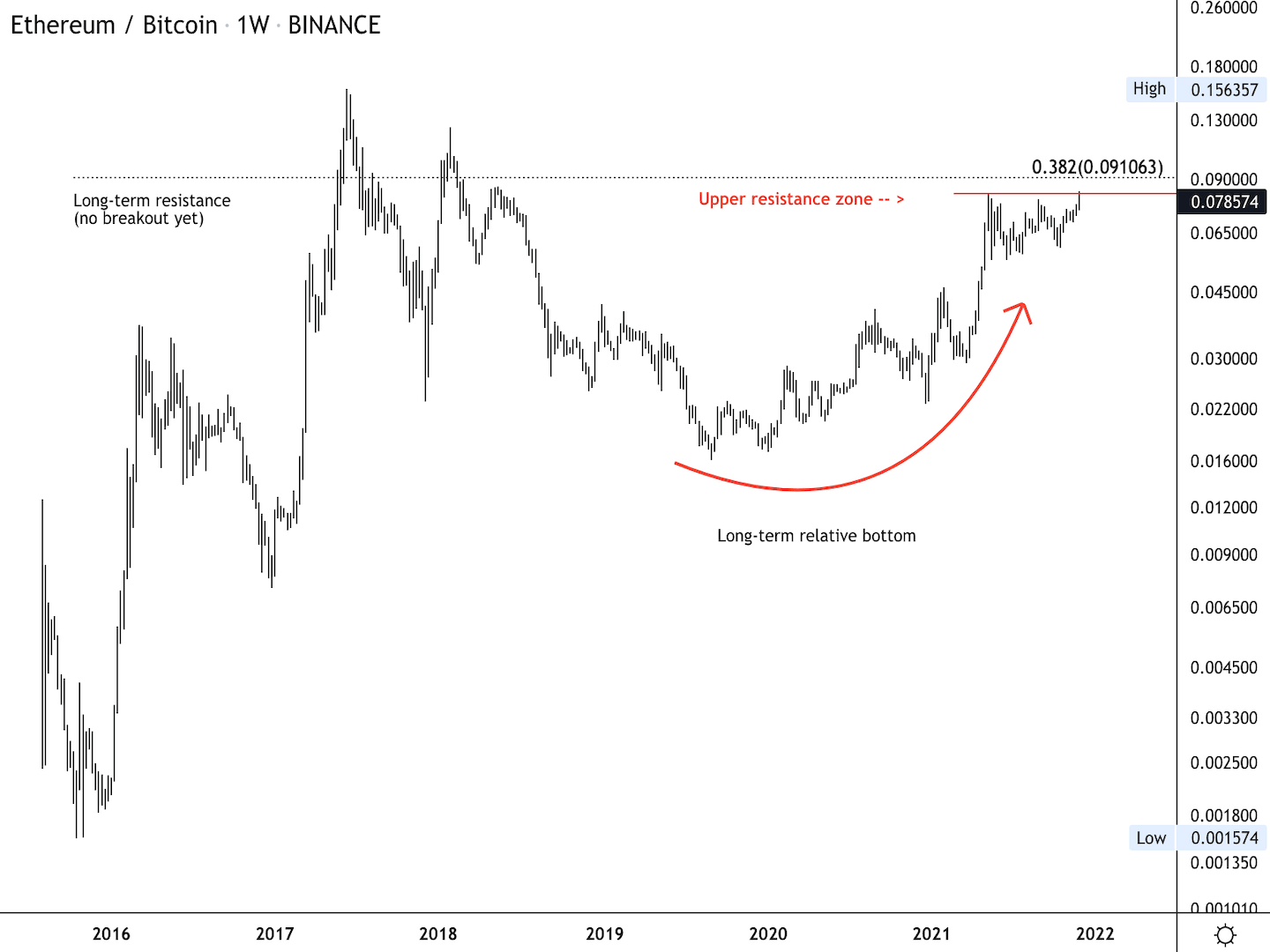

Also, on a relative basis, ether was poised to outperform bitcoin if a breakout above 0.08 in the ETH/BTC ratio is confirmed next week. Charts still show significant resistance, which preceded downturns in ETH/BTC during the 2018 crypto bear market.

How all of the above evolves remains to be seen once equity markets that have been jittery as the omicron variant of the COVID-19 virus spreads globally reopen on Monday.

ETH/BTC price ratio (Damanick Dantes/CoinDesk, TradingView)

Important events

8 a.m. HKT/SGT (12 a.m. UTC): Australia TD Securities inflation (Nov. MoM/YoY)

3 p.m. HKT/SGT (7 a.m. UTC): Germany Deutsche Bank factory orders (Oct. MoM/YoY)

5 p.m. HKT/SGT (9 a.m. UTC): Italy National Institute of Statistics retail sales (Oct. MoM/YoY

7:30 p.m. HKT/SGT (11:30 a.m. UTC): Speech by Ben Broadbent, Bank of England deputy governor for monetary policy

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.