Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC rages on, $40,000 may not be hopium after all

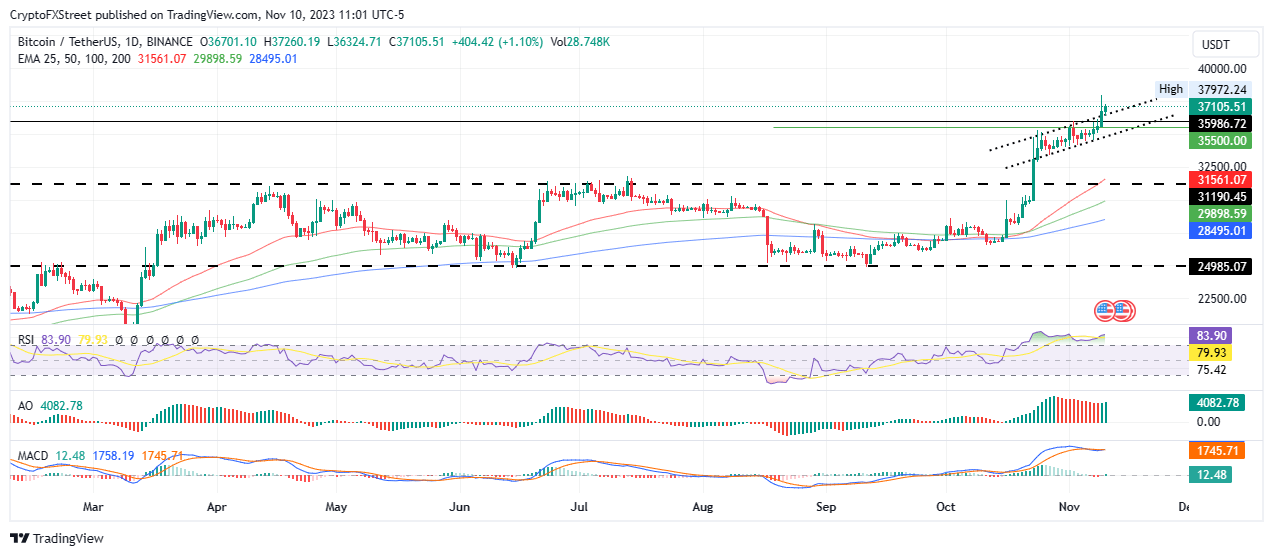

- Bitcoin price holding above the ascending parallel channel makes $40,000 a possibility as BTC bulls show resolve.

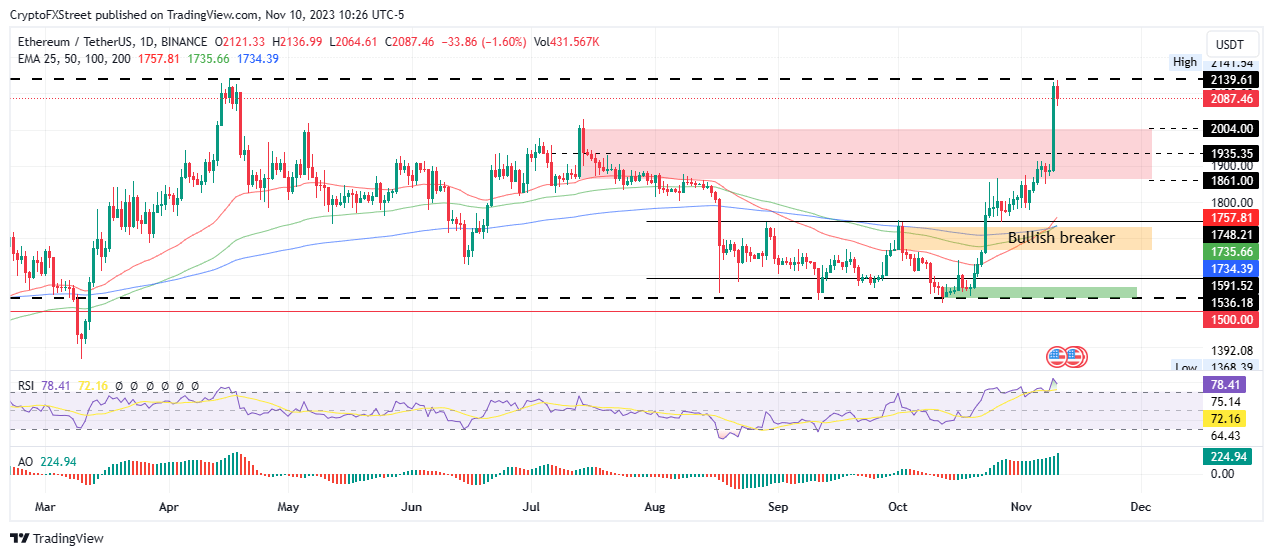

- Ethereum price could retest the supply zone between $1,861 and $2,004 amid falling momentum and effects of an overbought ETH.

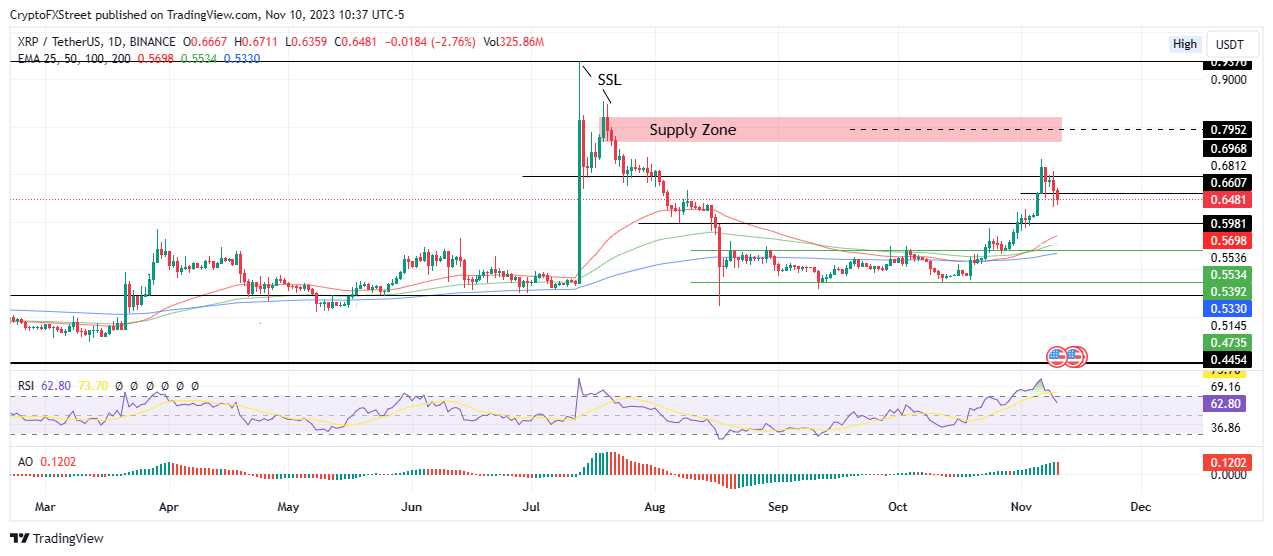

- Ripple price losing the $0.66 support level makes a prolonged downtrend a reality as XRP’s regulatory clarity comes into question.

Bitcoin (BTC) price is trading with a bullish bias on Friday, bringing the broader market with it, save for Ethereum (ETH) and Ripple (XRP) prices. Both ecosystems are choosing to pursue narratives on their own respective paths.

For ETH, the spot Ether exchange-traded funds (ETF) narrative is driving its price action, while the XRP market is navigating the waves of regulatory pressure with the ongoing tussle with the US Securities & Exchange Commission (SEC).

Also Read: BTC rallies to $37,900, fuels bullish outlook among Bitcoin traders

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Bitcoin price eyes $40,000 with BTC bulls still in play

Bitcoin (BTC) price remains on a bullish streak, with the latest breakout sending the king of cryptocurrency out from above the boundaries of an ascending parallel channel. Depending on how the bulls play their hand, BTC could realize more gains as $40,000 is now in sight.

Increased buying pressure from the bulls could see Bitcoin price extend to clear the range high at $37,972. In a highly bullish case, the gains could extend to the desirable $40,000, with the move constituting a 7% climb above current levels.

The Relative Strength Index (RSI) remains northbound despite BTC being massively overbought, hinting at a possible continuation of the trend as momentum continues to rise. Bulls have a strong presence in the BTC market, indicated by the position of the Awesome Oscillator (AO) and the Moving Average Convergence Divergence (MACD) in positive territory, which adds credence to the bullish thesis.

BTC/USDT 1-day chart

Conversely, increased selling pressure could pull Bitcoin price back into the fold of the ascending channel with the possibility of losing support due to the midline of the channel at $35,500. A break and close below the lower boundary of said channel could see Bitcoin price spiral to the $31,190 level, where the bullish outlook would be invalidated.

Notably, the MACD crossing below the signal line while both bands are above the midline is a warning sign, suggesting a possible sell signal as longs close their positions.

Also Reads: Bitcoin Weekly Forecast: BTC crashes ahead of ETF approval window, but bull run is not under threat

Ethereum price confronts $2,139

Ethereum (ETH) price is confronting the $2,139 resistance level, a formidable barrier that could mark the transition of ETH to the side of the fence last tested in May 2022, prior to the collapse of the Terra (UST) ecosystem. The AO is in positive territory with its histogram bars flashing green to show the bulls are in the front row seats.

A break and close above the $2,139 resistance level would set the Ethereum price on a path to more gains, starting with clearing the range high at $2,141.

ETH/USDT 1-day chart

On the flipside, the RSI position above 70 shows ETH is massively overbought. Its deviation south shows momentum is already falling. Both of these stances threaten the upside potential for Ethereum price.

If seller momentum increases, Ethereum price could fall back into the supply zone, which extends from $1,861 to $2,004. A break and close below its midline at $1,935 would confirm the continuation of the downtrend.

Also Read: Ethereum price breaks past $2,000 as BlackRock hints at filing for spot Ether ETF

Ripple price could slump further after losing $0.66

Ripple (XRP) price could shed more ground after losing critical support at $0.66. The RSI is showing that momentum is falling fast. The RSI has already called two sell signals, first crossing the signal line to the downside and second slipping below the 70 level. The overall bullish outlook will be invalidated once the price breaks and closes below $0.59.

XRP/USDT 1-day chart

Conversely, if sidelined investors join the party, Ripple price could pull north, restoring optimism above $0.66. However, to confirm the continuation of the uptrend, XRP must break and close above $0.79.

Also Read: XRP price extends losses as Ripple CEO Garlinghouse calls Gensler's SEC a “political liability”

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.