Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Altseason to begin in full force

- Bitcoin price has cleared crucial levels, suggesting a consolidation phase to begin again.

- Ethereum price plans to revisit the $4,000 psychological level.

- Ripple price marches slowly but surely to $1 to collect the buy-stop liquidity resting above it.

Bitcoin price action for the last two weeks has caused it to flip some crucial hurdles. This move is likely to translate into another phase of consolidation, allowing Ethereum, Ripple and other altcoins to explode.

Also read: AMC stock falls 13% after FXStreet profit call on Wednesday

Bitcoin price to explore higher highs

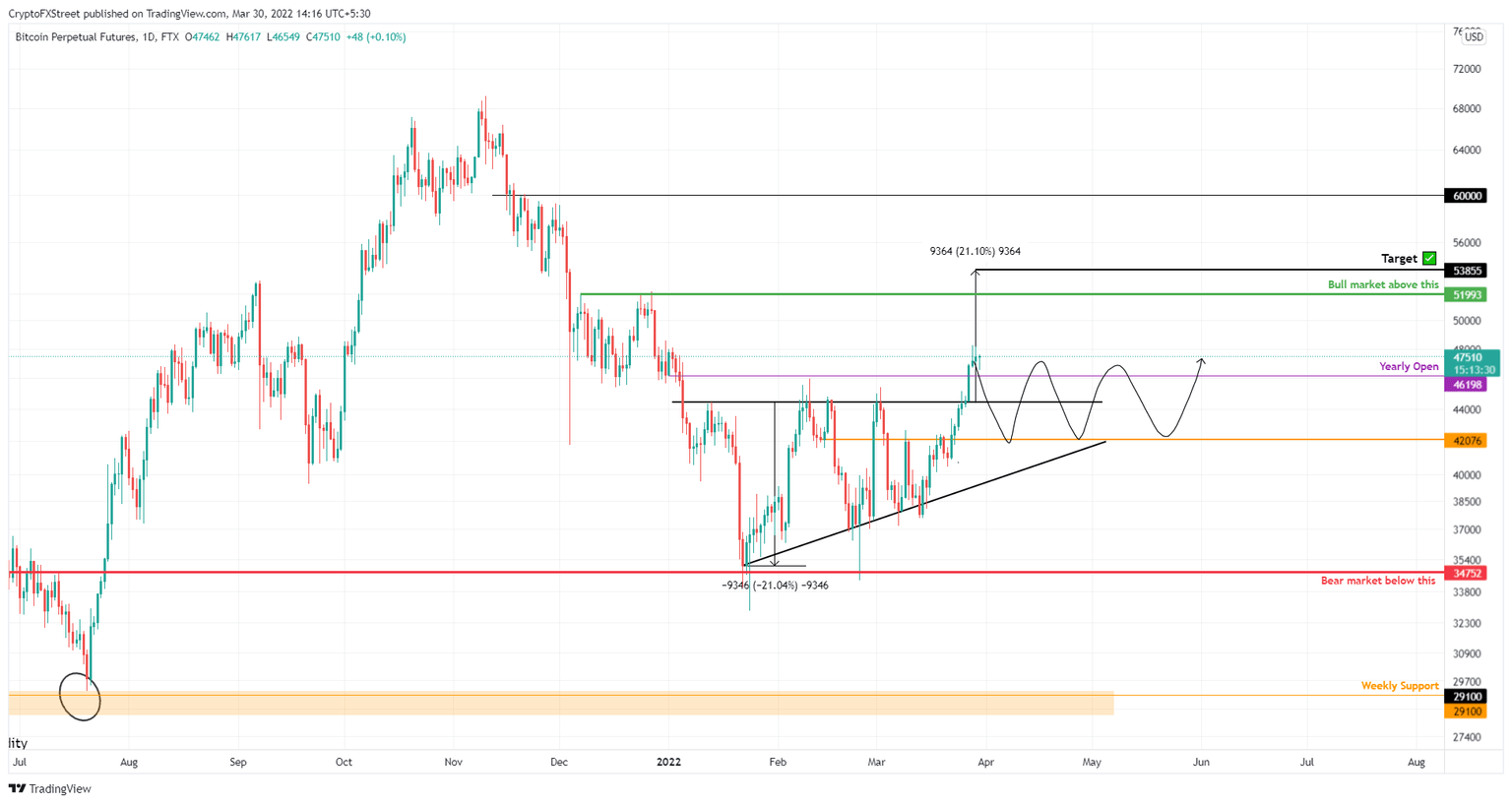

Bitcoin price broke out of an ascending triangle on March 27 but is stuck now consolidating above the yearly open at $46,198. Going forward, investors can expect BTC to continue consolidating between $53,000 and $45,000. This will have the effect of giving altcoins ‘free reign’.

In the case of Bitcoin price producing a weekly close above $52,000, there is a good chance the run-up might extend to $60,000.

BTC/USD 1-day chart

While things are looking up for Bitcoin price, a daily candlestick close below $45,000 will invalidate the bullish thesis. This move opens the threat of price reentering the ascending triangle.

https://www.youtube.com/watch?v=9-lVRPAL8mA

Ethereum price ready for more gains

Ethereum price reveals its intention to move higher through the volume profile indicator. This indicator shows a low volume node at roughly $3,703, indicating that not a lot of volume was traded up to this level.

This suggests Ethereum price will move into this area and consolidate around here to fill the inefficiency. In some cases, bulls could try to move into the high volume node present above, at $4,040.

ETH/USD 1-day chart

As for the downside, Ethereum price has a stable support barrier at $3,136 coinciding with the volume point of control. To make things interesting, the 100-day Simple Moving Average (SMA) is also present at $3,040.

Hence, a breach of $3,040 will be key and invalidate the bullish thesis for ETH, triggering a further crash to $2,853 or lower.

Ripple price continues its strut

Ripple price has been in an uptrend since it breached the bullish pennant formation on March 11. An absence of volatility, however, seems to be causing the run-up from $0.76 to $0.85 to be extremely slow.

Regardless, the momentum seems to be favoring bulls – with minor retracements only every now and then. If this trend continues, XRP price will likely strut toward the next target at $0.91 and eventually reach the $1 psychological level. This move will allow market makers to collect the buy-stop liquidity resting above these levels.

XRP/USD 1-day chart

The outlook for Ripple price seems extremely safe compared to Bitcoin or Ethereum. A retracement down to $0.76 will only delay not end the uptrend. A daily candlestick close below this level, however, will create a lower low and invalidate the bullish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.