Top 3 daily movers Stellar, Nano, Status: Altcoins stealing Bitcoin’s limelight to $37,000

- For the first time, Bitcoin exchanges hands at $37,000 as the crypto market’s value crosses the $1 trill mark.

- Stellar leads the altcoin rally sharing in Bitcoin’s limelight.

- Nano and Status rallies remain intact despite overbought conditions.

Enthusiasts in the crypto space are currently celebrating the market share at more than $1 trillion. Additionally, Bitcoin has refreshed the new all-time high at $37,000 amid the push to lift off above $40,000.

Intriguingly, some selected altcoins in the top 100 are performing exceptionally well. For instance, Stellar is up over 78% in the last 24 hours; Nano is up 96%, while Status has soared 100% in the same period.

Notably, volatility is exceptionally high in the market; hence it is difficult to tell how the market will react in the coming days. However, the purpose of this article is to look at the massive price action of these altcoins while attempting to demystify their next moves.

Stellar spikes to $0.4, leading the altcoin rally

Stellar continues to steal the attention from Bitcoin, especially in the top ten. The altcoin started the year with a bang, following a technical breakout above a descending parallel channel. The rally has since been consistent, forming in successive bullish candlesticks.

The new yearly high has been established at $0.42, but XLM has retreated to exchange hands at $0.376. The Relative Strength Index is currently overbought and, therefore, the need to tread carefully, especially after such massive price action.

XLM/USD4-hour chart

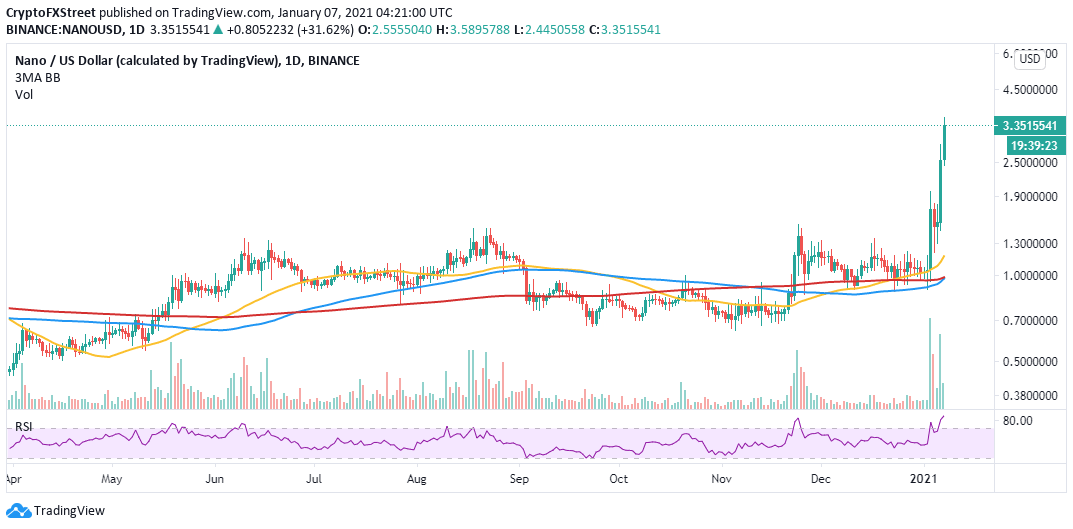

Nano’s breakout remains unstoppable

Nano is towering above the cryptocurrency horizon following a massive bullish action in the last 24 hours. Interestingly, the uptrend is still intact despite the overbought conditions. The RSI is exploring higher levels towards 100 as the price draws closer to $4.

A golden cross pattern formation reinforces the bullish outlook. The pattern forms when a shorter-term moving average crosses above a longer-term moving average, as seen in the chart; the 100 SMA makes way above the 200 SMA.

NANO/USD daily chart

Closing the day above $4 will call for more buy orders, perhaps creating enough volume for gains beyond $5. On the other hand, the bullish case will be thrown out the window if NANO closes the day under $0.4 and maybe retreat towards the tentative support at $2.5.

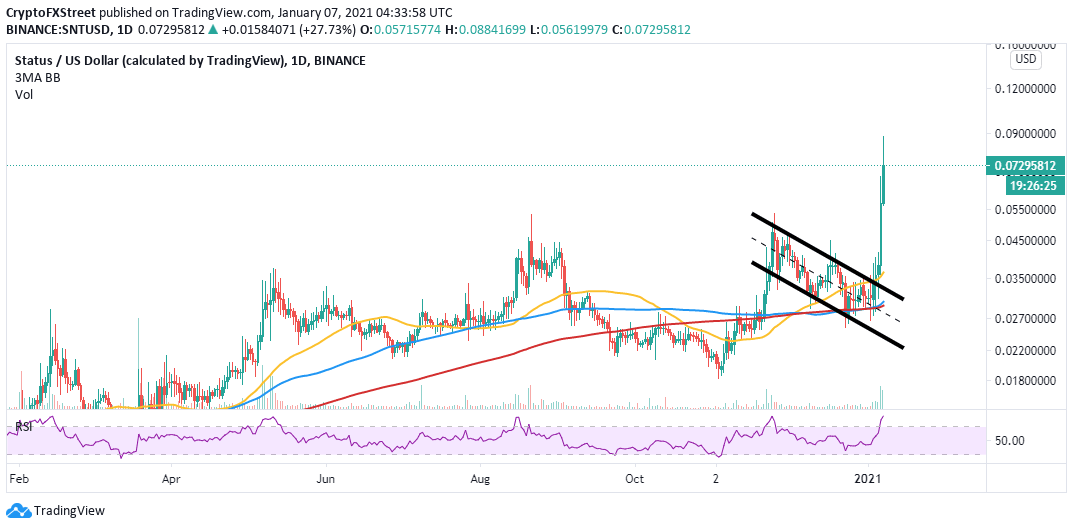

Status technical levels seem bullishly intact

Status seems ready to lift off to higher price levels despite the more than 100% accrued in gains over the last 24 hours. The bullish price action comes in the wake of a breakout above a descending parallel channel.

On the upside, a new yearly high has been achieved at $0.088, but SNT has corrected to exchange hands at $0.076. The token is still in the hands of the bulls based on the moving averages. The 50 SMA is significantly above the 100 SMA and the 200 SMA. Additionally, a golden cross pattern has recently come into the picture following the 100 SMA crossing above the 200 SMA.

SNT/USD daily chart

On the other hand, traders must be aware of the overbought solutions, with the RSI deeply in the overbought area. If SNT fails to break the hurdle between $0.09 and $0.1, losses are likely to engulf the crypto, forcing SNT into a retreat to levels around $0.045.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520(16)-637455917093119021.png&w=1536&q=95)