Three signs retail Bitcoin traders have returned in August

While Bitcoin hovers near $120,000, driven by institutional demand, many analysts are asking when retail investors will start their FOMO cycle for Bitcoin, as in previous bull runs.

Several datasets and analyses from August indicate retail investors have made a comeback, though not yet in full force.

Notable signs of retail investor return in August

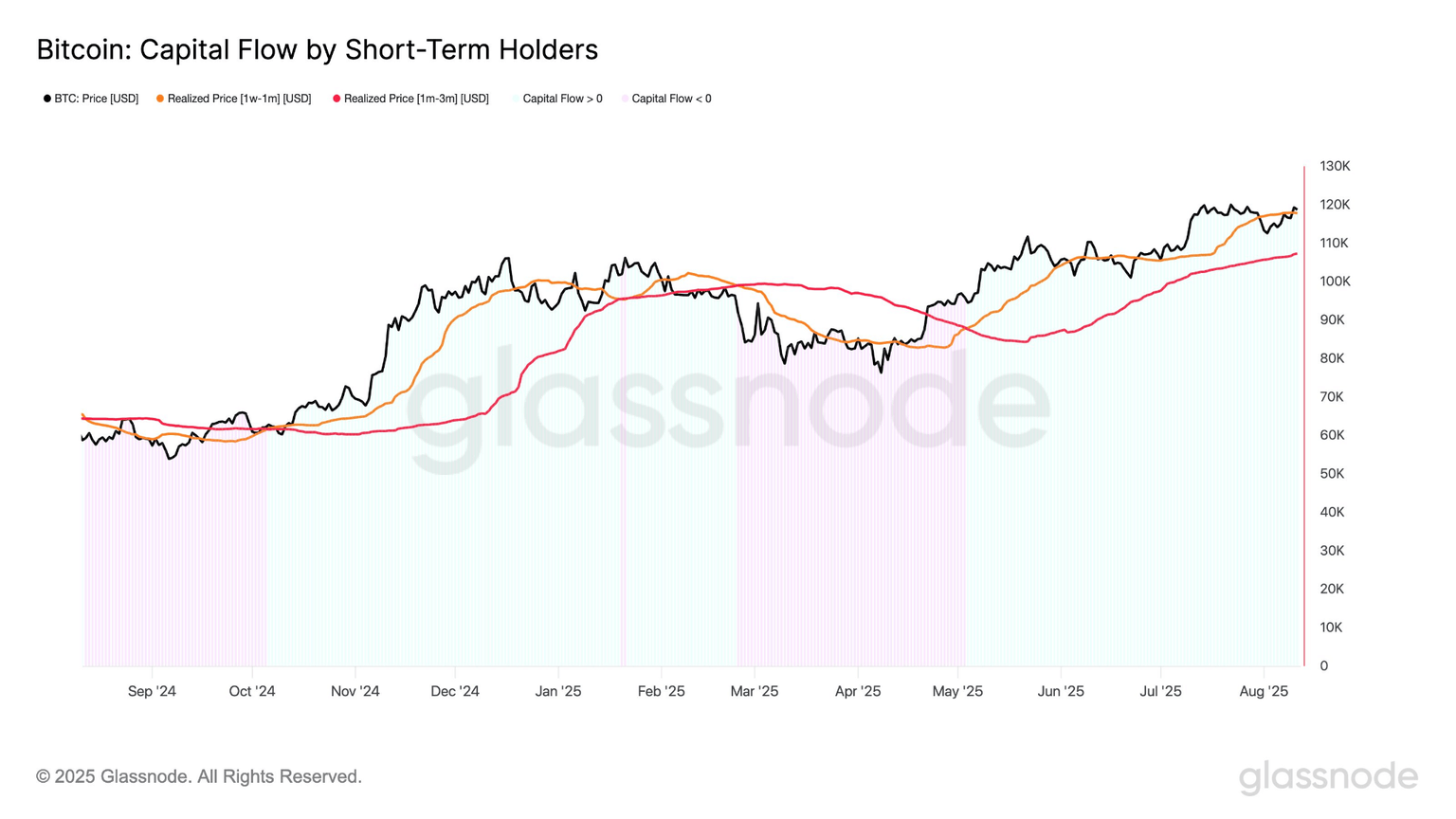

The first sign is the rise in the cost basis of Bitcoin holders with a holding period of 1 week to 1 month. This cost basis has climbed steadily since June and, by August, surpassed the cost basis of holders with a 1–3 month period.

Cost basis, also called realized price, refers to the average on-chain price at which investors purchased the asset.

Bitcoin Capital Flow by Short-Term Holders. Source: Glassnode

According to Glassnode, this phenomenon shows that new buyers are willing to pay more than short-term investors before them.

When the newer group (1w–1m) has a higher cost basis than the older short-term group (1m–3m), it signals strong short-term demand. This demand often comes from retail investors willing to pay a premium to enter the market.

“The gap remains wide, suggesting short-term demand for Bitcoin is still strong,” Glassnode reported.

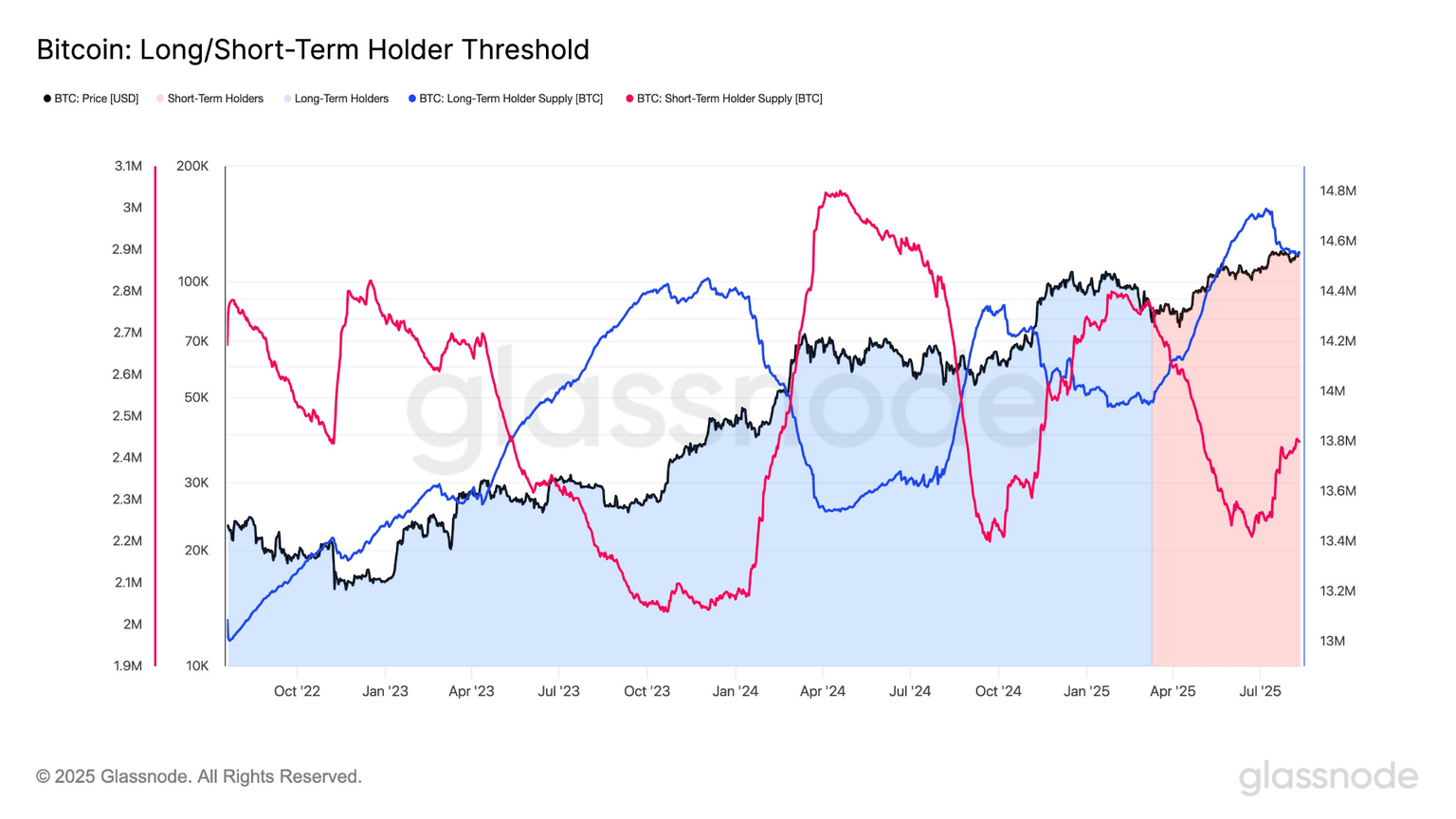

Another sign from the same report shows that short-term holders (STH)—investors holding Bitcoin for fewer than 155 days—accumulated over 220,000 BTC from June 21 to August, representing a 9.9% increase.

Bitcoin Long/Short-Term Holder Threshold. Source: Glassnode

“While notable, it’s modest compared to Jan–Mar, when supply surged by 540,000 $BTC (+25%) in one of the sharpest rotations this cycle,” Glassnode commented.

In other words, short-term investors are accepting a higher cost basis and increasing their BTC holdings in August.

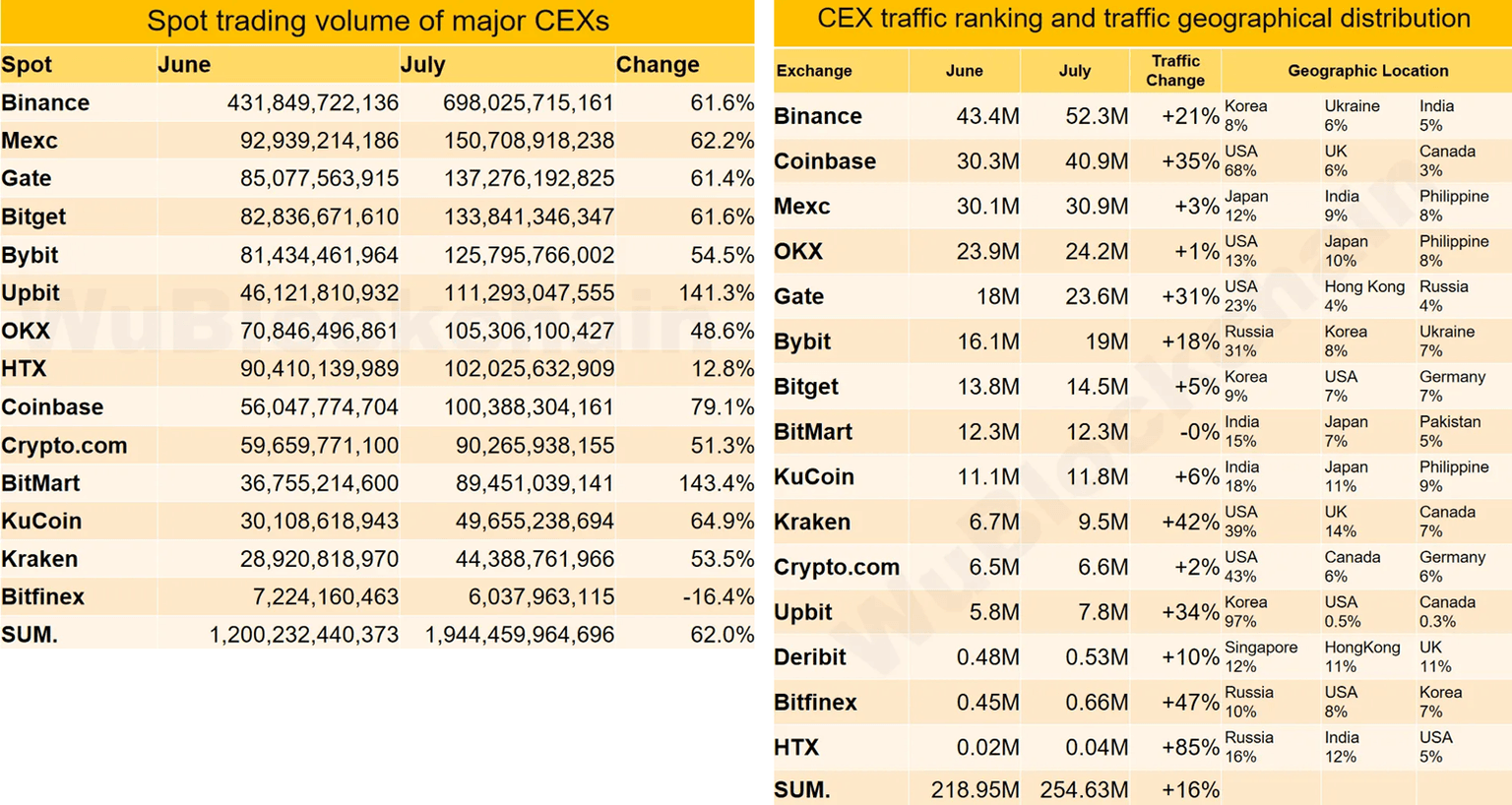

The third sign is the sharp rise in spot trading volume on major exchanges. Institutional demand often goes through OTC channels to avoid volatility risk, while retail traders usually buy on large exchanges.

A recent Wu Blockchain report shows that spot trading volume on major exchanges in July 2025 jumped 62% from June. This is the largest monthly increase this year, reflecting a revival in retail trading activity.

Traffic And Spot Volume of Major CEXs. Source: Wu Blockchain.

The same report notes that exchange traffic rose an average of 16% last month. Binance traffic increased 21%, while Coinbase traffic soared 35%.

This rise in traffic and volume in July could extend into August, serving as an early sign of renewed retail investor interest.

However, the recovery still lags far behind previous cycles. Investor Mike Alfred believes the bull run could still be in its early stages.

“Bitcoin is $120,000 and no one cares. Most people dropped their kids off to school today, went to work, doomscrolled, ate a bagel and drank 2 coffees and a Red Bull. They paid no attention to BTC. People in crypto are chasing memecoins and ETH Treasury companies. We are so early!” Alfred explained.

If retail participation increases more strongly, it could catalyze a much bigger bull run. However, history also shows strong retail inflows often signal a market top.

Author

BeInCrypto

BeInCrypto

Since 2018, BeInCrypto has grown into a leading global crypto news platform. Through our award-winning journalism and close ties with industry leaders, we deliver trusted insights into Web3, AI, and digital assets.