This indicator suggests whales are officially hodling the Shiba Inu price

- Shiba Inu price maintains bullish outlook forecasted in previous outlooks.

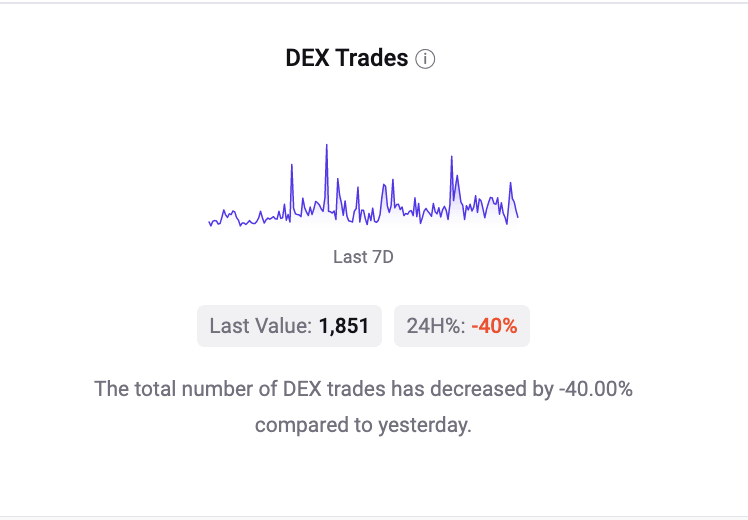

- Total number of transactions on decentralized exchanges has decreased by 40% in the last 24 hours for the SHIB price.

- Invalidation of the uptrend remains at $0.00001150.

Shiba Inu price points to hodling whales

Shiba Inu price continues to validate the bullish trade idea mentioned in previous outlooks. A 5% rally has occurred since the entry setup was issued on Friday, August 5.

"A second attempt at the $0.00001220 level could be the bullish catalyst traders are looking for" - Weekend Thesis.

Shiba Inu price is still far from accomplishing the intended target zone at $0.00001400 and potentially 0.00001700. If market conditions are genuinely bullish, the SHIB price will likely retest the $0.00001200 level before rallying higher sometime during the week.

On-chain metrics are beginning to confound the bullish technicals. CryptoQuant DEX Trades Analyzer recently reported a drop of 40% in Shiba Inu transactions on all decentralized exchanges in the last 24 hours. In theory, the fewer transactions signal more hodlers in the market, and more hodlers would translate to smart money confidence in future bullish targets.

SHIB/DTA

Shiba Inu price currently trades at $0.00001237. The notorious meme token should remain on traders' watchlist for potential opportunities. A volatile spike towards $0.00001300 could be a significant catalyst for higher targets. Invalidation of the uptrend remains at $0.00001150.

SHIB/USDT 1-Hour Chart

In the following video, our analysts deep dive into the price action of Shiba Inu, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.