These crypto tokens rallied through the Trump-Musk breakup

- The spat between Donald Trump and Elon Musk hit the prices of most crypto tokens, including Bitcoin.

- TRON, Conflux, OKB, SPX6900, and ONT post gains in the last seven days, defying the market-wide negative sentiment.

- Crypto market capitalization stands above $3.41 trillion on Monday, up 4.1% from the one-month low seen on June 6.

Bitcoin (BTC) tested support at $100,372 last week on June 5, in the aftermath of Elon Musk’s criticism of US President Donald Trump’s spending bill and the public spat that followed. Bitcoin, altcoins and crypto market capitalization have all recovered since then. BTC gained slightly under 2% and top tokens like Tron (TRON), Conflux (CFX), OKB (OKX Block), Ontology (ONT) and SPX6900 (SPX) rallied, irrespective of the tussle between the Tesla Chief and the US President.

Crypto isn’t heartbroken, these five tokens are rallying

Sectors like Made in China tokens, exchange platforms' native tokens and social coins like TRON rallied in the last seven days, even as billions of dollars in value were wiped from the crypto market capitalization and top cryptos like BTC and Ethereum (ETH) noted a price decline.

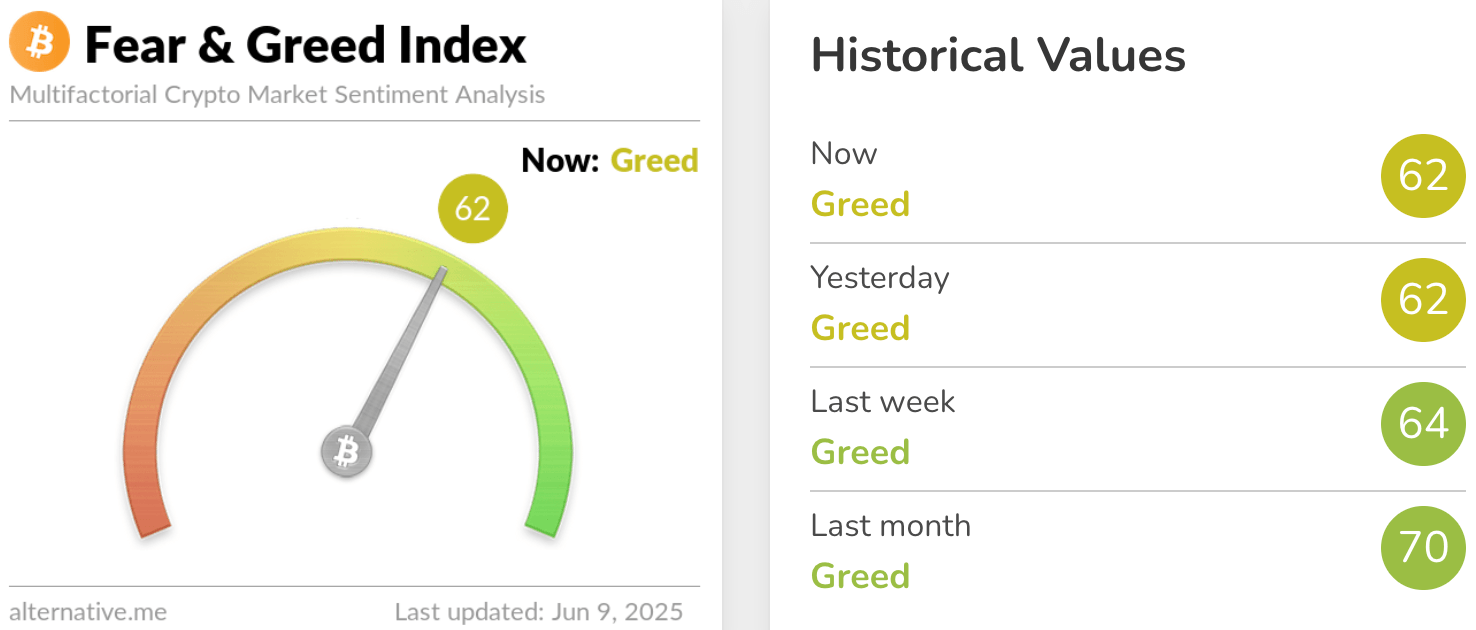

While market participants’ sentiment turned to 'fear' from 'neutral' in the same time period, speculating on the aftermath of the Trump-Elon breakup. The sentiment among traders slowly recovered and reads between 62 and 64, on a scale of 0 to 100, representing 'greed' in the Fear & Greed Index.

Fear & Greed Index | Source: Alternative

These five tokens have rallied in the past seven days, outpacing Bitcoin and other top cryptos, unaffected by the public spat between Trump-Musk. TRON gained nearly 5%, CFX added 7% to its value, OKB rallied nearly 5%, ONT posted nearly 4% gains and SPX6900 observed a double-digit rally, up 30% over the last seven days.

The five tokens belong to different categories like Made in China coins CFX and TRON, the exchange’s native token OKB, the decentralized identity token ONT and the Ethereum-based coin SPX6900.

Does the crypto rally have legs?

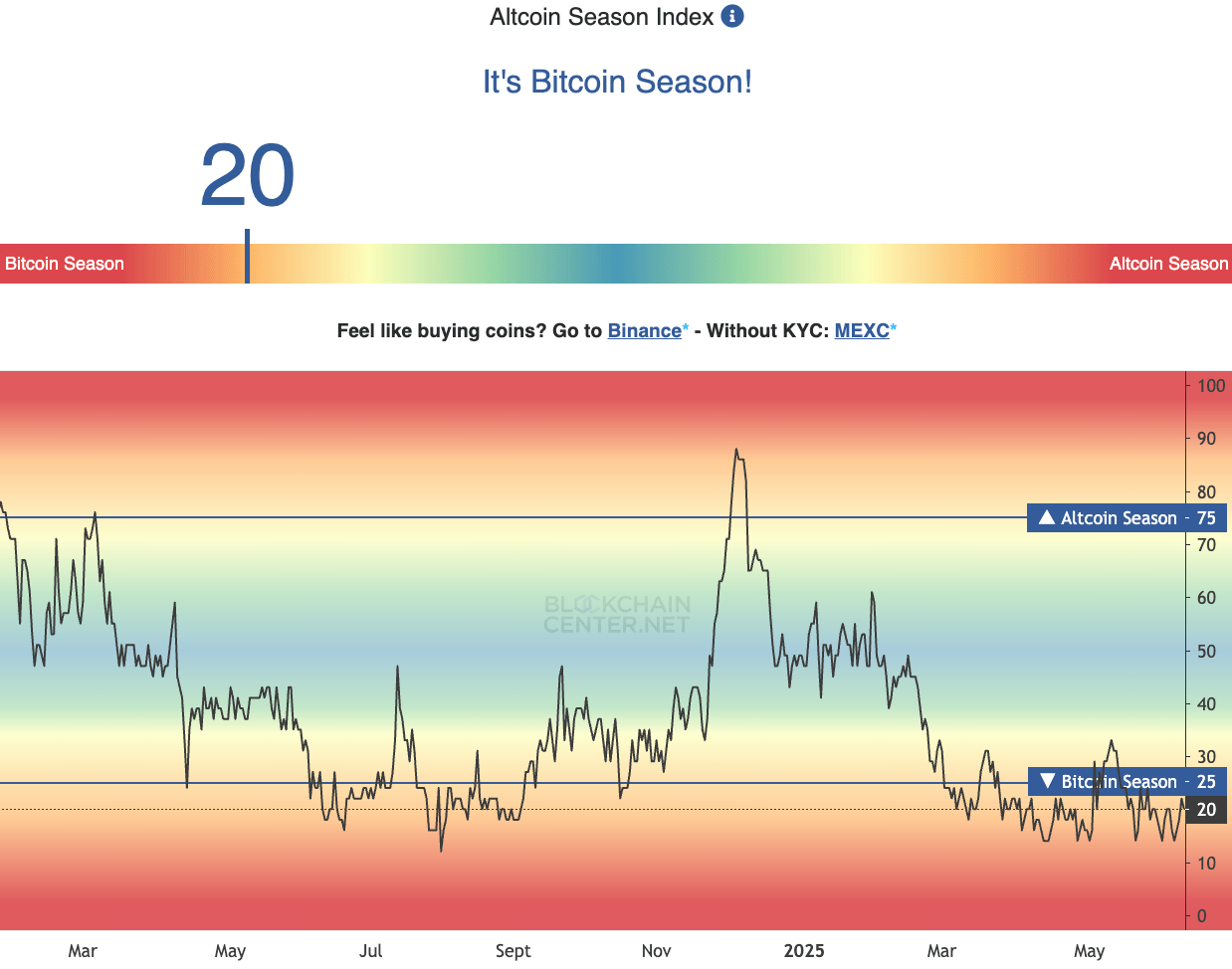

As Bitcoin’s market dominance (BTC market cap against the entire crypto market, including altcoins and stablecoins) continues to grow, there is a lower likelihood of an altcoin season. An altcoin season is a period during which 75% of the cryptos ranked in the top 50 coins by market capitalization outperform Bitcoin over 90 days.

Bitcoin market cap dominance daily chart | Source: TradingView

Typically, Bitcoin dominance stabilizes or reduces, paving the way for capital rotation and higher gains in altcoins, as seen in previous crypto cycles. The altcoin season index at Blockchaincenter indicates that it is not altcoin season, nor is it even a Bitcoin season, and the index reads 20 on a scale of 0 to 100.

Altcoin Season Index | Source: Blockchaincenter

Commenting on the factors influencing Bitcoin and altcoin prices this week, Bitunix’s market team told FXStreet in a written note that:

“Long-end U.S. bond yields hit new highs due to poor auction yields, market risk appetite will deteriorate sharply, negative for risky assets, especially crypto markets. Bitcoin faces major pressure $106,500, key support is $104,000-103,500, if BTC loses $103,500 support, liquidation strength reaches $1.33 billion.”

Analysts recommend that traders “tightly control risk positions,” and observe the direction of capital flows to the US Dollar before making decisions on derivatives trades in crypto.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.