The Graph price has more room to go down despite 40% drop

- GRT price might struggle to stay above $0.5 as technicals turn bearish.

- A recent report by Santiment indicates The Graph could be poised for a deeper correction.

The Graph has been one of the best-performing assets in the past month after getting immediately listed on Binance and Coinbase. The digital asset managed to quickly climb towards a $1 billion market capitalization in just three days.

GRT price finally undergoes an inevitable correction

According to Santiment, the word grt was the highest trending on social media, way above Elon Musk and other coins. It’s often the case that when this metric is at its highest, the digital asset suffers a correction.

So this was a top for GRT. It could be a temporary top. Just keep in mind the power of the crowd is when everyone is talking about a token. Market goes opposite.

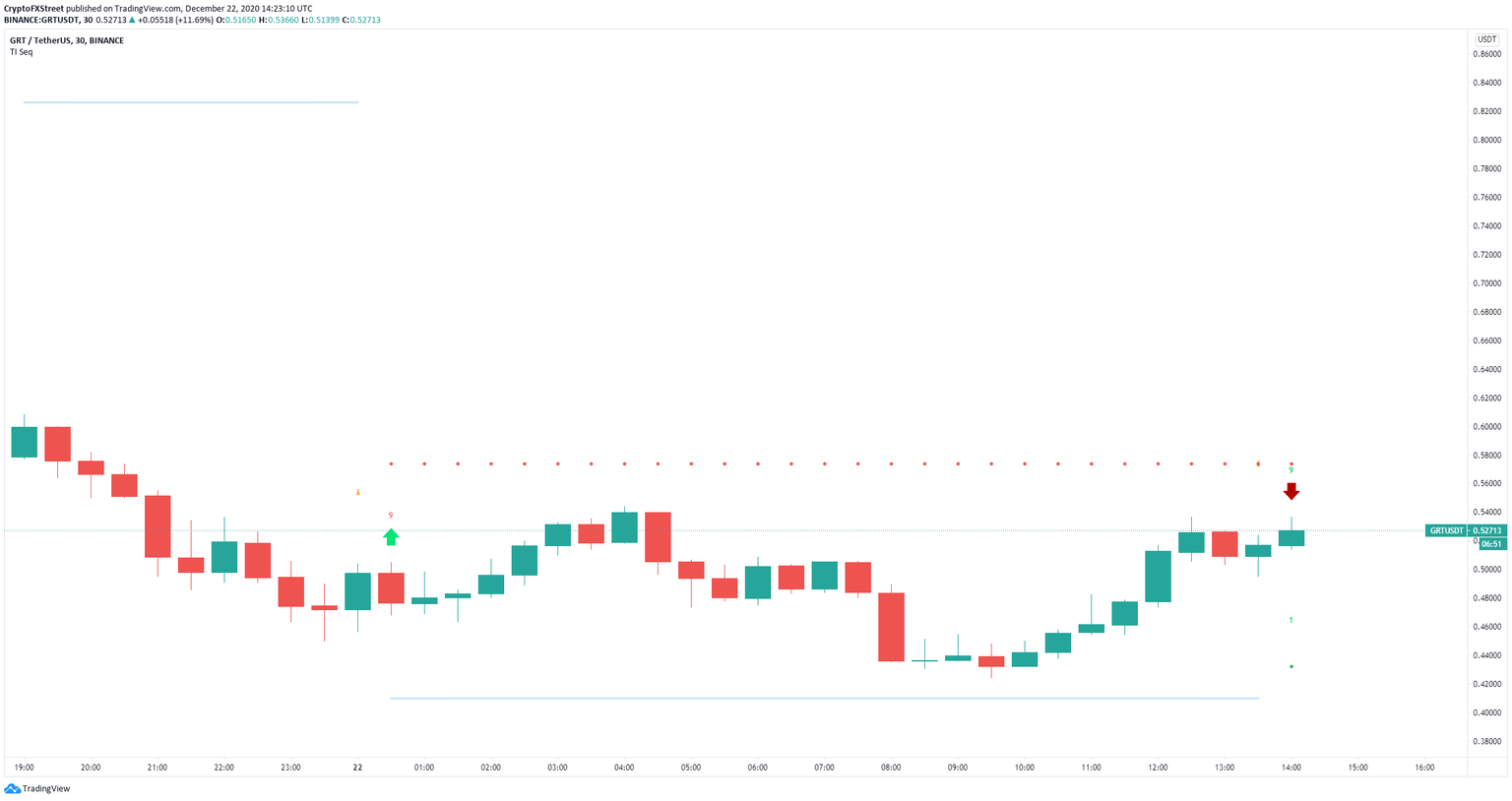

GRT/USD 30-minutes chart

Investors need to be extra careful as GRT price could fall lower. On the 30-minutes chart, the TD Sequential indicator has presented a sell signal which adds even more selling pressure.

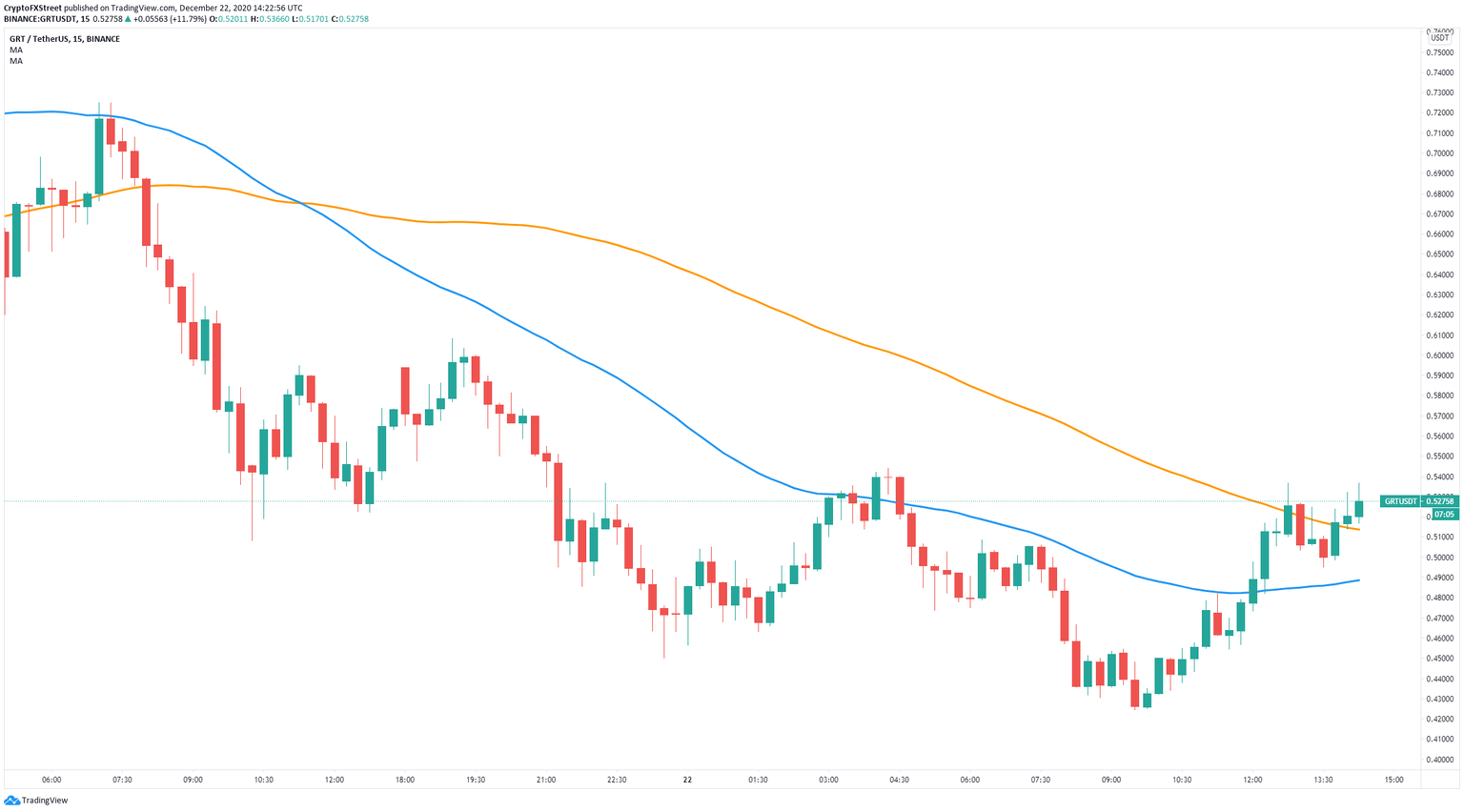

GRT/USDT 15-minutes chart

The Graph has been holding the 50-SMA support level on the 15-minutes chart for a while. However, a breakdown below this point can quickly drive GRT price towards the 100-SMA at $0.49. Failure to hold this level will push the digital asset to its last low at $0.42.

On the other hand, GRT bulls remain in control of the 15-minutes chart which is an uptrend. So far, they have defended the 50-SMA and aim to crack the last significant high at $0.543 which would push GRT price towards $0.6.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.