The cryptocurrency market update: Bitcoin bulls and bears standoff continue, someone has to give in

- Bitcoin (BTC) is locked in a tight range with the support of $8,000.

- Altcoins retain rangebound bias during early Asian hours.

The cryptocurrency market is dominated by bearish sentiments during early Asian hours. Bitcoin and most altcoins out of top-20 are nursing losses on a day-to-day basis. Binance Coin (BNB) is the biggest loser, down 4%, while Tezos (XTZ) and Bitcoin Cash (BCH) is in a green zone. The total cryptocurrency market capitalization stayed at to $220 billion, down $223 billion from this time on Wednesday; an average daily trading volume is registered at $65 billion. Bitcoin's market share settled at 65.9%.

Top-3 coins price overview

BTC/USD is hovering in the range limited by $8,150 on the upside and $8,000 on the downside. While the price managed to recover from the recent low of $7,990, the upside momentum is nowhere to be seen. Looking we will need to see a sustainable move above $8,150 barrier strengthened by the upper line of 1-hour Bollinger Band to mitigate the initial bearish pressure.

BTC/USD, 1-hour chart

Ethereum, the second-largest digital asset with the current market capitalization of $19.0 billion, has settled at $175.00. The recovery is capped by SMA50 (Simple Moving Average) 1-hour currently at $175.48. Once it is out of the way, the upside is likely to gain traction with the next focus on $176.00. At the time of writing, ETH/USD down 1.3% on a day-to-day basis and unchanged since the beginning of the day.

ETH/USD, 1-hour chart

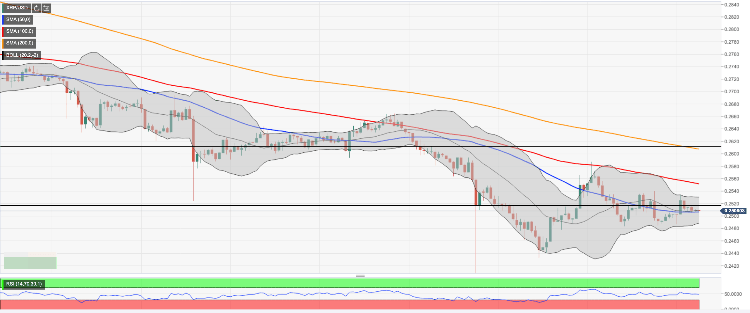

Ripple’s XRP returned to $0.2500 on Thursday after a short-lived dip to $0.2400. The third-largest digital asset with the current market value of $10.8 billion has lost 1.6% of its value in recent 24 hours, unable to develop a sustainable recovery. The initial barrier is created by $0.2530 (the upper line of 1-hour Bollinger Band).

XRP/USD, 1-hour chart

Author

Tanya Abrosimova

Independent Analyst