The cryptocurrency market update: Bitcoin and major altcoins extend the recovery

- Bitcoin (BTC) settles above $7,200 during early Asian hours.

- Altcoins retain upside bias, following the lead of the first digital currency.

The cryptocurrency market has once again demonstrated its volatile nature. After a sharp collapse during early Asian hours on Monday, Bitcoin and all major altcoins managed to regain the lost ground and enter into green territory. The total cryptocurrency market capitalization jumped to $196 billion from $180 billion this time on Monday; an average daily trading volume decreased to $91 billion. Bitcoin's market share settled at 66.3%.

Top-3 coins price overview

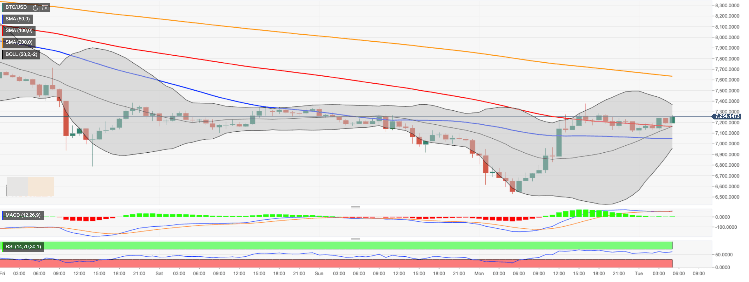

BTC/USD jumped above $7,000 and settled at $7,260 at the time of writing. The first digital asset has gained nearly 9% on a day-to-day basis and stayed unchanged since the beginning of Tuesday. The next crucial resistance is located on the approach to $7,350 (the upper line of the 1-hour Bollinger Band. A sustainable move above this barrier will trigger further recovery towards $7,600-$7,700 area that includes SMA200 (Simple Moving Average) 1-hour

BTC/USD, 1-hour chart

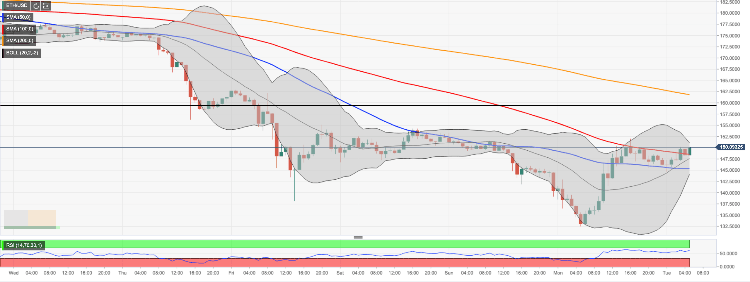

Ethereum is hovering around $150.00 amid the global recovery on the cryptocurrency market. The second-largest digital asset, with the current market capitalization of $16 billion, has gained over 9% in recent 24 hours and 2.5% since the beginning of the day. ETH/USD is supported by $148.50 (SMA100 1-hour) and $147.60 ( the middle line of 1-hour Bollinger Band) A sustainable move above $150.00 will take to $154.30 (the upper boundary of the weekend consolidation channel).

ETH/USD, 1-hour chart

Ripple's XRP bottomed at $0.2014 on Monday and recovered to $0.2218 by the time of writing. The third-largest coin with the current market capitalization of $9.5 billion has gained 4.5% on a day-to-day basis and 1.5% since the beginning of Tuesday. The local support is created by $0.2166 (the lower line of 1-hour Bollinger Band) the resistance is located on the approach to $0.2300.

XRP/USD, 1-hour chart

Author

Tanya Abrosimova

Independent Analyst