Tezos Price Analysis: XTZ may retest $2.17 before resuming a recovery to $3

- Tezos rebounded from the technical support of $2.17.

- The further recovery may be limited by a strong resistance area above $2.4.

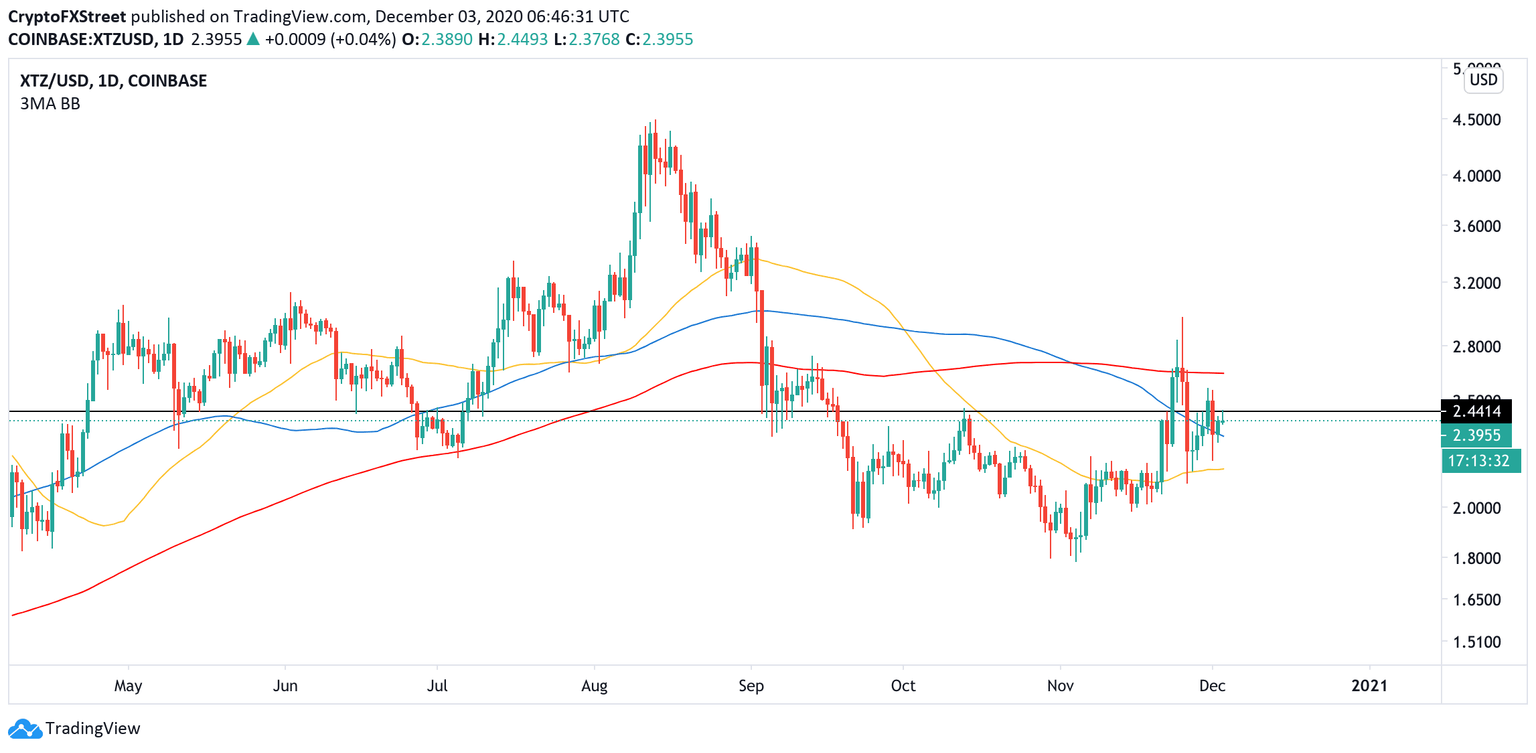

Tezos (XTZ) is the 19th digital asset with a current market capitalization of $1.8 billion and an average daily trading volume of $177 million. The native token of the blockchain platform based on smart contracts technology bottomed at $1.78 on November 4 and has been gaining ground steadily ever since. XTZ stopped within a whisker of $3 on November 25 before retreating to $2.4 by the time of writing.

The coin has gained over 3% in the past 24 hours snd 1.8% on a week-to-week basis.

XTZ recovery stalled

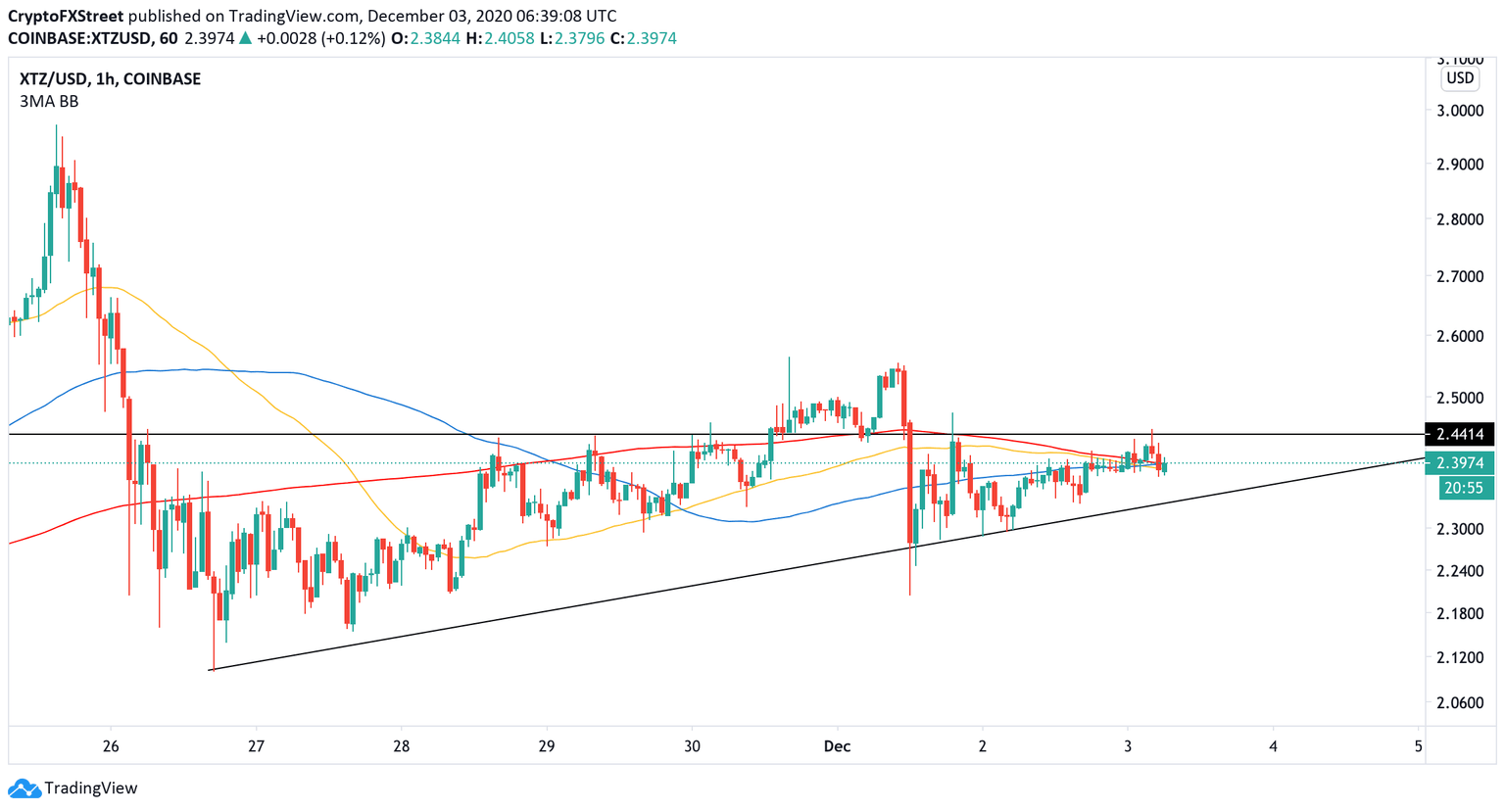

As FXStreet previously reported, XTZ/USD broke below the critical support created by a lower line of a short-term ascending channel. The development worsened the short-term technical outlook and eventually resulted in XTZ/USD move towards the recent low of $2.17.

While XTZ managed to re-gain some ground, the further recovery may be limited as the price bumped into a stiff supply area of $2.4. This barrier has been verified as resistance on numerous occasions since November 28. a sustainable move above this area is needed for the upside to gain traction with the next focus on the psychological $3.

XTZ/USD 1-hour chart

On the downside, the coin is supported by the upside trendline from November 26 low at $2.3. Once it is out of the way, the sell-off will likely gain traction with the next focus on $2.17, followed by $2.

XTZ/USD daily chart

From the longer-term point of view, the above-mentioned support of $2.17 is reinforced by the daily EMA50, meaning that this area has the potential to stop the bearish assault and trigger a new upside wave with the initial target at $2.6 (daily EMA200).

Author

Tanya Abrosimova

Independent Analyst