Tezos holders in despair as XTZ price fails to live up to the expectations

- Tezos price aimed to hit $2.8 as the team announced several upcoming anonymity features.

- Unfortunately, the digital asset had a bearish breakout and might be facing further downside pressure.

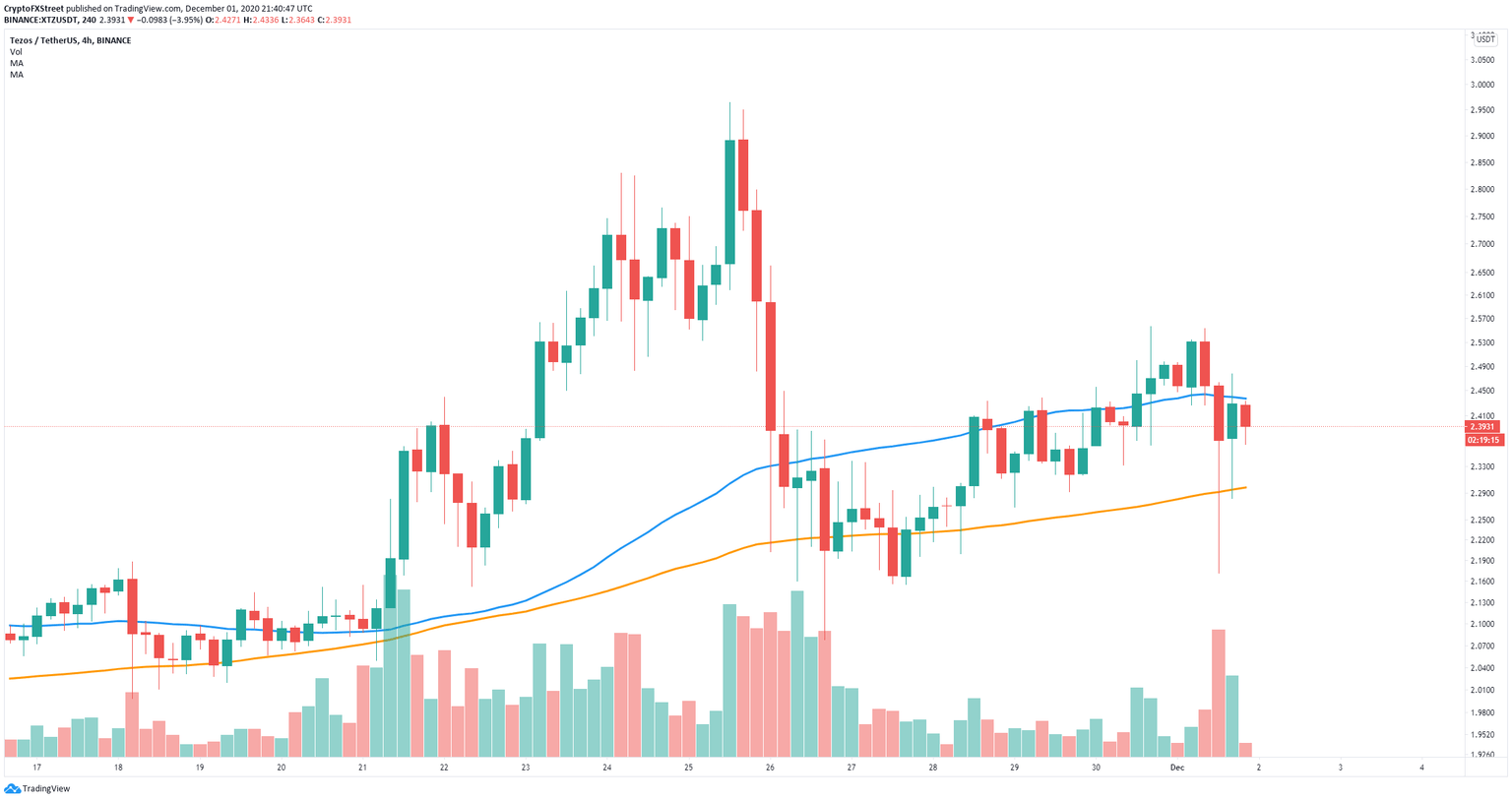

On November 30, the team of Tezos announced several upgrades to the network like a shielding system for transactions and other anonymity features. Most investors expected Tezos price to see a significant spike after the announcement; however, the digital asset failed and had a breakdown below a trading pattern on the 4-hour chart.

Tezos price fails to hold critical support level

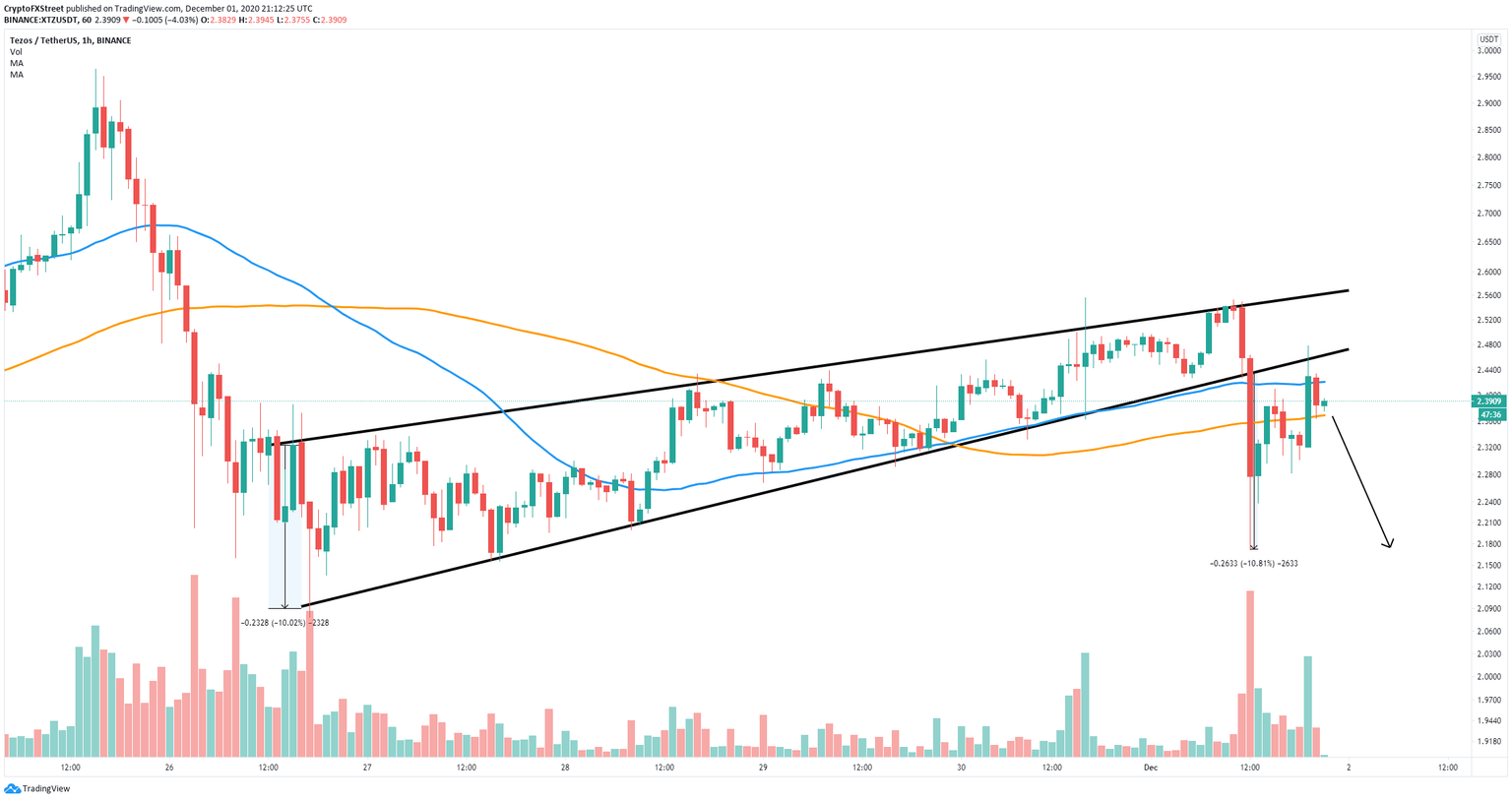

On the 1-hour chart, an ascending channel is formed since November 26 and was boken on December 1. The lower trendline of the pattern coincided with the 100-SMA, which added even more strength to the support level.

XTZ/USD 1-hour chart

Unfortunately, Tezos price did slip below the lower trendline and touched $2.17 before re-testing it again several hours later. Bulls were unable to climb above the 100-SMA and are trying to hold the 50-SMA. Losing it would quickly drive XTZ towards the low at $2.17.

XTZ/USD 4-hour chart

On the 4-hour chart, bulls have defended the 50-SMA two consecutive times and are trying to push Tezos price above the 100-SMA. Cracking the moving average can quickly drive XTZ to a high of $2.55. Above this level, the next price target could be the 2020-high at $2.96.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.