Tezos to add anonymity features, XTZ price aims to hit $2.8 in the short-term

- Tezos price is currently trying to recover from a major dip to $2.078 on November 26.

- The developers have announced a new upgrade to implement the shielding of transactions.

While Tezos price slowly recovers from the last market crash, its developers have announced a new upgrade named Edo, which intends to add shielding on transactions and a ticket system for smart contracts to issue tokens.

Tezos price needs to crack this critical resistance level

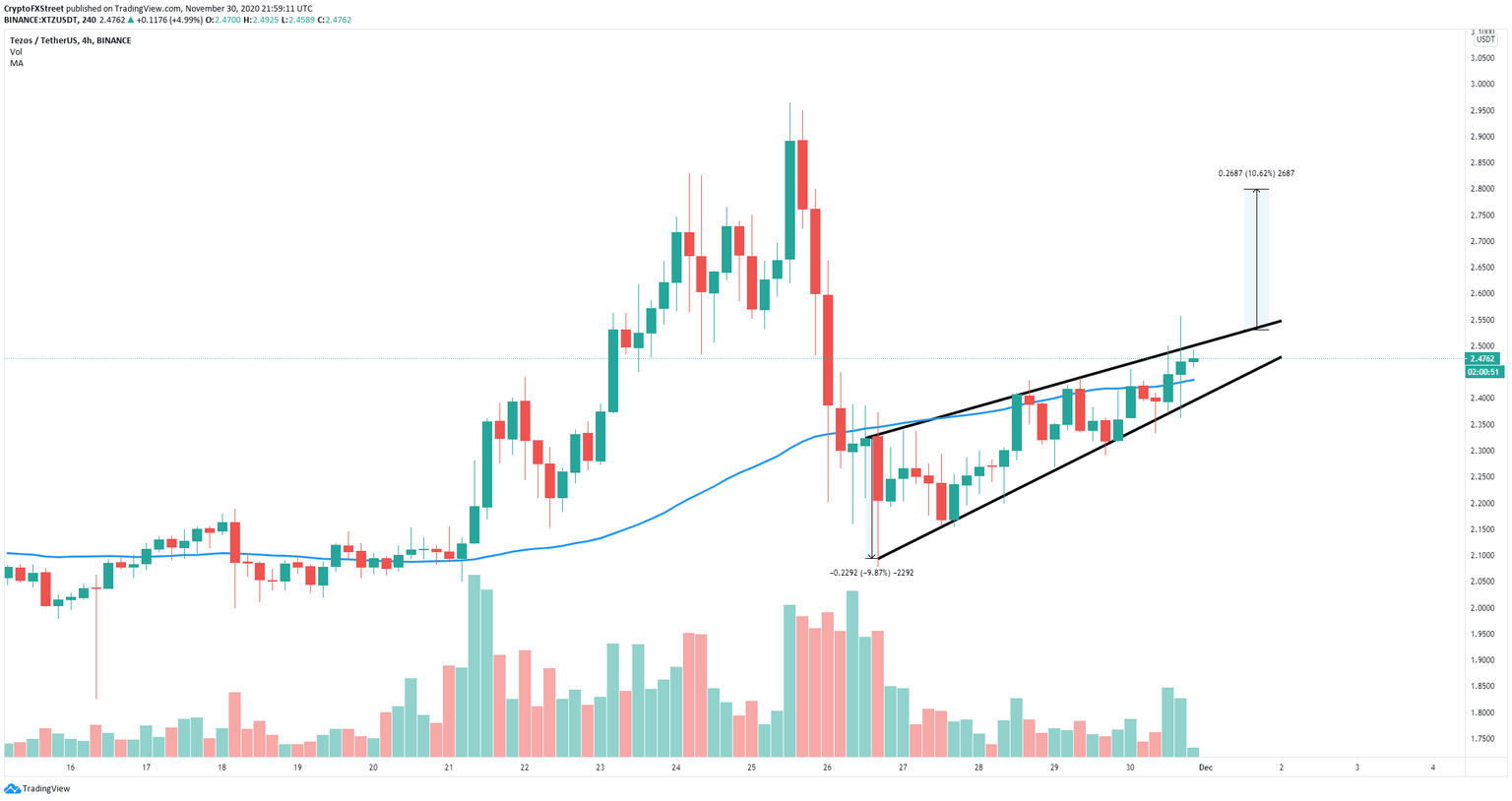

On the 4-hour chart, XTZ has created an ascending wedge pattern and it’s currently trading at $2.47, right below the upper trendline. Bulls have managed to push Tezos price above the 100-SMA, and turn it into a support level.

XTZ/USD 4-hour chart

A breakout above the upper boundary of the pattern at $2.51 would quickly drive Tezos price towards $2.8, a 10% jump. On November 30, the team of Tezos announced several privacy features in the next upgrade, boosting buying pressure.

It seems that Tezos will be getting Zcash’s privacy features like the shielding of transactions and a ticket system mechanism for smart contracts to issue tokens and grant portable permissions to other smart contracts. The announcement also stated:

The “adoption period” (sometimes referred to as the “fifth period”) is an important improvement we have wanted to make to the governance mechanism for some time. Just like any other feature of the protocol, Tezos protocol amendments may make changes to the amendment process itself.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.