Tether market cap nears $70B as SEC crypto crackdown hurts stablecoin rivals

The United States Securities and Exchange Commission (SEC) plans to sue Paxos for issuing and listing its Binance USD (BUSD $1.00) stablecoin, benefitting its top-rival, Tether (USDT $1.00), whose market capitalization has risen to multimonth highs.

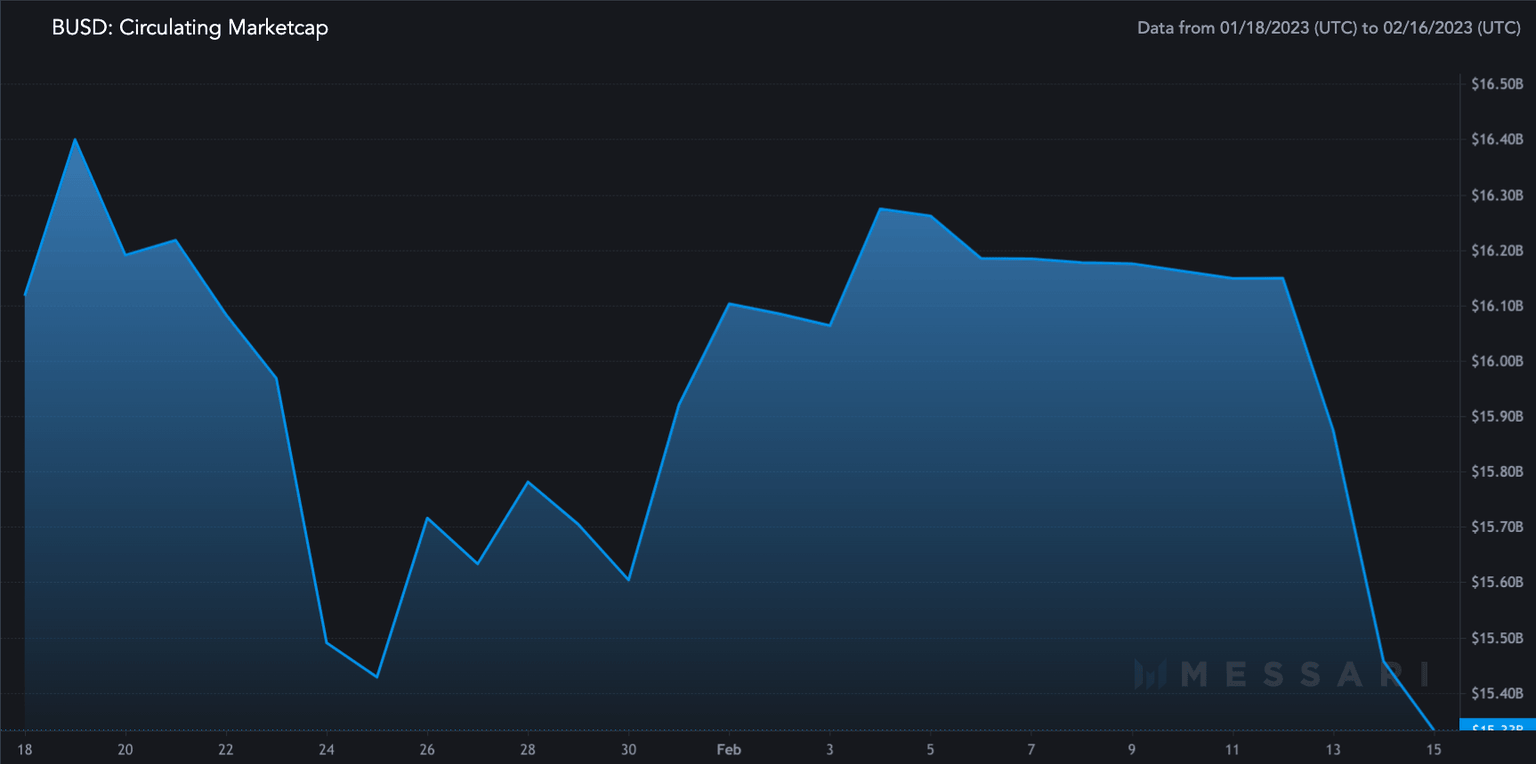

BUSD market cap drops by $2 billion

The SEC claims that BUSD, a U.S. dollar-backed stablecoin, is a security, noting that Paxos has violated investor protection laws by white-labeling it.

Since Feb. 13, when the news broke, the BUSD market cap has lost roughly $2 billion, down to around $14 billion as of Feb. 16 — the lowest since January 2022.

BUSD circulating supply. Source: Messari

As Cointelegraph reported, Binance has seen its withdrawals and BUSD redemptions surge post-Paxos crackdown.

USD Coin market cap downtrend continues

At the same time, USD Coin (USDC $1.00), the second-largest stablecoin by market capitalization, has also witnessed capital outflows in reaction to the SEC crackdown news. Its supply decreased from $41.29 billion on Feb. 12 to as low as $40.99 billion on Feb. 14.

However, this figure rebounded to $41.30 billion on Feb. 15 after Circle clarified that it had not received any lawsuit threat from the SEC.

Despite recent inflows, USDC’s market cap remains in a general downtrend since its June 2022 peak of $56 billion — a 25% decline over the past eight months.

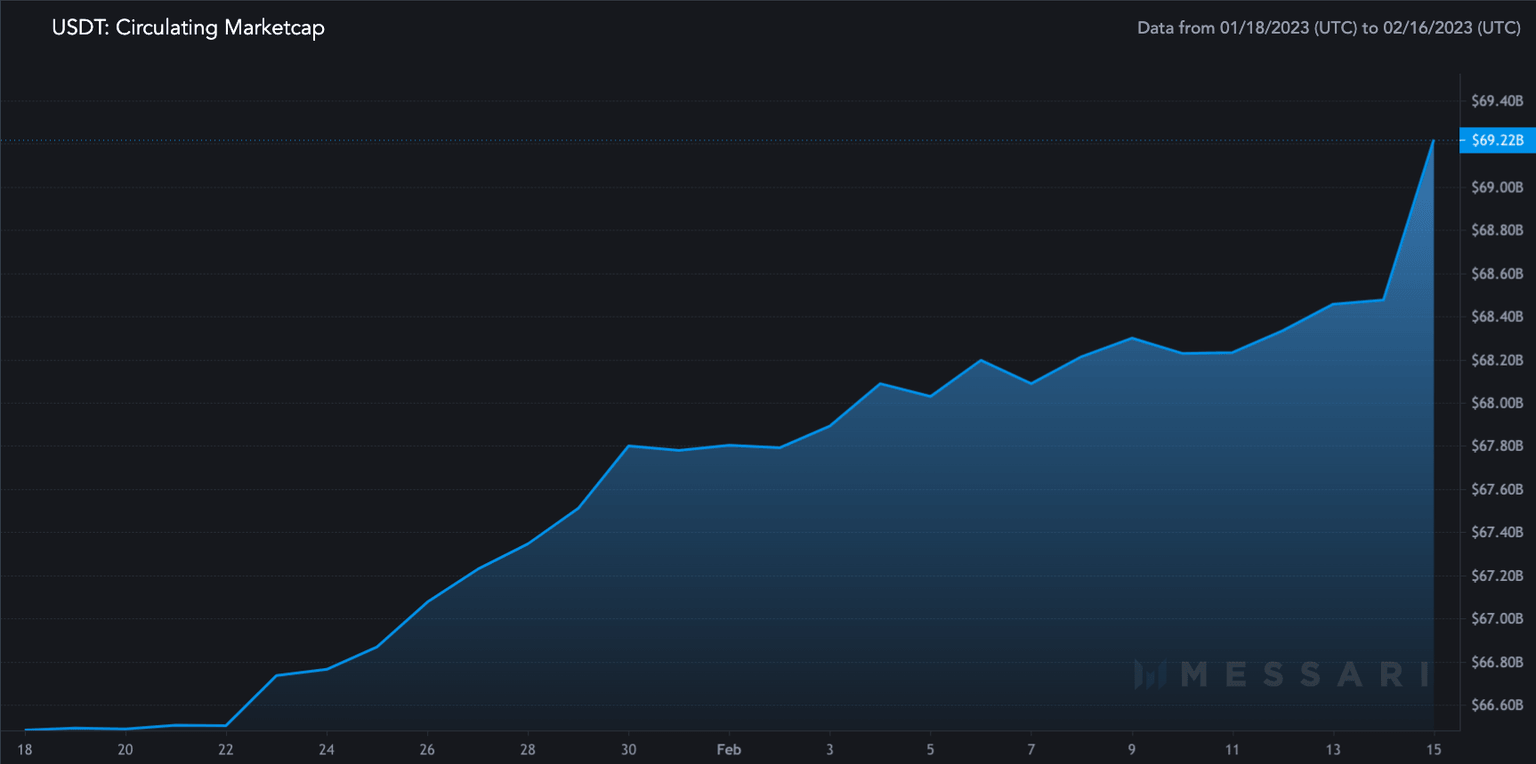

Tether dominance jumps, market cap rises over $69 billion

The regulatory crackdown on U.S.-based stablecoin firms has been a boon for top stablecoin Tether, whose market cap has jumped over $69 billion.

Data shows that nearly $890 million of inflows since Feb. 12 has pushed Tether’s market dominance to 51.25% as of Feb. 15.

USDT circulating market cap. Source: Messari

The jump likely suggests that investors were spooked by the crackdown on BUSD and sought safety in Tether USDT. Tether is owned by Hong Kong-based iFinex, which also owns the Bitfinex cryptocurrency exchange.

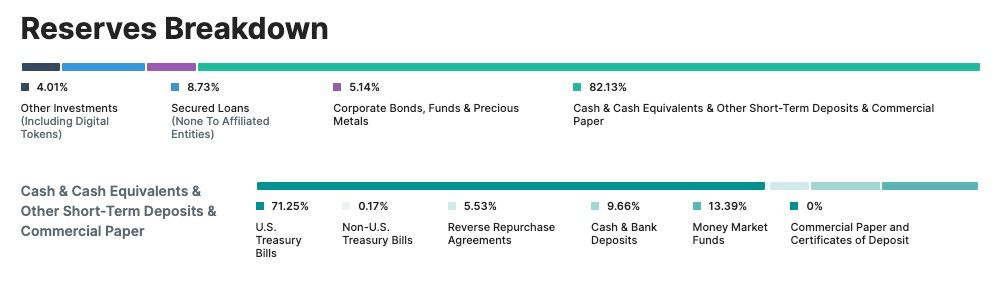

Investigators have long attempted to uncover the accounting behind Tether to prove that its circulating USDT supply is not 100% backed by the dollar (and even a mix of other cryptocurrencies, treasury bills, money market funds and other assets) as it claims.

Tether has repeatedly denied the accusations and provides regular assurance opinions signed by third-party accounting companies every quarter.

Tether Reserves breakdown. Source: Tether.to

The latest report from Dec. 31, 2022, states that consolidated assets amounted to at least $67 billion, exceeding consolidated liabilities by at least $960 million.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.