Tether launches AI protocol to support USDT and Bitcoin payments

- Tether launches “Tether AI,” an open-source platform to facilitate the integration of crypto payments into AI tools

- The platform includes native USDT and Bitcoin payment support through a Wallet Developer Kit (WDK).

- The move aligns with stablecoin sector growth and Citi’s forecast of a $3.7 trillion tokenized asset economy.

Tether has unveiled “Tether AI” to integrate crypto payments into AI infrastructure using Bitcoin and USDT.

Tether unveils “Tether AI” platform for decentralized payments integration

Tether, issuer of the world’s largest stablecoin USDT, is expanding into artificial intelligence with the launch of “Tether AI,” an open-source project designed to embed crypto payment capabilities directly into AI systems.

The new platform introduces a fully modular AI runtime architecture called Personal Infinite Intelligence, which can operate independently of cloud providers and centralized API gateways. A Wallet Developer Kit (WDK) is central to the project, which allows developers to integrate native USDT and Bitcoin payments into autonomous systems and software agents.

According to Tether CEO Paolo Ardoino, the goal is to create a decentralized, censorship-resistant foundation for AI tools.

“Tether AI removes the barriers to AI development by being open, decentralized, and natively compatible with crypto,” Ardoino stated.

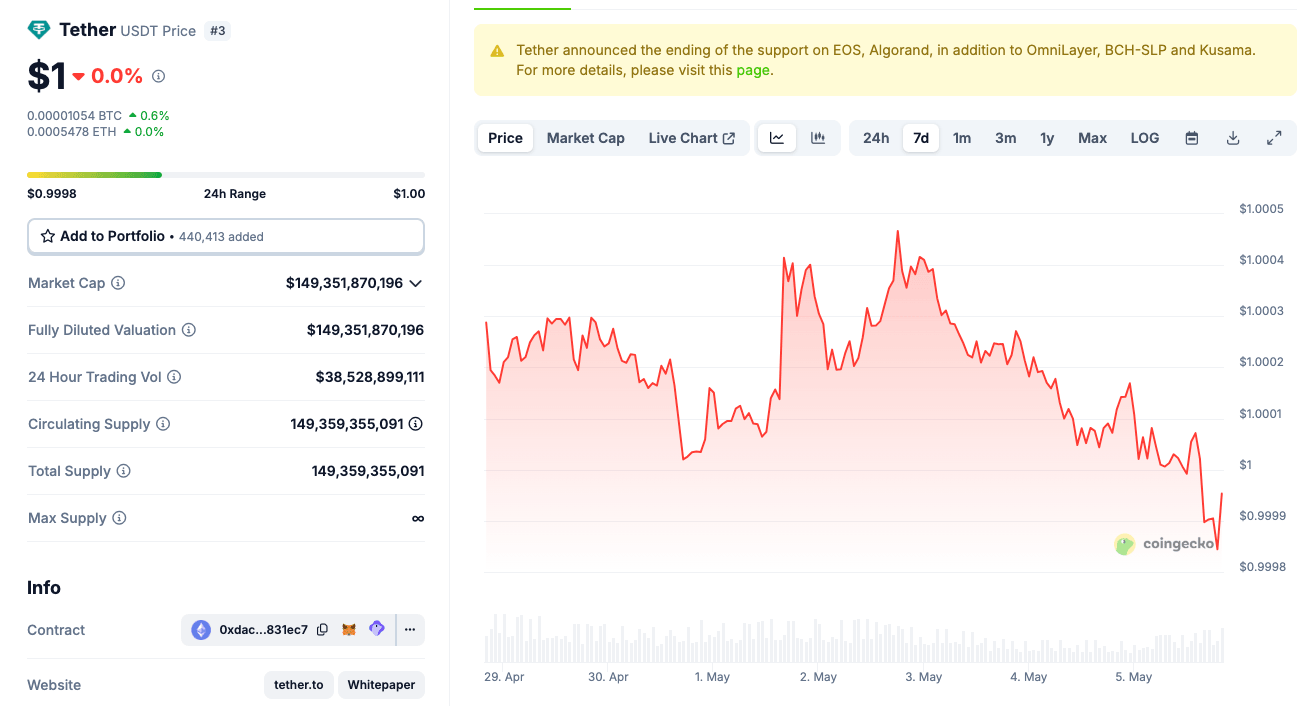

Tether (USDT) market data, as of May 5, 2025 | Source: Coingecko

By embedding crypto transactions directly into AI models, Tether is opening the door to payment-enabled agents that can perform real-world transactions autonomously, such as paying for APIs, executing smart contract actions, or monetizing AI services on-chain.

At the time of publication, Tether’s USDT stablecoin had a market capitalization of $240 billion, accounting for over 65% dominance of the global stablecoin market share.

What’s ahead: Tether’s AI strategy aligns with $3.7 trillion growth forecast for stablecoin sector

Tether’s pivot into artificial intelligence comes just weeks after Citi had projected the stablecoin sector could reach $3.7 trillion by 2030, citing regulatory clarity and technological convergence with traditional payments.

Notably, US lawmakers have moved to fast-track the GENIUS stablecoin bill currently in review. With Tether AI, the USDT issuer could enjoy a first-mover advantage as crypto convergence with AI technology solidifies over the coming years.

If Tether AI gains traction, it may offer the financial rails for autonomous services in DeFi, gaming, data markets, and beyond. However, at press time, Tether has yet to announce an official release date.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.