Terra Price Prediction: LUNA bulls overshoot, 20% downswing likely

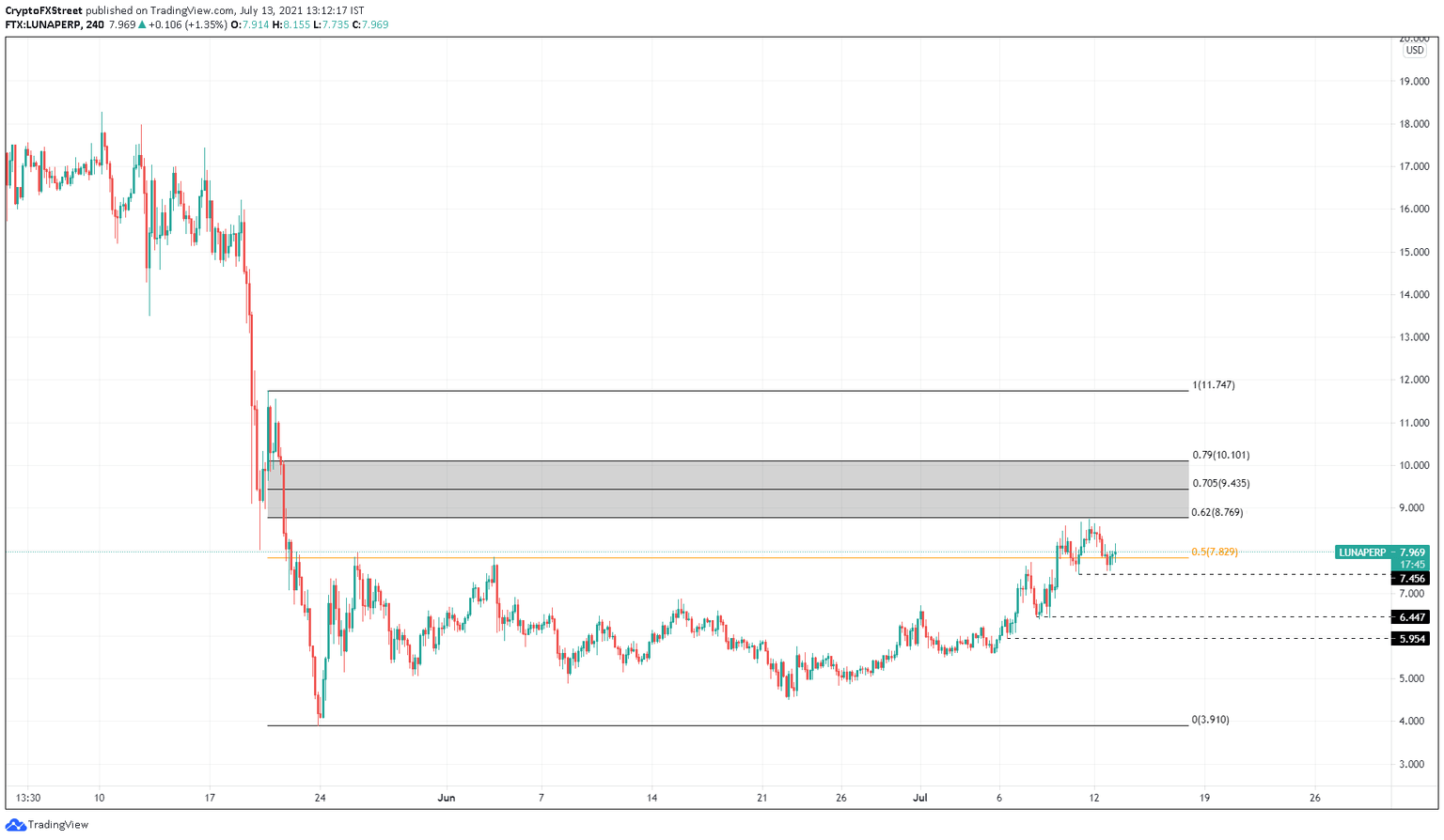

- Terra price rallied 56% over the past six days and tagged a resistance level at $8.769.

- Rejection at this zone has already begun and is likely to extend by 20% to $6.447.

- A decisive 4-hour candlestick close above $10.101 will invalidate the bearish thesis.

Terra price has been on a constant uptrend since it bottomed on June 22. As LUNA comes exceptionally close to the high probability reversal zone, it is likely that a reversal will ensue.

Terra price might create equal highs before heading lower

Terra price surged 91% since June 22 and 56% since July 5, showing massive buying pressure. While this uptrend paints a bullish picture so far, the recent retest of the high probability reversal zone, ranging from $8.769 to $10.101, indicates that a retracement is likely.

Although the run-up from $5.604 to $10.101 was steady, it was without significant corrections. Therefore, investors can expect a pullback that might push LUNA to breach $7.456, $6.447 and tag $5.954. If this move were to occur, it would be a 20% retracement from the current level – $7.924.

In some cases, Terra price might even set up an equal low at $5.592, the July 5 swing low and consolidate here before establishing a new bias.

LUNA/USDT 4-hour chart

While a retracement seems logical after such an elongated run-up in a choppy market, a potential spike in buying pressure could delay or offset the downswing.

Although a retest of the 70.5% Fibonacci retracement level will hinder the bearish argument, if the bulls shatter the 79% Fibonacci retracement level at $10.101, it will invalidate the bearish thesis and trigger a run-up to the range high at $11.747.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.