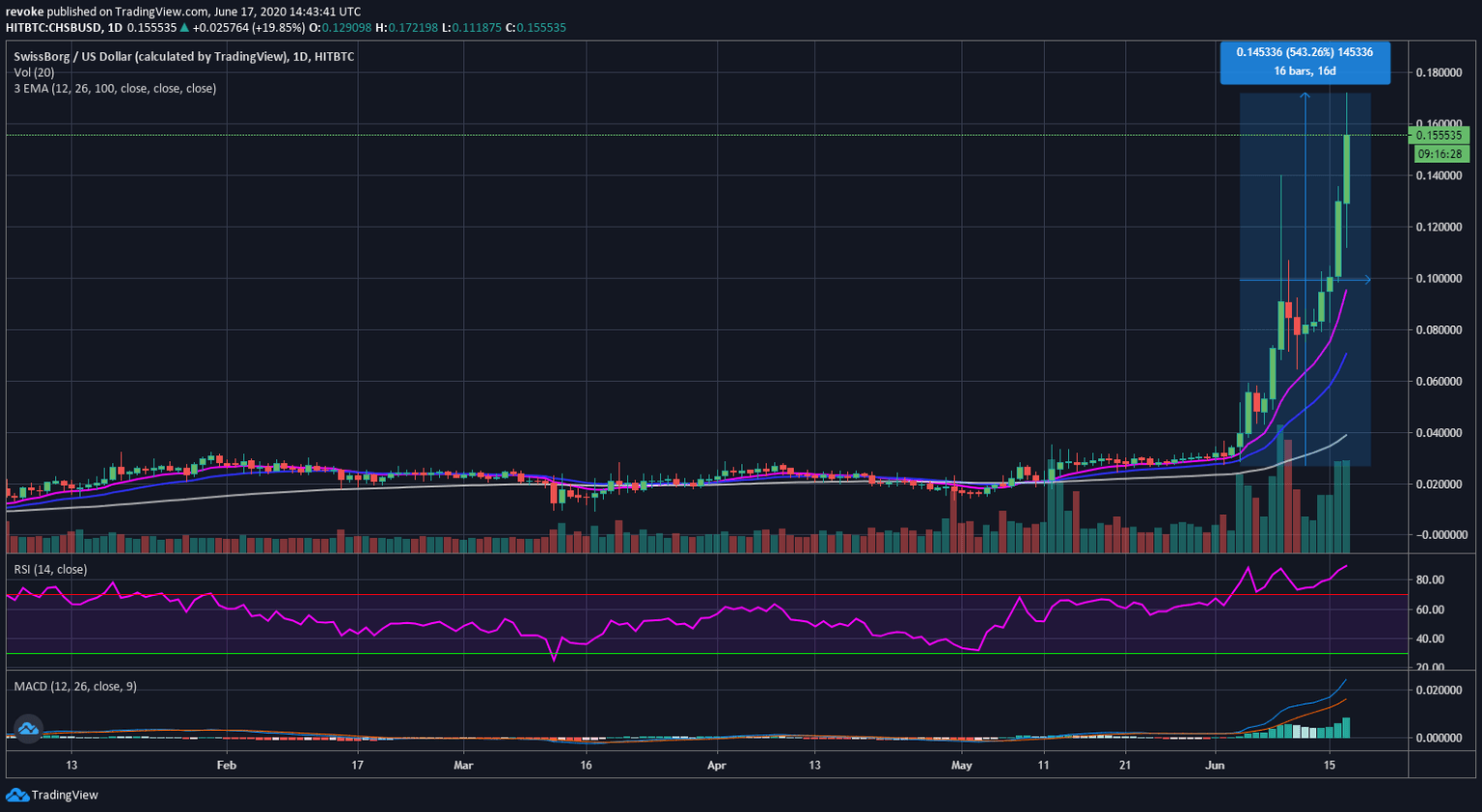

SwissBorg Price Overview: CHSB/USD up 540% in 16 days hitting a new ATH, here is why

- SwissBorg is currently trading at $0.157, a new all-time high.

- CHSB/USD has been in a strong daily uptrend for the past three weeks.

SwissBorg has been outperforming most of the coins in the market for the past 20 days. Today on June 17, CHSB is up 23% after a huge bull break yesterday as well. Just in the last two days, CHSB is up by almost 70%. The daily RSI is extremely overextended and has been for the past 17 days, however, it is clearly not stopping the bulls.

What is the cause behind this meteoric rise?

CHSB started trading in early 2018 after a successful ICO raising $50 million. This large sum of money was not enough to deal with the massive bear market crypto was about to enter. The timing was clearly not in the favor of SwissBorg and even though CHSB started out strong trading at $0.066, it quickly dropped to $0.025 in April 2018 and kept dropping until 2020.

Was SwissBorg simply undervalued all these years? It’s certainly possible. CHSB trading volume was extremely low throughout 2019, the average was around $40,000 per day. It seems that a series of positive announcements and news is finally giving SwissBorg the attention it deserves.

The biggest announcement came from the launch of the Wealth app, a product that allows users to invest in products using crypto. The app is slowly being released ‘one country at a time’. CHSB also conducted a successful ‘Protect and Burn’, essentially a buy-back mechanism that reduces the supply of the coin forever and protects holders against bear markets.

SwissBorg also announced the Wealth app will be launched in 70 more countries in the next few days and it will allow users to purchase a real piece of gold using crypto.

CHSB/USD daily chart

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.