Swipe Price Forecast: SXP whales target $7 as they remain in accumulation mode

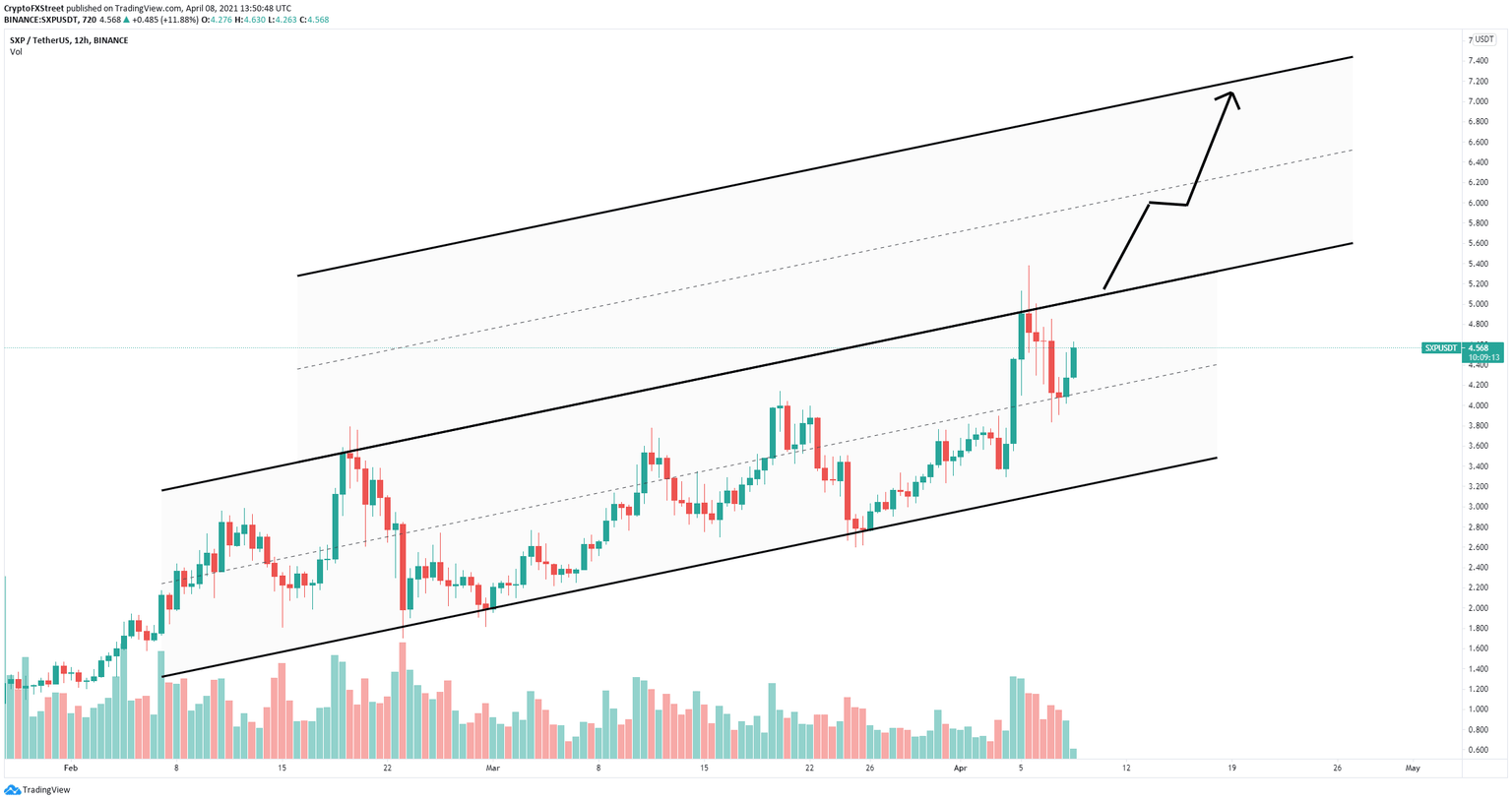

- Swipe price is contained inside an ascending parallel channel on the 12-hour chart.

- The digital asset is one key resistance level away from a massive 40% breakout to new all-time highs.

- Most on-chain metrics are in favor of SXP bulls.

Swipe price has recently established a new all-time high at $5.02 compared to the previous high on August 13, 2020. The digital asset had a massive crash throughout the second half of 2020 and started a recovery run at the beginning of 2021. On April 5, SXP experienced $1.4 billion in trading volume, its highest ever, indicating that investors are more interested than ever in the asset.

Swipe price needs to crack this barrier to reach $7

On the 12-hour chart, Swipe has formed an ascending parallel channel that can be drawn connecting the higher highs with a trendline and the lower highs with another. The upper boundary resistance is located at $5.10.

SXP/USD 12-hour chart

A breakout above $5.10 has an initial price target of $6 with a long-term target of $7, calculated by measuring the distance between the lower trendline and the upper trendline of the parallel channel.

SXP Holders Distribution chart

To add credence to this bullish outlook, we can see that the number of whales has significantly increased during the past two months. Since April 4 alone, the number of large holders with 100,000 to 1,000,000 has increased by 11.

SXP MVRV (7d) chart

Additionally, the Market Value to Realized Value ratio (MVRV), which shows the average profit or loss of SXP tokens that moved in the last 7 days, is far away from the danger zone at 20%.

The bearish outlook suggests that a rejection from the upper resistance trendline of the parallel channel at $5 will drive Swipe price down the middle trendline at $4.25. A breakdown below this point should push SXP towards $3.4.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B16.07.32%2C%252008%2520Apr%2C%25202021%5D-637534925358072731.png&w=1536&q=95)

%2520%5B16.09.39%2C%252008%2520Apr%2C%25202021%5D-637534925854766385.png&w=1536&q=95)