SushiSwap price climbs 20% with suspicion of manipulation as new wallet buys SUSHI

- SushiSwap price is up almost 20%, liquidating thrice the number of shorts than longs.

- SUSHI could stretch an additional 5% to clear the $0.80 psychological level, with Lookonchain speculating manipulation.

- A fresh wallet is buying SUSHI on DEX and depositing USDC to perpetual exchanges like dYdX through multiple addresses.

- Investors looking to ride the wave should exercise caution, lest they are caught off guard, characteristic of smart money.

SushiSwap (SUSHI) price is bullish, pumping hard with a pronounced green candlestick as SUSHI outperforms most players in the cryptocurrency arena. However, whether the hard pump is genuine or not has been called to question by web3 blockchain analytics tool, Lookonchain, which grabs data from decentralized exchanges and lists them to the public.

Also Read: BALD deployer hints at Sushi Swap as next target after meme coin exploit, SUSHI price rallies

SushiSwap price may be subject to manipulation

SushiSwap (SUSHI) price is up almost 20% in the last 24 hours, with a trading volume increase to the tune of almost 445%. The surge has the altcoin outperforming most cryptocurrencies, including the crypto top ten. However, Lookonchain has identified suspicious activity onchain, pointing to possible manipulation with the culprit going long on SUSHI for profit.

The price of $SUSHI is up 16% today.

— Lookonchain (@lookonchain) October 31, 2023

It seems someone is manipulating the price of $SUSHI and going long $SUSHI to make profits.

A fresh wallet is buying $SUSHI on #DEX and depositing $USDC to perpetual exchanges such as #dydx through multiple addresses(probably long $SUSHI). pic.twitter.com/IQQ93xE2PQ

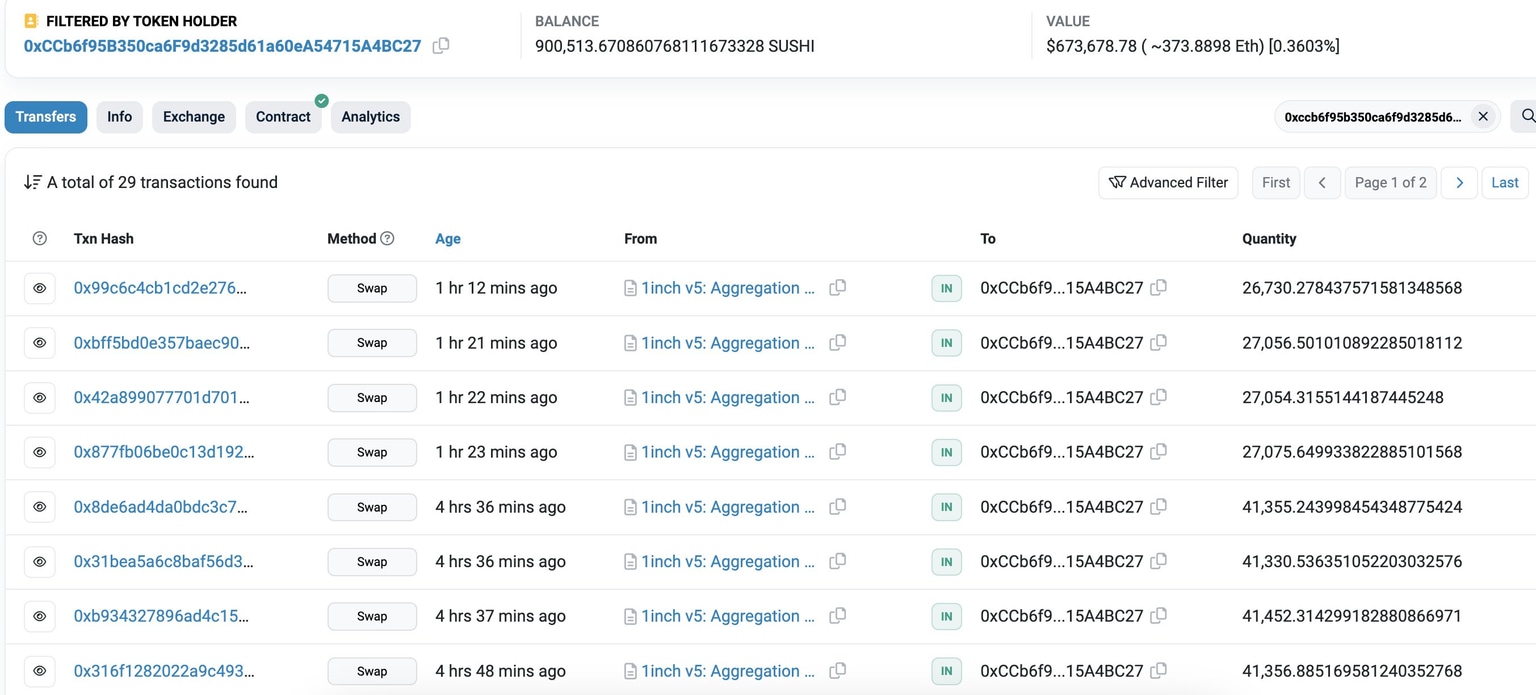

Revelations by the web3 blockchain analytics tool shows that a new wallet is buying SUSHI on decentralized exchanges and depositing Circle (USDC) stablecoin to perpetual exchanges such as dYdX (DYDX) through multiple (90+) new addresses, with a possible intention to long SUSHI. Noteworthy, the wallet spent 640,000 USDC to buy 900,514 SUSHI tokens at $0.71 per token, with Lookonchain indicating that:

The wallet may be making profits by raising the price of SUSHI and going long SUSHI.

Fresh wallet suspiciously buying SUSHI

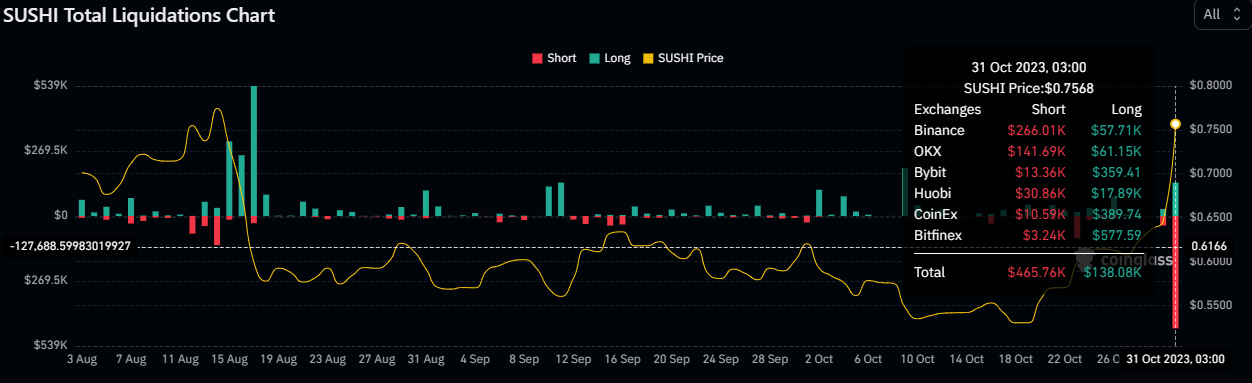

Notably, the uptrend has seen up to $465,760 in short positions liquidated, which is three times the number of liquidated long positions, at $138,080.

SUSHI liquidations

SushiSwap price outlook

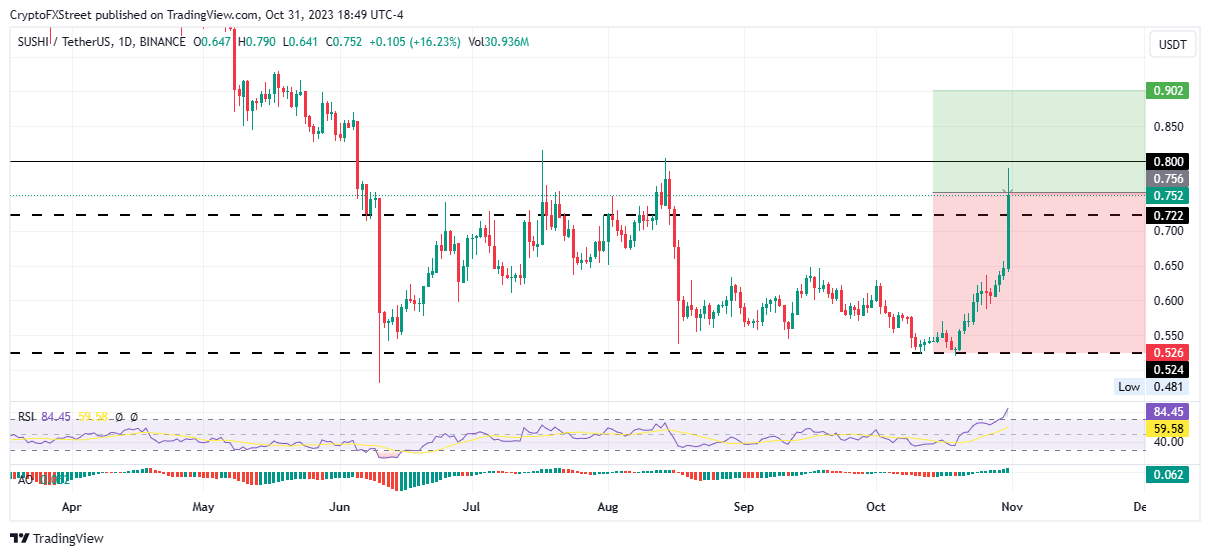

At the time of writing, SushiSwap price is $0.75, after a rejection from the $0.80 psychological level. However, there is still upside potential with the Relative Strength Index (RSI) showing momentum is still rising despite SUSHI being overbought. Equally, the Awesome Oscillator (AO) indicator remains in the positive territory with green histogram bars. This favors the upside.

Increased buying pressure could see SushiSwap price shatter the $0.80 resistance level, stretching higher to collect sell-side liquidity above it In a highly bullish case, the gains could extend for SUSHI market value to test the $0.90 level.

SUSHI/USDT 1-day chart

Nevertheless, investors should exercise caution, with Lookonchain speculating possible manipulation. Succumbing to greed could see longs caught off guard as SushiSwap could correct sharply, akin to characteristic moves by smart money.

The ensuing selling pressure could send SushiSwap price south, moving below the $0.72 level. Further south, all the ground covered could be lost for the cryptocurrency to test the $0.65 foot of the breakout. In the dire case, SUSHI could extrapolate the losses, going as low as the support floor at $0.52. Such a move would constitute a 30% fall from current levels.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.