SushiSwap becomes a multi-chain while SUSHI price aims for new all-time highs

- SushiSwap price is ready for a breakout to new all-time highs above $21

- The decentralized exchange will support five different chains to escape Ethereum fees.

- SUSHI faces weak resistance on the way up according to various indicators.

In the past two weeks, the search for alternatives to the Ethereum network has been intensive as gas fees have made it impossible for some users to interact with certain ERC-tokens. SushiSwap has noticed this and it’s going multi-chain.

SushiSwap contracts deployed on five more chains

To escape Ethereum fees and allow smaller traders to interact with the platform, SushiSwap has decided to go live on Binance Smart Chain (BSC), Fantom, Polygon, xDai Chain, and Moonbeam Network.

Binance Smart Chain has been the fastest growing chain in the past month with popular projects like PancakeSwap beating Uniswap in terms of the trading volume.

According to the project’s CTO Joseph Delong, BSC and Fantom have robust support for Erc-20 tokens but the rest will 'need some work’. Nonetheless, this is a huge step for SushiSwap and its future growth.

SushiSwap price aims for new all-time highs

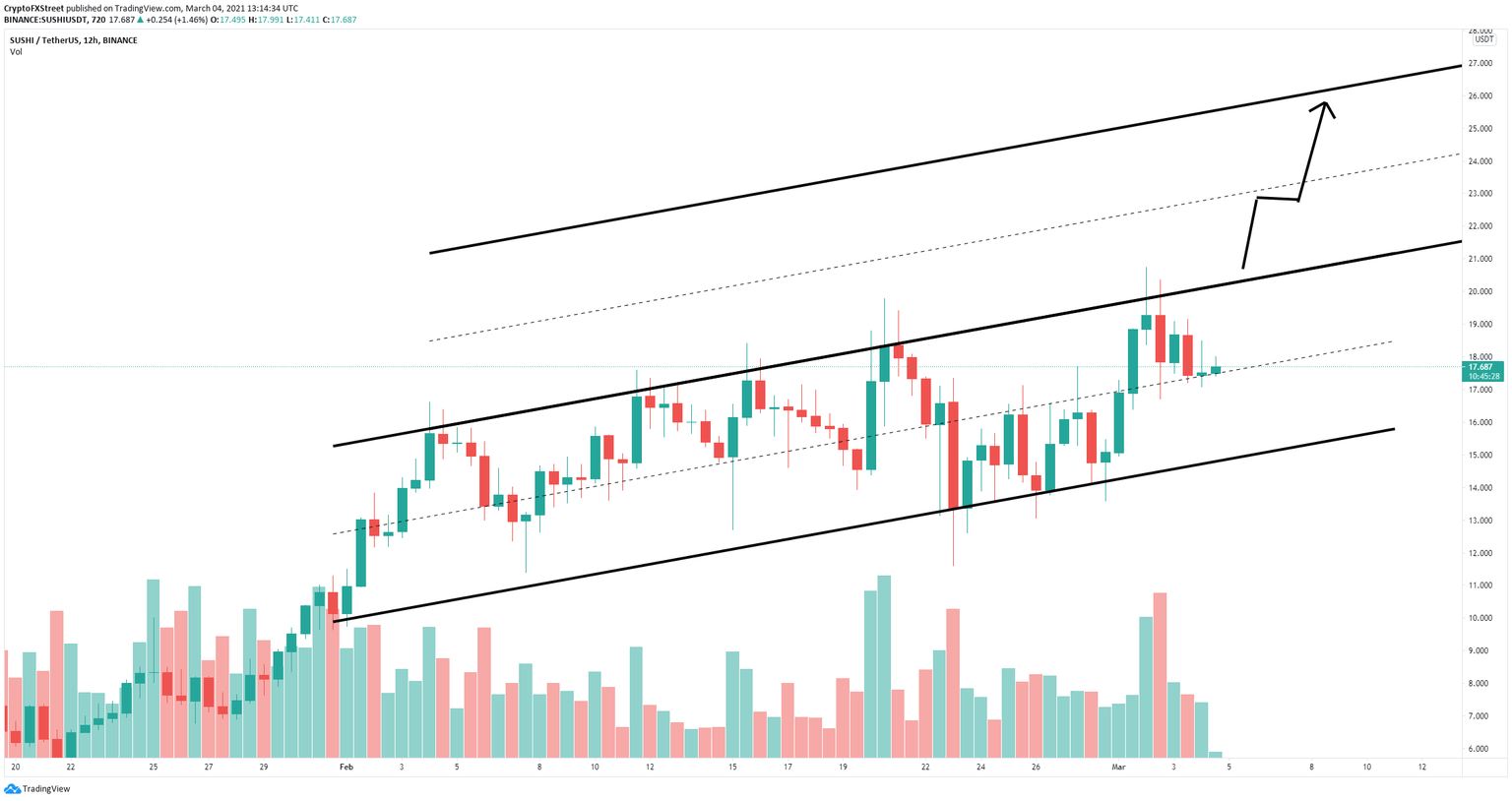

On the 12-hour chart, SUSHI has established an ascending parallel channel with a critical resistance trendline at $20.4. A breakout above this key level should quickly push SushiSwap price towards $23.4 and up to $26 in the long-term.

SUSHI/USD 12-hour chart

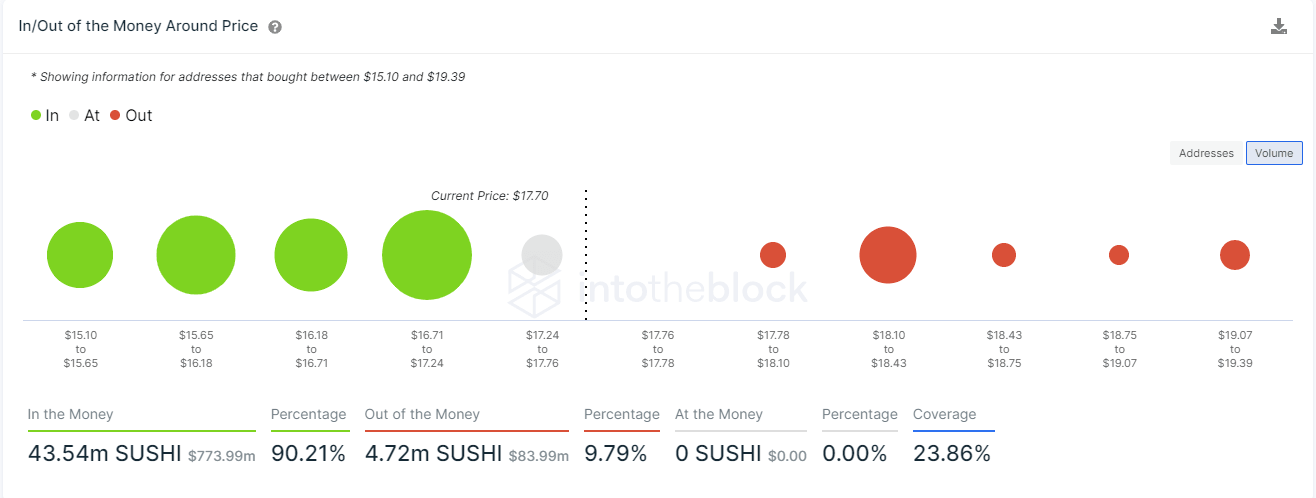

The In/Out of the Money Around Price (IOMAP) chart shows practically no barriers on the way up. The only significant resistance area seems to be located between $18.1 and $18.4 but nothing beyond this point.

SUSHI IOMAP chart

On the flip side, there is a robust support area formed between $16.7 and $17.2 where 564 addresses purchased 15.8 million SUSHI tokens. A breakdown below this key point will push the digital asset down to $15.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.