Stratis Technical Analysis: STRAT/USD massive 57% bull run may continue until $1

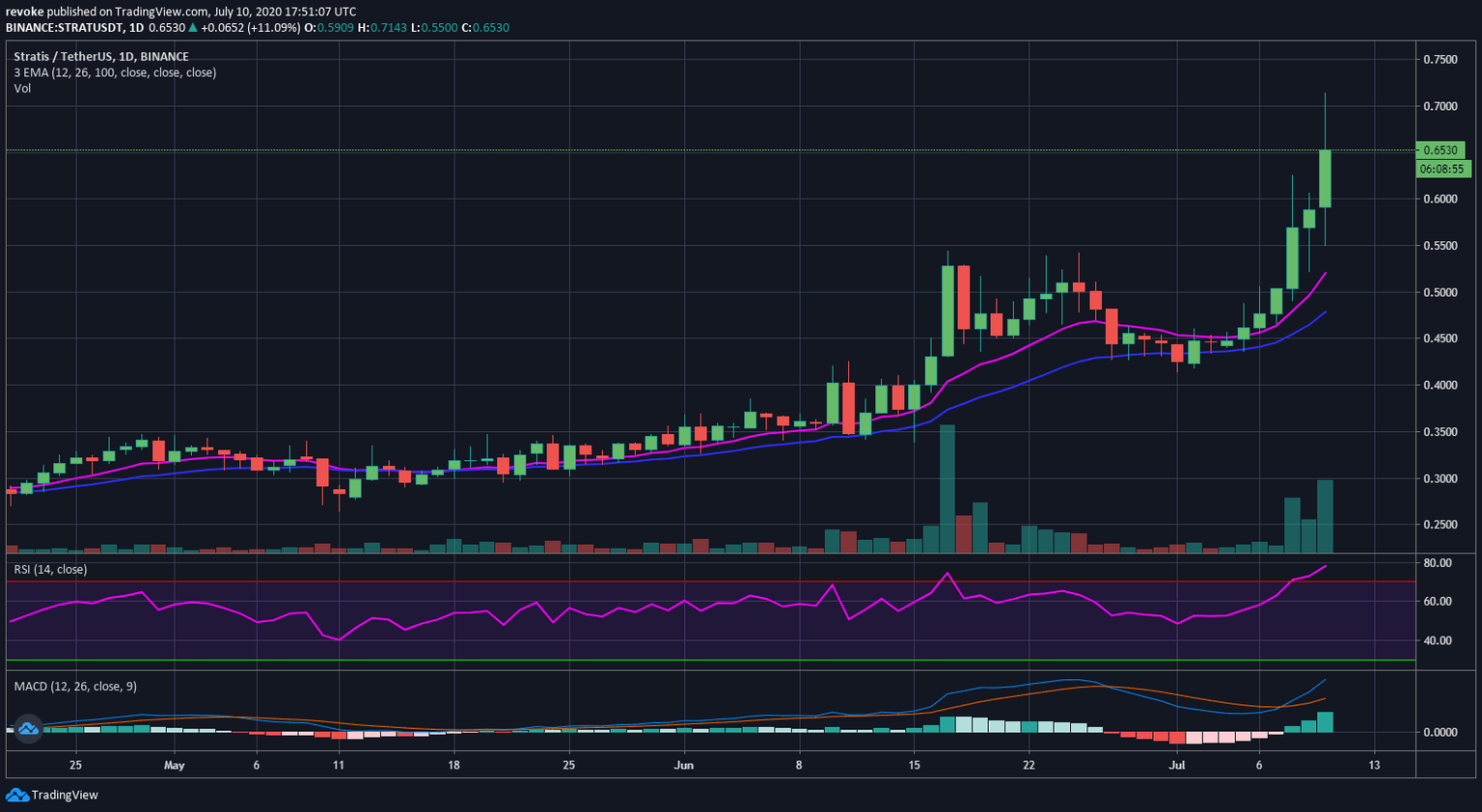

- STRAT/USD is up 13% in the last 24 hours after an extended bull rally.

- The daily uptrend is robust with increasing bullish volume in the past three days.

Stratis has been going up since March 12 hitting a 500% price increase after peaking at $0.71. The last seven days have all been green for STRAT without any sort of consolidation or pullback. The RSI is overextended but FOMO could continue pushing the digital asset to new highs.

STRAT/USD daily chart

The daily chart is obviously in an uptrend with bulls dominating bears but an overextended RSI which could indicate a pullback is nearby. The MACD crossed bullish only three days ago. The daily 12-EMA at $0.52 is the only support level on the way down, followed by the 26-EMA at $0.47 and the low at $0.414.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.