Stellar Price Prediction: XLM aims for $0.3 as bulls buy the dip

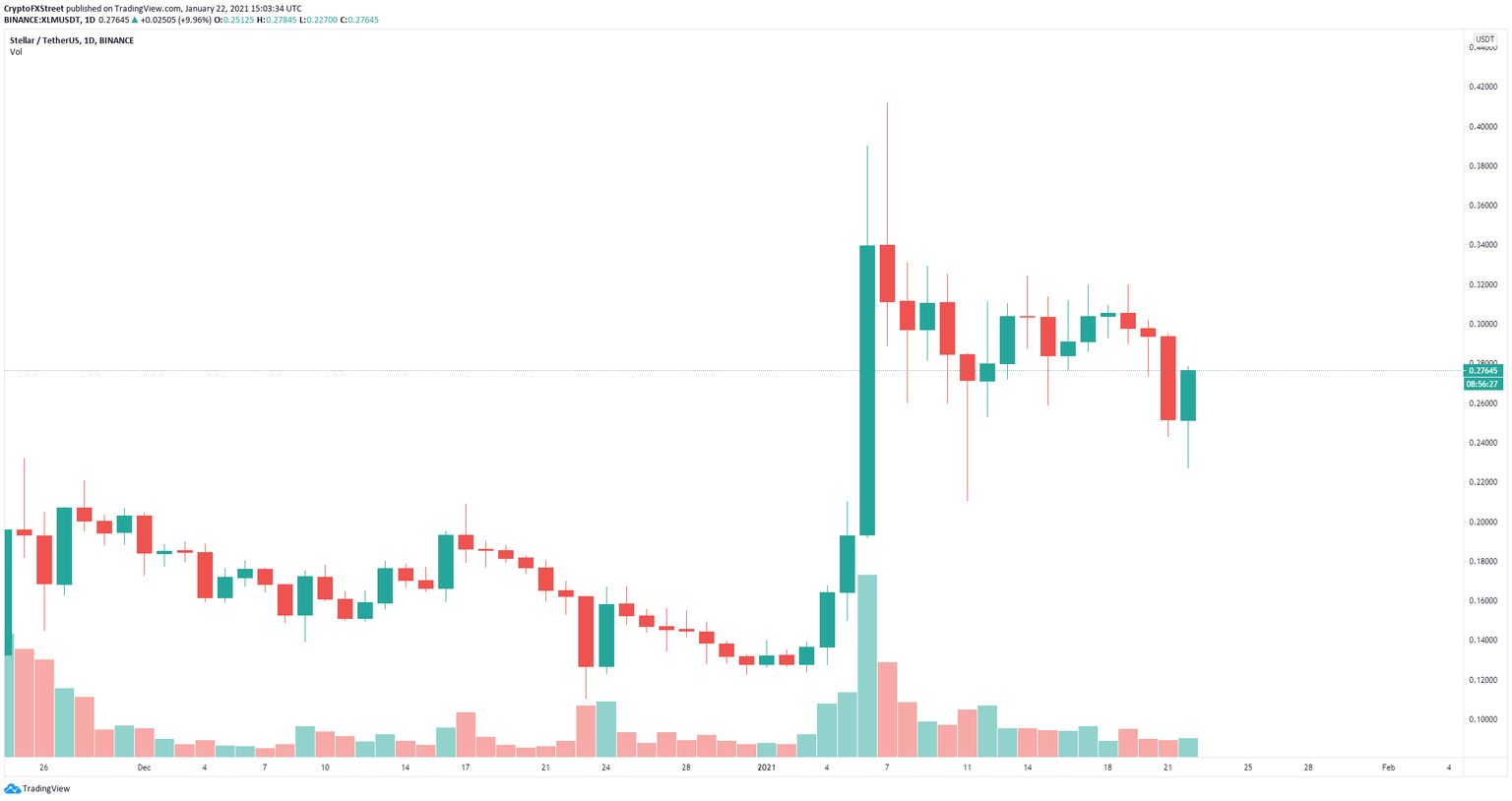

- Stellar price had a massive 18% sell-off on January 21 as the entire crypto market collapsed.

- Bulls managed to buy the dip and pushed the digital asset above a crucial resistance level.

Stellar was trading sideways for close to two weeks before the recent sell-off. In previous articles, the potential of a massive breakout or breakdown was discussed as the Bollinger Bands were extremely squeezed.

Stellar price crashes, bulls see an opportunity to buy the dip

Although Stellar price plummeted by more than 18% in just 24 hours, from a high of $0.294 to a low of $0.227, bulls bought the dip quickly. XLM is already trading at $0.276 at the time of writing, almost gaining all back in less than 24 hours.

XLM/USD daily chart

This is certainly a major indicator that the bulls are very much alive; however, they still need to establish a few short-term uptrends. The most significant resistance point on the 4-hour chart is located at $0.29, which coincides with the 50-SMA and the 100-SMA levels. A breakout above this point would be a clear shift in momentum for the bulls with the potential to drive Stellar price up to $0.32.

XLM/USD 4-hour chart

On the other hand, a rejection from $0.29 could also lead XLM into a new leg down as there is little support below $0.30. The most significant level for the crypto to move downwards is located at $0.227.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.