XLM Price Prediction: Stellar has a bearish fakeout and recovers immediately

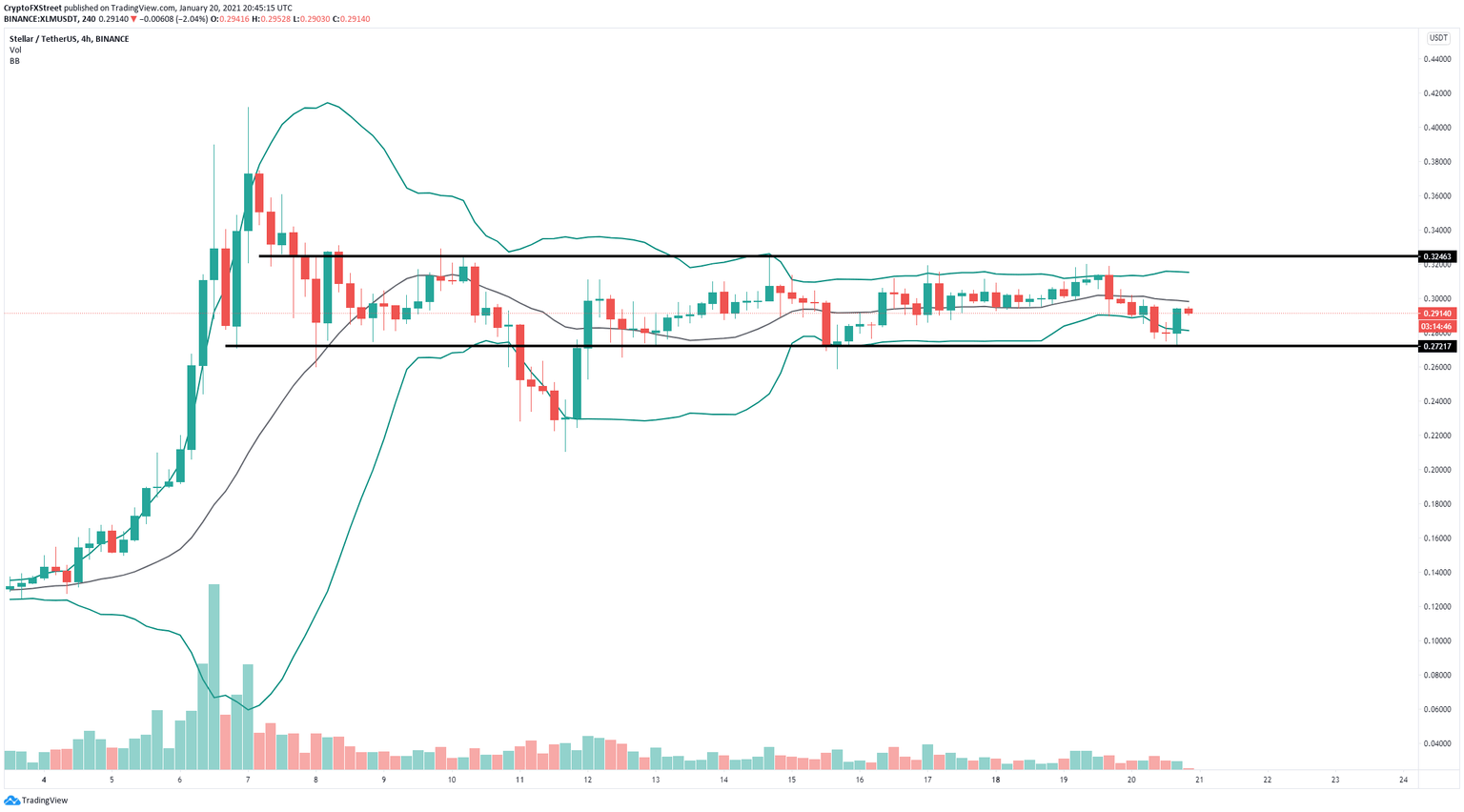

- XLM price has been trading inside a tightening range on the 4-hour chart for the past two weeks.

- The digital asset had a bearish breakdown that turned out to be a fakeout as bulls quickly bought the dip.

After a significant rally to $0.411, XLM price has been trading sideways for the past two weeks awaiting a clear breakout or breakdown. On January 20, Stellar had a breakdown below a crucial support level, but saw no bearish continuation.

XLM price recovers from bearish breakdown and targets $0.40 again

On the 4-hour chart, the Bollinger Bands were extremely squeezed and the bears saw a breakdown around 12 hours ago that turned out to be a fakeout as bulls quickly bought the dip at $0.273, pushing the digital asset to a current price of $0.291.

XLM/USD 4-hour chart

Stellar is trading inside a static range between $0.324 and $0.272 on the 4-hour chart. The upper Bollinger Band coincides with the resistance level at $0.324. As XLM has rebounded from the fakeout, a breakout above this critical point is likely and can drive its price towards $0.4.

On the other hand, the middle Bollinger band could act as a resistance level at $0.30 rejecting XLM price and pushing it towards $0.272. A breakdown below this point would quickly move Stellar to $0.2.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.