Stellar price falls below crucial support level as regulatory concerns increase

- Stellar price lost a critical support level and aims for $0.11.

- Max Keiser, Bitcoin pioneer, stated that SEC will probably target other coins like Stellar or Cardano.

Bitcoin analyst, Max Keiser has recently stated in an interview that the SEC will most likely not stop with Ripple and will target other ‘garbage coins’ including Stellar or Cardano. Keiser asserted that the SEC works as ‘Bitcoin’s drone’ targeting other coins.

Stellar price plummets as SEC regulatory concerns grow

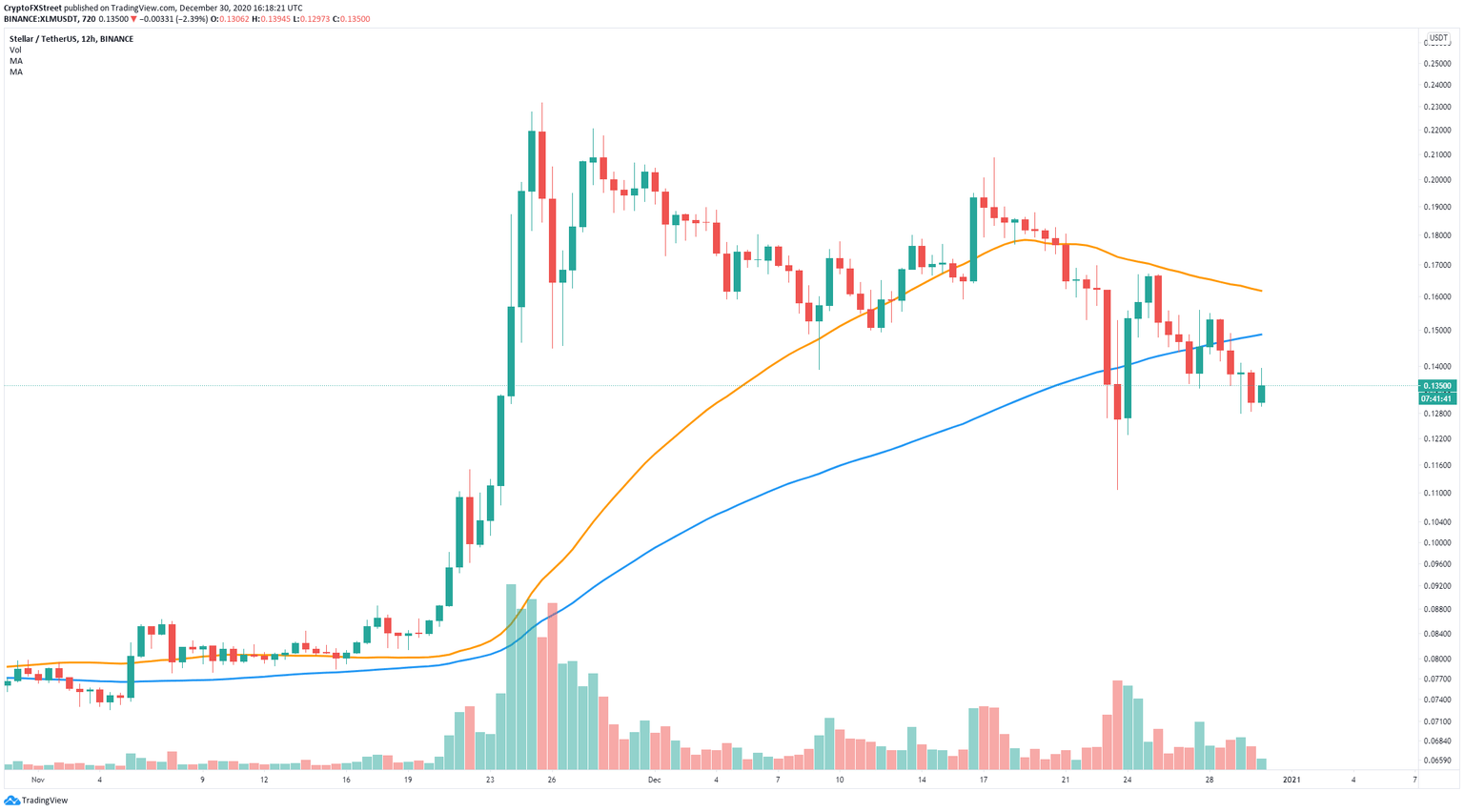

In our last analysis of XLM, we talked about how the bulls needed to defend a crucial support level in the form of the 100-SMA on the 12-hour chart. Unfortunately, they didn’t and Stellar price has fallen to $0.134 since then.

XLM/USD 12-hour chart

Bears have established a clear lower high at $0.155 compared to $0.167 and a lower low at $0.128 compared to $0.1342, confirming a downtrend on the 12-hour chart. The next potential price target seems to be $0.11.

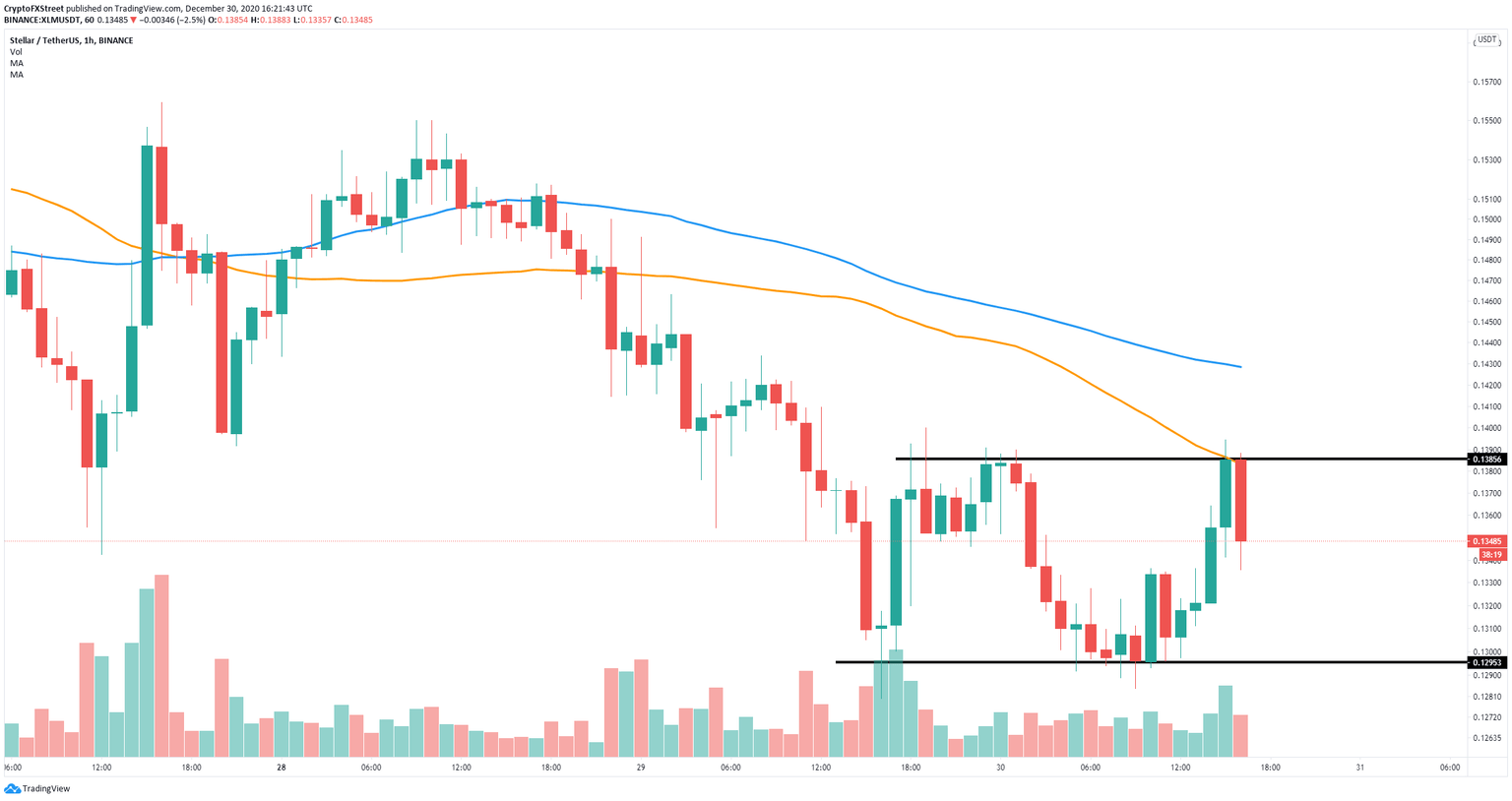

XLM/USD 1-hour chart

Bulls are trying to push XLM above the 50-SMA on the 1-hour chart which coincides with a significant resistance level at $0.138, tested on several occasions. Breaking out above this point can easily push Stellar price towards the 100-SMA at $0.142.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.