Speculation of Ripple, SEC settling by November 9 intensify as Judge Torres issues ultimatum

- Judge Torres responded to the SEC’s letter, which states the regulator intends to meet and confer a briefing schedule with Ripple.

- She also noted the court will set a schedule with regard to remedies if both parties fail to agree.

- XRP price has seen a 15% increase in the past week, bolstered by the recent Bitcoin rally.

The conclusion to Ripple and the Securities & Exchange Commission’s (SEC) legal tiff is likely to take place by the second week of November. Such is the speculation that is now taking shape, given Judge Analisa Torres’ recent statement.

Ripple and SEC need to agree

The SEC sent Judge Torres a letter on October 19, in which it requested time until November 9 for both the regulator and Ripple to agree on a briefing schedule with regard to remedies. Judge Torres responded to this letter on Tuesday, granting both parties the requested time.

However, in addition to the approval, Judge Torres also gave the SEC an ultimatum. In the case that both parties fail to propose a briefing schedule jointly, Torres said, the court will be setting the schedule. The deadline for the same is November 9, as requested by the regulatory body.

#XRPCommunity #SECGov v. #Ripple #XRP By November 9, 2023, the parties shall jointly propose a briefing schedule with regard to remedies. If the parties cannot agree on a schedule, Judge Torres will set the schedule. pic.twitter.com/OHOG0FNPV2

— James K. Filan (@FilanLaw) October 24, 2023

Since this meeting is to establish a path toward solving their differences, crypto enthusiasts are eyeing this date as a potential due date for the settlement of the lawsuit that began in December 2020. SEC charged Ripple with violating securities laws by offering XRP three years ago and the crypto company fought it out until July this year when the court ruled in favor of Ripple. It attained a partial victory and the SEC’s request for appealing the decision was also denied soon after.

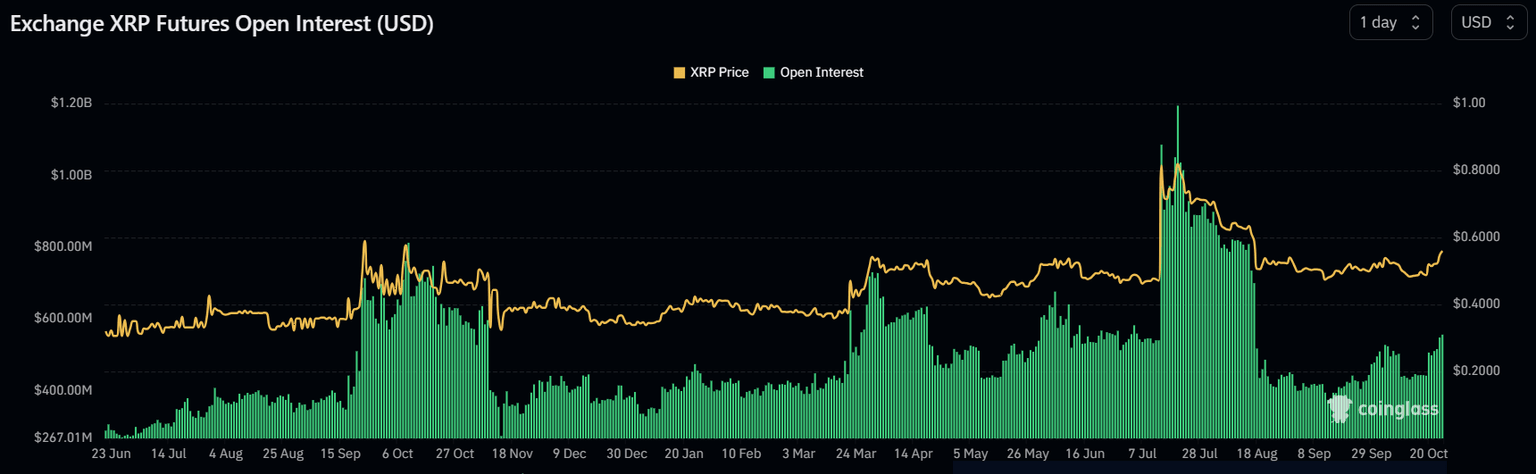

Thus, Ripple enthusiasts are hinging their bullishness with this date, which is also visible on-chain.With the date inching closer, the Open Interest, i.e., the total number of outstanding Ripple futures or options contracts in the market, has been increasing. From an eight-month low of $374 million at the beginning of September, the Open Interest has risen to $555 million, marking a 48.4% increase.

Ripple Open Interest

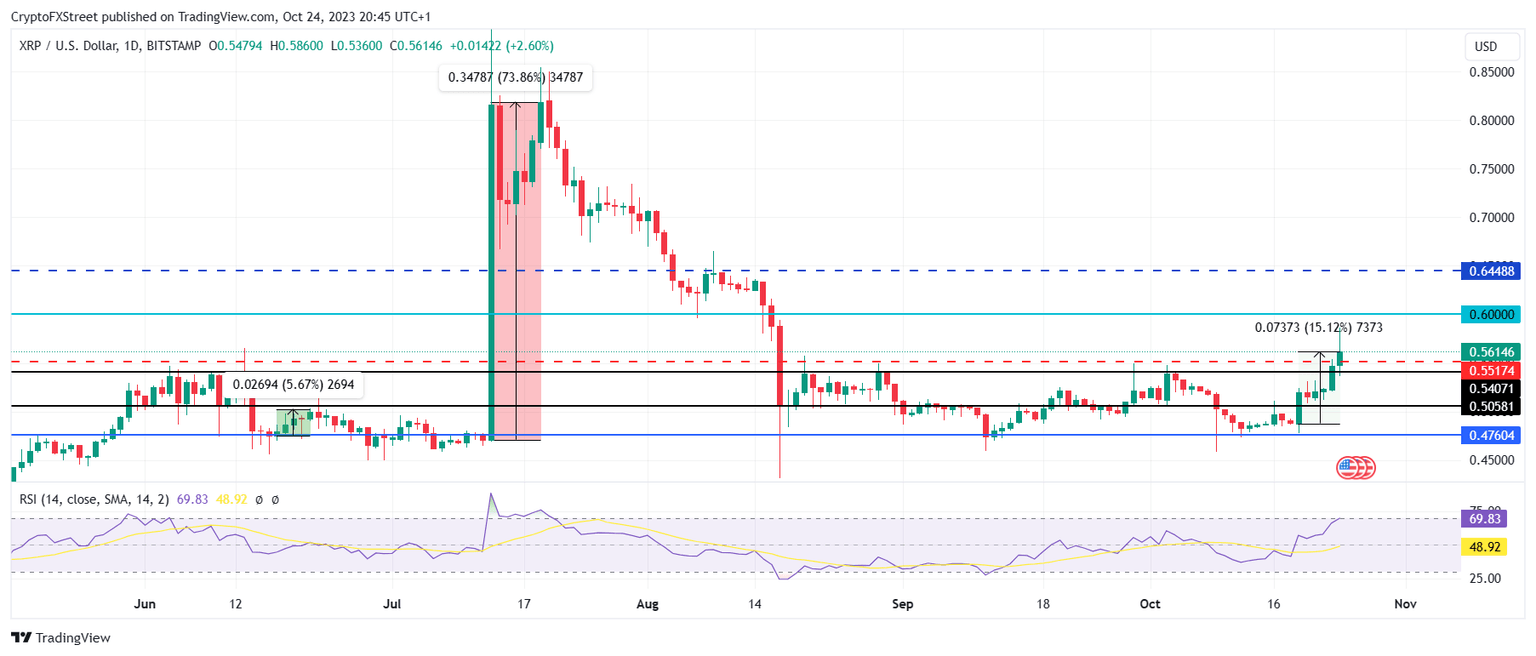

XRP price at a crucial level

XRP price is presently at an important level as the altcoin will need to sustain the bullishness it has acquired in the past few days in order to keep the rally going. Up by 15.1% in the past week, the Ripple native token is presently trading at $0.561.

In doing so, it managed to breach the 23.6% Fibonacci Retracement level, coinciding at $0.551. Flipping this level into a support floor would provide the altcoin a much-needed boost in order to recover to $0.600.

XRP/USD 1-day chart

This bullish thesis, however, could be invalidated if XRP price fails to sustain the $0.551 level as a support level, given the retraction of BlackRock’s spot Bitcoin ETF listing from the DTCC website, the original listing of which was also the cause of the recent rally.

Consequently, the altcoin would fall back down to $0.540 and maybe even $0.505 in a worst-case scenario.

Read more - XRP price might find bullishness to hit $0.60 as chances of SEC winning the lawsuit reduce to 3%

SEC vs Ripple lawsuit FAQs

Is XRP a security?

It depends on the transaction, according to a court ruling released on July 14:

For institutional investors or over-the-counter sales, XRP is a security.

For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

How does the ruling affect Ripple in its legal battle against the SEC?

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token.

While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and will need to keep litigating over the around $729 million it received under written contracts.

What are the implications of the ruling for the overall crypto industry?

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at.

Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say.

Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales are likely to persist.

Is the SEC stance toward crypto assets likely to change after the ruling?

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation.

While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

Can the court ruling be overturned?

The court decision is a partial summary judgment. The ruling can be appealed once a final judgment is issued or if the judge allows it before then. The case is in a pretrial phase, in which both Ripple and the SEC still have the chance to settle.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.