Space ID price succumbs to selling pressure with $3.54 million worth of ID tokens unlocked in a cliff event

- Space ID ecosystem has a cliff unlocks due on September 22, with holders looking to avoid being caught in exit liquidity.

- 18.49 million ID tokens worth $3.54 million will be unlocked, allocated toward community airdrop, ecosystem fund, foundation, and marketing.

- The distribution could instigate selling pressure on the token, likely sending it below the $0.1829 support as traders avoid exit liquidity.

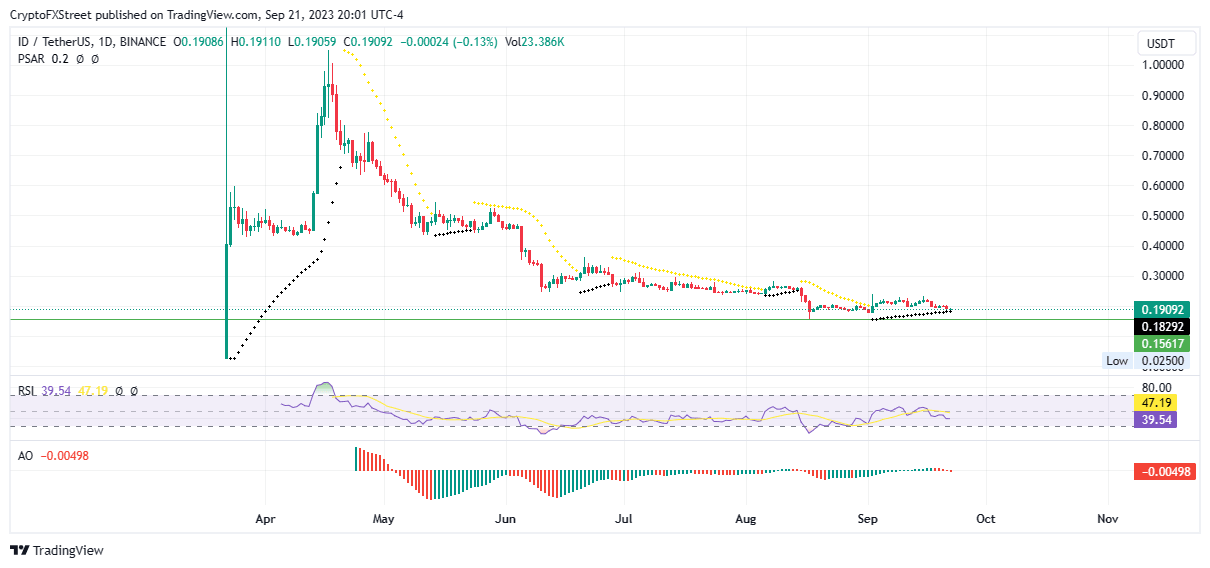

Space ID (ID) price remains bullish based on the Parabolic SAR price-tracking indicator, which continues to track ID price from below. However, the token is trading at a value that is significantly lower than its rate 24 hours ago, an outcome attributed to its scheduled token unlocks event.

Also Read: Quant price maintains steady multi-month downtrend but 60% of QNT holders remain above water

Space ID price falls 5%

Space ID (ID) price is down 5% in the last 24 hours, succumbing to selling pressure as token holders close their positions to avoid being caught as part of exit liquidity. The price is currently testing the support provided by the Parabolic SAR, though thinly, at $0.1829.

Two outcomes remain plausible in this case, either the price would lose the aforementioned support, or hold steady, with the latter indicating that the effects of the unlocks has already been priced in with the 5% fall.

Meanwhile, the Relative Strength Index (RSI) and the Awesome Oscillator (AO) continue to tip the odds in favor of the bears. The critical level to watch is the $0.1561 support, crucial as it coincides with the last lowest low.

ID/USDT 1-day chart

Space ID token unlocks, 18.49 million ID tokens unleashed

Space ID has just unleashed 18.49 million ID tokens worth approximately $3.54 million at current rates. Cliff unlocks is where a specified amount of tokens are unlocked immediately after a specified period or vesting phase.

As part of the token allocations, 31.4% goes to the community airdrop (5.83 million), while 15% goes to the ecosystem fund (2.78 million). Further, 27% will go to the foundation (5 million), while 26% will go towards marketing (4.88 million).

ID cliff token unlocks

Specifically for the community airdrop and marketing allocations, increased supply in the market is bound to impact the value of Space ID. This is because the recipients are likely to cash in for immediate profit, unlike tokens going towards the ecosystem fund and the foundation.

Other token unlock events due today include the 1Inch ecosystem, set to unleash 53,570 tokens worth around $13,780 in the next few hours. The tokens will be distributed among the team, investors, and the VC.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.