South Korea retail crypto trading hits $18B, beating local stock market

Retail trading volumes for crypto assets in South Korea surged to $18 billion in the last 24 hours, outperforming the country’s entire stock market by 22%, according to a new report from 10x Research.

In a Dec. 2 research report, 10x Research founder Markus Thielen said that retail crypto trading volumes had reached their second-highest level of the year on Dec. 2, with South Korean traders frenzying over a series of “high momentum” altcoins.

According to the report, Ripple’s XRP token (XRP $2.69) witnessed over $6.3 billion in volume on the day in South Korea. Dogecoin (DOGE $0.4258) came in second at $1.6 billion, followed by Stellar (XLM $0.5428) at $1.3 billion, Ethereum Name Service (ENS $41.58) at $900 million and Hedera (HBAR $0.3481) at $800 million.

These high-momentum cryptocurrencies are being driven predominantly by retail traders, capitalizing on and reinforcing momentum-driven trends.

XRP, ENS, and HBAR — which belong to a category of older tokens colloquially called “dino coins” by crypto natives — have all been major outperformers when compared to the rest of the crypto market, each respectively gaining 90%, 73%, and 168% in the last week.

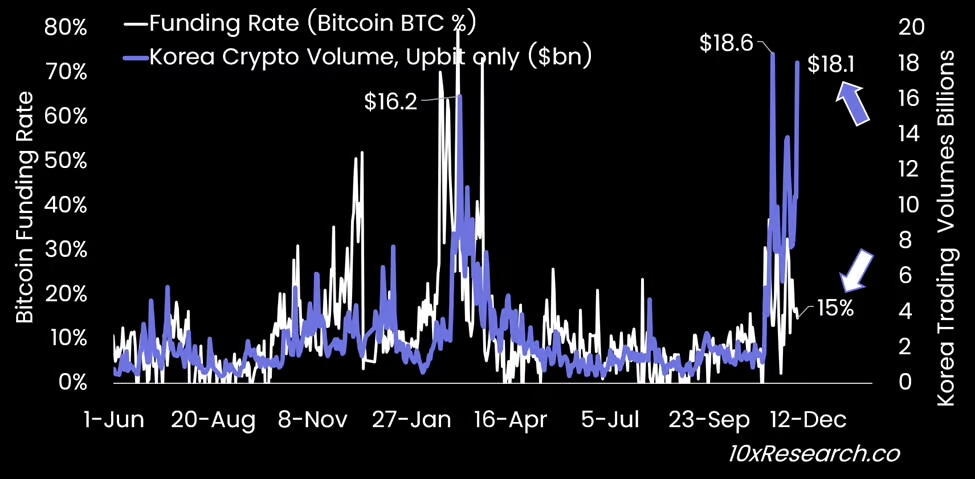

Additionally, Thielen noted that Bitcoin’s funding rate — an indicator of perps activity — was “relatively mild” at just 15% on an annualized basis.

Bitcoin’s funding rate is sitting at a “mild” 15% while interest in altcoins skyrockets. Source: 10x Research

When combined with the recent uptick in trading activity for altcoins, Thielen said this was a surefire sign that an “altseason” is already well underway.

“We are seeing one of the largest divergences recorded between a relatively mild Bitcoin funding rate at 15% annualized while retail trading volumes in Korea have ramped up to $18bn.”

“The action is clearly in the altcoin market and everybody needs to have a strategy to catch these waves but still remain disciplined,” he added.

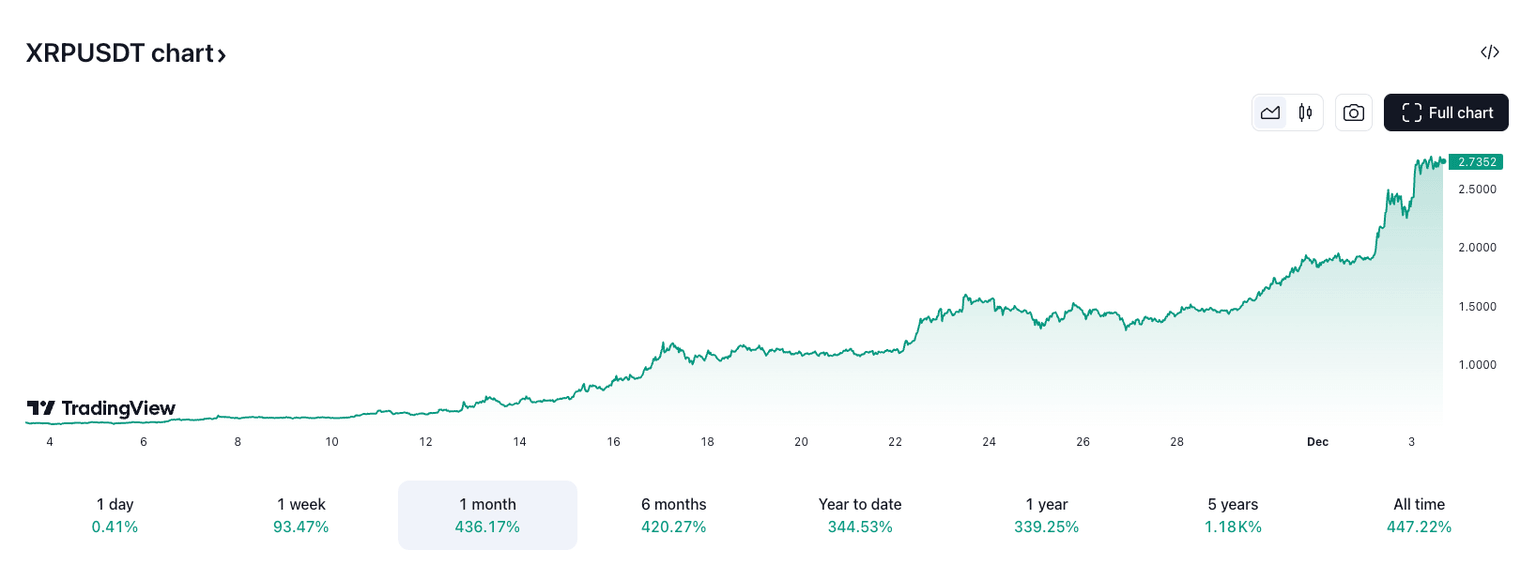

Ripple’s XRP has been staging a historic rally over the last month, surging from a price of $0.50 to a new yearly high of $2.80 on Dec. 2, per TradingView data.

XRP has rallied over 436% in the last month. Source: TradingView

The startling run-up has seen the token eclipse both Solana SOL $229.72 and Tether USDT $1.00 in terms of market cap, making it the third-largest crypto asset by total value at the time of publication.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.