Solana shoots for the stars, but buyers might be too late for the party

- Solana is one of the outliers in cryptocurrencies today with solid gains.

- Buyers need to wait for an entry-level as price action is too volatile to buy at the market.

- Sellers puzzled as well on where to get in for a short position.

Solana (SOL) is or will become a victim of its success. Where some cryptocurrencies see some profit-taking, Solana keeps trading higher. Price action is very choppy though, and it is not a good idea to jump in straight away.

Profit will come to those who are patient and wait for the right opportunity to buy. Price action in SOL ranges around 10%, at least per day. Remarkably, that has happened for 14 consecutive days in a row. The risk of buying SOL at the market is that as a buyer, you get stuck with a price that is already too high up and can only result in a loss on the day or an even more significant loss soon, as real support levels are too far away.

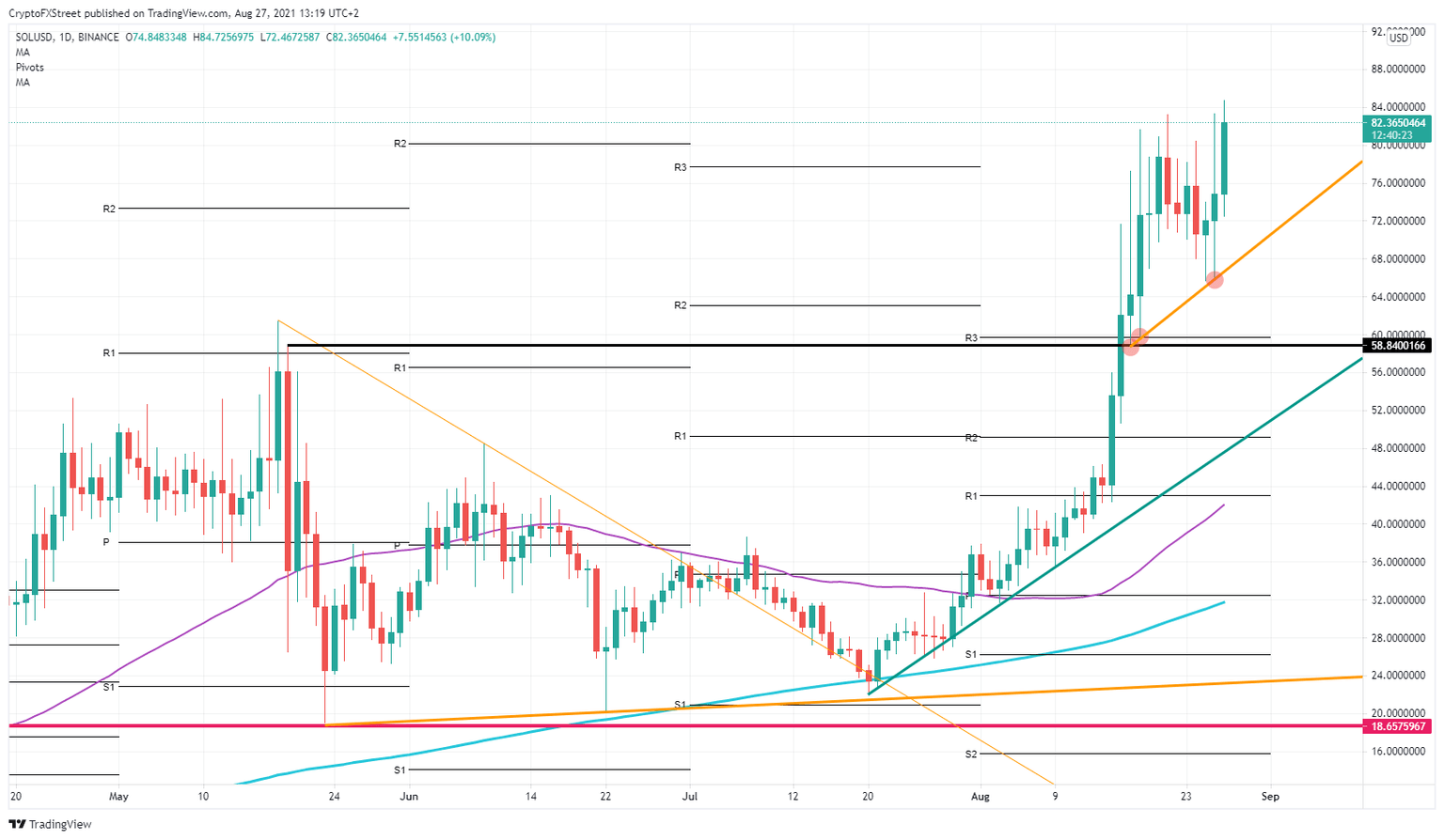

Points of interest for buyers are the yellow ascending trend line where buyers stepped in on August 17 and 18 and recently on August 26. This shows the importance of this trend line of buyers, each time eagerly stepping in as price action swings back up the following day(s).

Buy opportunities are serving themselves to controlled and patient buyers

The more conservative buyer will look at a double bottom close to one another at $60 - $59. Around this area, Solana has the R3 monthly resistance and just below a fundamental technical level going back to May 19.

It is no fun for the sellers trying to take a stab at running the price action down. No fundamental top levels have been identified so far, so most of them will try to start short-selling some SOL at the previous high. They are getting kicked out of their positions for possibly a third time in just two weeks.

A breather in the price action would be more than welcome. If Solana wants to hold itself up, it will need to attract new buyers and build momentum for another push higher.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.