Solana Price Prediction: SOL continues its 10% rally after fakeout

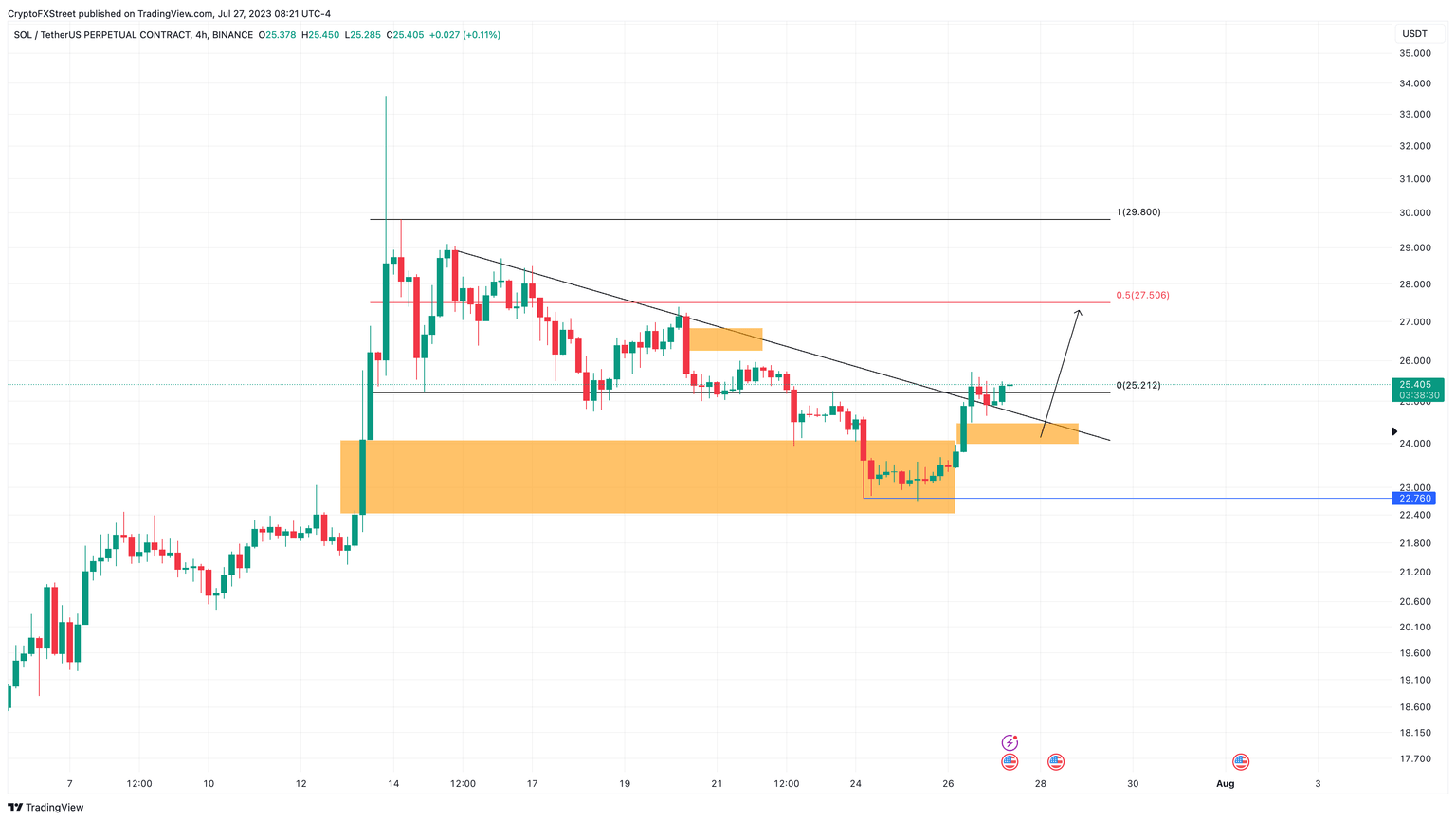

- Solana price swept deep below the range low at $25.12 on July 22 and set up a local bottom at $22.70.

- After undoing all the losses in the following four days, SOL is ready to extend this rally by another 10%.

- Invalidation of this bullish outlook will occur if the altcoin creates a lower low below $22.76.

Solana (SOL) price slipped below a crucial support structure to balance out an imbalance. Completion of this goal was quickly followed by a spurt of buying pressure that undid the recent losses. Now SOL could trigger another swift rally to collect liquidity to the upside.

Read more: Solana records one outage in first half of 2023, 100% uptime in Q2

Solana price ready to breakout

Solana (SOL) price created a range, extending from $25.12 to $29.80 on July 14. After producing a set of lower highs for the next week, SOL breached the support level at $25.21, resulting in nearly 8% in losses.

After this decline set up a local bottom at $22.70, Solana price kickstarted its recovery rally that created another inefficiency, extending from $23.97 to $24.49. While a dip into this area would be a good opportunity to buy, it is unlikely SOL holders will get a chance to accumulate. Regardless, setting up some bids at these levels would be a good idea for bulls.

A bounce at the aforementioned inefficiency or from the current position at $25.41 would result in an extension of the uptrend for Solana price. This move will target the range’s midpoint at $27.50 and would constitute a 10% gain.

But in a highly bullish case, SOL could even go for a sweep of the range high at $29.80, bringing the total gain to 20%.

SOL/USDT 1-day chart

On the other hand, if Solana (SOL) price creates a lower low below $22.76 on the four-hour or higher timeframe, it would invalidate the bullish outlook.

Such a development could see SOL target the sell side liquidity resting below the July 13 swing low at $21.34.

Also read: Top 3 cryptocurrencies to focus on in July 2023 and their targets: SOL, OP, COMP

Like this article? Help us with some feedback by answering this survey:

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.