Solana price eyes 25% gains as SOL arrives at an inflection point

- Solana price dropped nearly 31% over the past eight days, retesting the 200-day SMA at $135.16.

- A recovery above the weekly resistance level at $135.71 will likely trigger a 25% run-up to $169.79.

- A four-hour candlestick close below $115.51 will invalidate the bullish thesis for SOL.

Solana price has seen a considerable drop over the last week as the crypto markets continue to bleed. While this descent might seem bearish, it has allowed SOL to reach an inflection point, allowing it a chance to make a comeback.

Solana price looks ready for a recovery rally

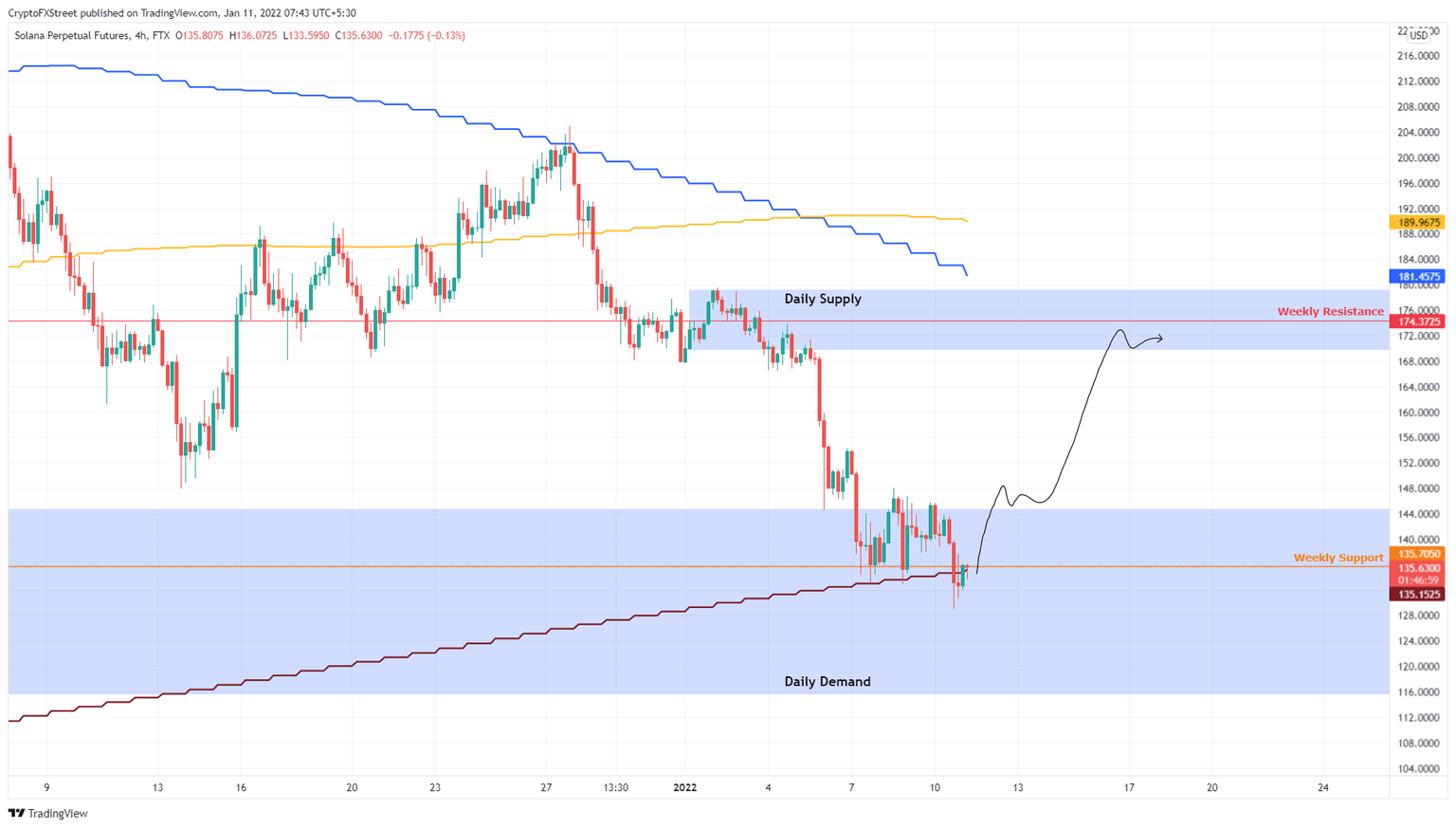

Solana price shed roughly 31% since January 2 and seemed to set a base at a weekly support level - $135.71. However, yesterday’s sell-off pushed SOL below the said barrier and well below the 200-day Simple Moving Average (SMA) at $135.16.

Investors should note that the weekly support level and the 200-day SMA are inside the daily demand zone, extending from $115.51 to $144.70. Hence, this cluster of support levels is a strong confluence that bears are unlikely to sustain a breach.

Hence, market participants can expect Solana price to kick-start a 25% uptrend to retest the lower limit of a daily supply zone, ranging from $169.79 to $179.19. The January 6 swing high at $154.32 might pose a temporary blockade, but bulls are likely to push through it.

In some cases, Solana price could retest the weekly resistance level at $174.37 present inside the daily supply zone, bringing the total climb from 25% to 28%.

SOL/USDT 4-hour chart

While things are looking up for Solana price, a four-hour candlestick close below the daily demand zone’s lower limit at $115.51 will create a lower low. This development will skew the odds in the bears’ favor and invalidate the bullish thesis for SOL. In this situation, Solana price could revisit the $110.35 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.