Solana dips 10% despite DeFi Development Corp's plan to raise $5 billion to boost SOL treasury

- DeFi Development Corporation revealed plans to raise up to $5 billion through an equity line to boost its Solana treasury.

- The company earlier withdrew a Form S-3 filed with the SEC, which contained its plan to raise $1 billion to buy SOL.

- SOL declined 10% despite the announcement.

Solana (SOL) is down 10% on Thursday after DeFi Development Corporation (DFDV) announced an equity line of credit agreement with RK Capital Management to raise $5 billion in sales of its shares to stack additional SOL.

DeFi Dev Corp secures $5 billion equity line in bid to boost SOL acquisition

Nasdaq-listed DeFi Development Corp is set to bolster its Solana treasury strategy through a newly secured $5 billion equity line of credit (ELOC) with RK Capital Management, according to a press release on Thursday.

The agreement grants DeFi Dev Corp the flexibility to issue and sell shares at its discretion, although subject to certain conditions, including the filing of a resale registration statement with the US Securities and Exchange Commission (SEC).

An equity line will allow the company to gradually sell its shares during advantageous conditions rather than issuing fixed equity pricing.

“Unlike other equity offerings, an ELOC enables DeFi Development Corp. to raise capital gradually, when it’s strategically advantageous,” DeFi Development wrote in the press release.

The move is part of DeFi Dev Corp’s broader strategy to aggressively accumulate SOL. The company stated that it will use any proceeds from the issuance and sale of shares to purchase Solana.

It also follows the company's withdrawal of a filing it submitted to the SEC in April, according to a statement on Wednesday. DeFi Dev Corp said the regulator found it ineligible to submit an S-3 filing as it failed to include a management report on internal control over financial reporting.

The company also shared that it integrated its liquid staking token (LST), dfdvSOL, into RateX, a yield trading platform built on Solana. The incorporation allows dfdvSOL to generate yield from RateX’s ecosystem, providing holders with fixed-yield products, yield trading opportunities and liquidity farming incentives.

DeFi Dev Corp currently holds 609,190 Solana, valued at $93 million at publication time. The company has made a total of 11 purchases since it began its Solana treasury strategy in April.

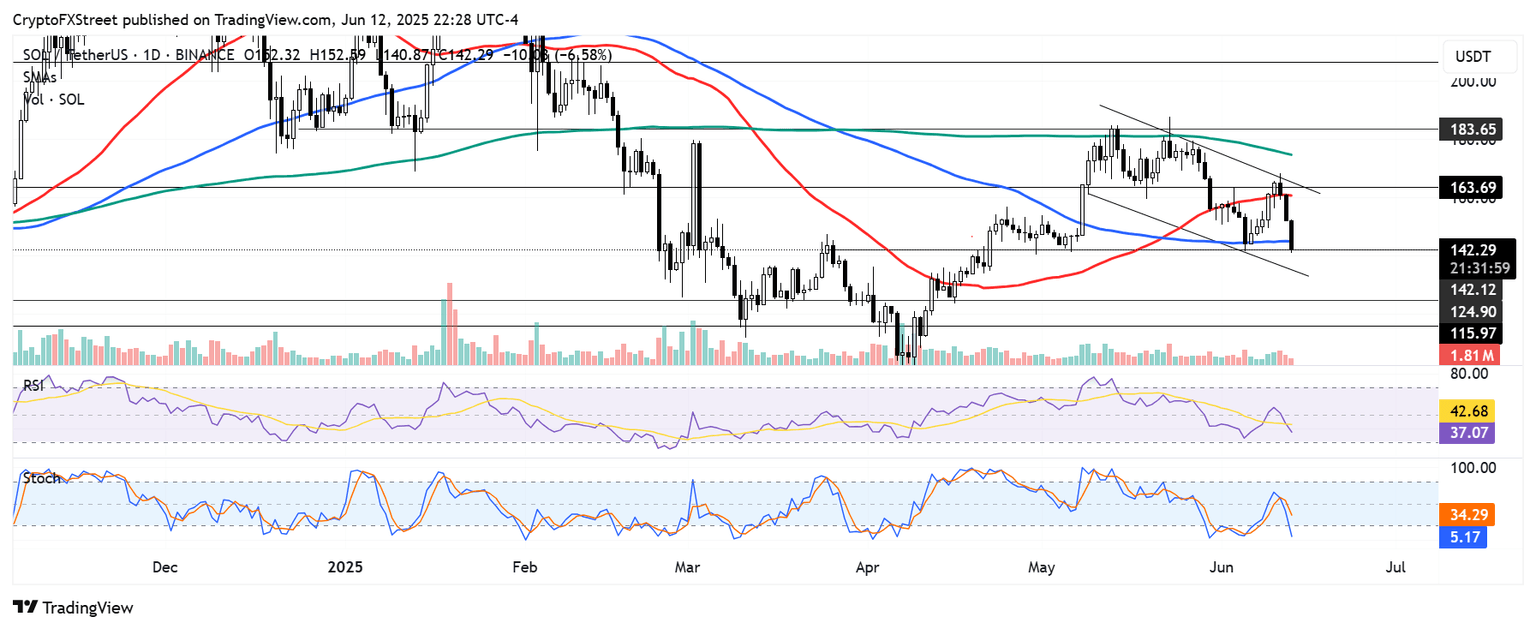

Following the announcement, SOL declined below the 50-day Simple Moving Average (SMA) after it saw a rejection at the upper boundary of a descending channel the previous day. As a result, SOL is down 10% over the past 24 hours and is testing the $142 support, strengthened by the 100-day SMA. A further decline below $142 could see SOL testing the channel's lower boundary. The decline mirrors that of Bitcoin (BTC) and the general crypto market, with several altcoins witnessing double-digit losses.

SOL/USDT daily chart

The Relative Strength Index (RSI) declined below its moving average and neutral level while the Stochastic Oscillator (Stoch) is in the oversold region, indicating strong bearish pressure.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi