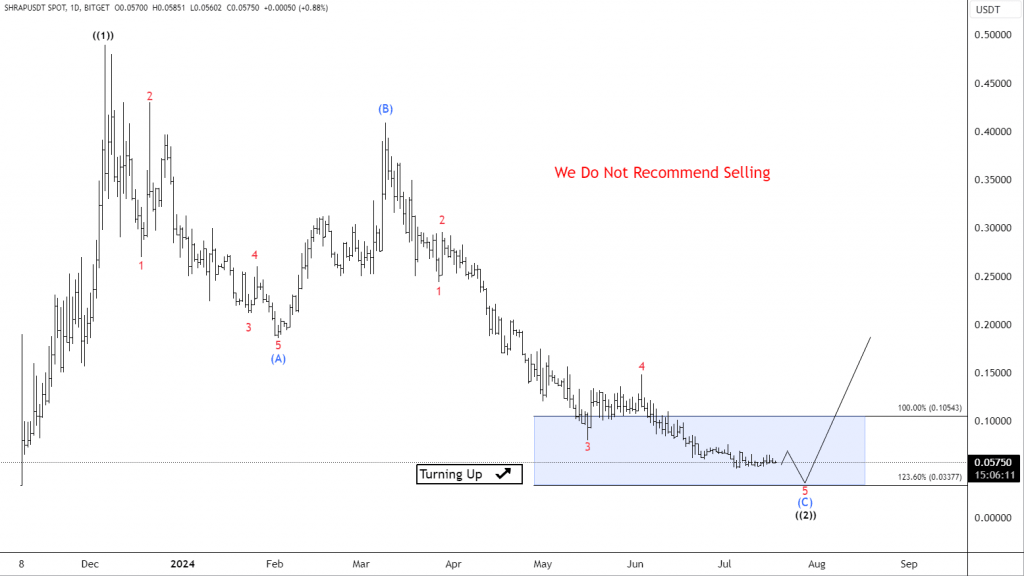

Shrapnel (SHRAP) enters final daily correction phase

SHRAP is a cryptocurrency associated with the blockchain-based game Shrapnel, developed by gaming company Neon Machine nad it aims to create an intensely competitive AAA extraction shooter game. In today’s bog, we’ll explain the daily Elliott Wave structure taking place and explain the potential outcome for the token.

Since December 2023, SHRAP started its decline leading to almost a 90% loss of value. The current move from the peak is unfolding within a 3 waves ZigZag structure and it’s considered as a corrective Elliott Wave structure which will result on a reversal to take place after it ends. The token is already trading lower within wave 5 of (C) and it entered the final phase of the decline. It also reached the equal legs area at $0.10 – $0.03 from where it’s expected to end the daily move to the downside.

The blue box showing in our chart is a technical area where we expect SHRAP to find Buyers and finish the correction within the ZigZag Structure. Up from there, it’s expected to turn to the upside starting a new bullish cycle or at least bounce in 3 waves from there.

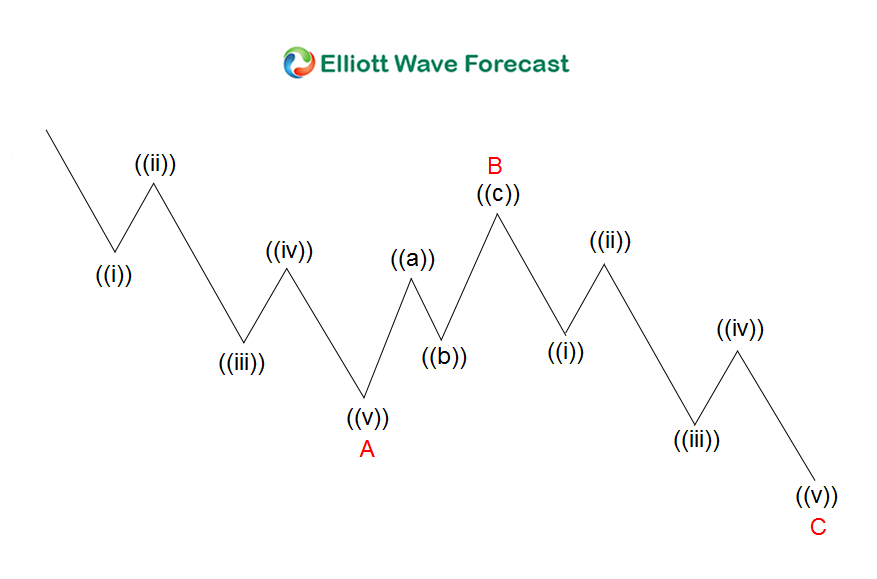

Elliott Wave zigzag structure

SHRAP daily chart 7.18.2024

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com