Shiba Inu price uptrend far from over, SHIB targets $0.00007

- Shiba Inu price takes a breather as RSI points to overbought.

- SHIB price saw additional tailwinds with spillover effects from Nasdaq, Tesla and Bitcoin.

- Drawing Fibonacci retracements reveals where price could go next in this uptrend.

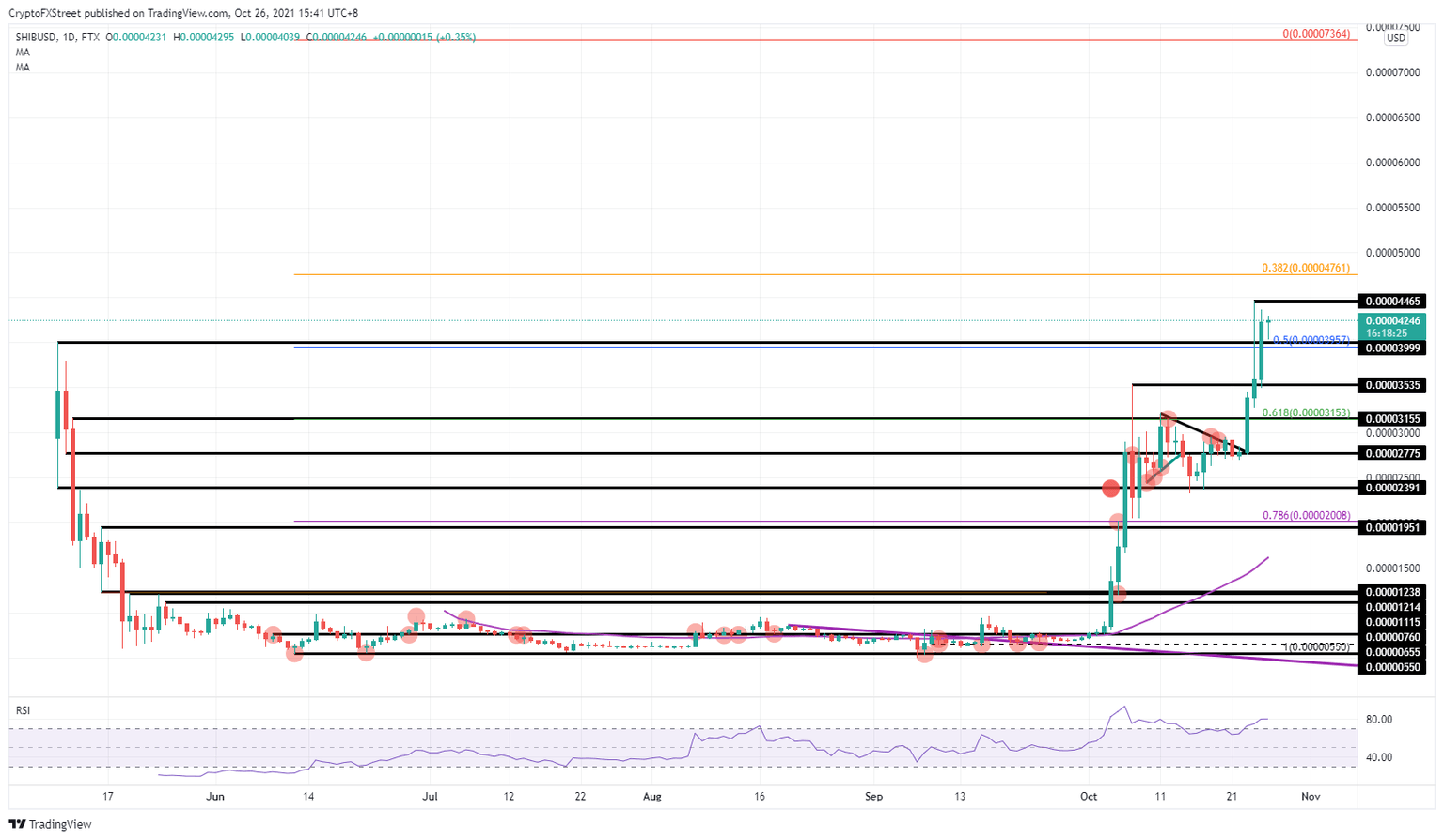

Shiba Inu price has been on a tear since Friday, generating 61% gains for investors. SHIB price is taking a breather today, however, providing bulls with the opportunity to add to their SHIB positions. A Fibonacci retracement from the all-time low reveals there is still 83% more gains in the uptrend, potentially targeting $0.00007364.

Shiba Inu price bound for another 83% gains

Traders who bought Shiba Inu price at $0.00002775 will have seen their positions return around 61% of profits. As Shiba Inu price takes a pit stop at around $0.00004465, new buyers and buyers who want to re-enter the trade have the option to at $0.00004000. SHIB price already broke through this level twice before, but today is respecting it as support, with bulls defending the level to keep the uptrend alive.

For SHIB price monthly pivots do not seem to have played a part in the uptrend. Fibonacci retracements are another story, however, with the 50% Fibonacci level falling in line with $0.00003999, and both 61.8% and 78.6% also falling in line with crucial historical levels from May. Considering this, the next profit level is likely to be at the 38.2% Fibonacci level near $0.00004761 and ultimately $0.00007364, which means that entering today could offer 83% of gains in the future.

SHIB/USD daily chart

As mentioned, Shiba Inu price could start to retrace as the current rally depends on many external tailwinds. Should one or all of these start to fade, expect a quick nose dive in the price action towards $0.00003153 as first real support. In the case that global markets completely shift to risk-off, expect cryptocurrencies to be the first to be ousted in the portfolio reshuffle and SHIB price to hit $0.00002008.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.