Shiba Inu price signals 50% upswing as SHIB forms triple tap setup

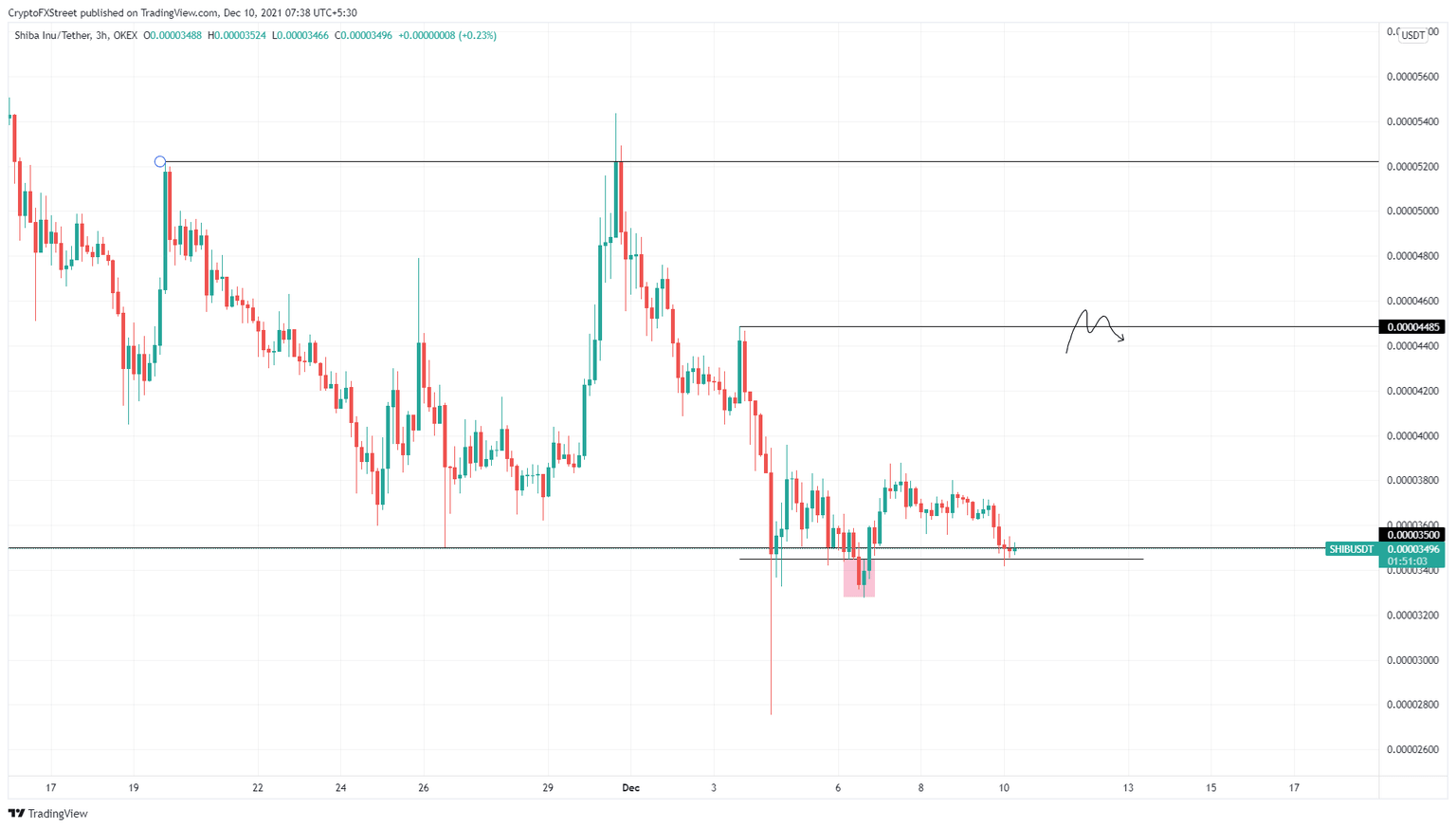

- Shiba Inu price is hovering above the $0.0000350 support level, completing its third tap.

- SHIB is consolidating in a tight area and could be due for a 50% run-up to $0.0000522.

- A breakdown of the $0.0000327 support level will invalidate the bullish thesis.

Shiba Inu price is hovering around a crucial support level and shows signs of triggering a quick run-up. The recent dip below this barrier suggests that the market makers have already collected liquidity, indicating that downside risk is relatively less.

Shiba Inu price to blastoff soon

Shiba Inu price set up $0.0000350 as a support floor after the December 4 flash crash and rallied nearly 14% thereafter. The retracement that ensued dipped below the said barrier and set up a swing low at $0.0000327. This move collected liquidity resting below the $0.0000350 platform and recovered quickly, indicating that the bulls are in play.

After a brief rally, SHIB retraced again and is currently retesting the $0.0000350 foothold, indicating the formation of a triple-tap setup. Often, the third tap of this technical formation is followed by a massive surge in buying pressure.

Assuming a similar development, investors can expect Shiba Inu price to set up a swing high above the $0.0000380 ceiling and collect liquidity resting above it. This move will confirm the start of an uptrend. Beyond this, SHIB is likely to continue its ascent to retest the $0.0000448 hurdle, constituting a 28% gain.

In a highly bullish case, Shiba Inu price could extend beyond $0.0000448 and make a run for the $0.0000522 resistance level and the liquidity resting above it. This move would represent a 50% ascent for SHIB.

SHIB/USDT 3-hour chart

On the other hand, if Shiba Inu price fails to bounce off the $0.0000350 support level, the consolidation might continue. However, if the selling pressure knocks SHIB down to produce a lower low below the $0.0000327 platform, it will invalidate the bullish thesis.

In such a case, Shiba Inu price could venture lower and retest the December 4 swing low at $0.0000275.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.