Shiba Inu price safe from falling to December 2022 lows; investors pull back regardless

- Shiba Inu price is exhibiting signs of recovery, rising by more than 4% in the last 24 hours.

- Network growth is currently at a two-year low which indicates that there is bearishness among investors still.

- However, this might be short-term since the broader market has still not conceded to fear.

Shiba Inu price is attempting to escape the bearishness witnessed by the crypto market over the last few days. Unlike Dogecoin, SHIB is following Bitcoin's lead to note consecutive green candlesticks, which could increase not only the meme coin's value but investors' faith as well.

Also read - Dogecoin price treads water, knocking investor confidence, DOGE sells

Shiba Inu price might make a comeback

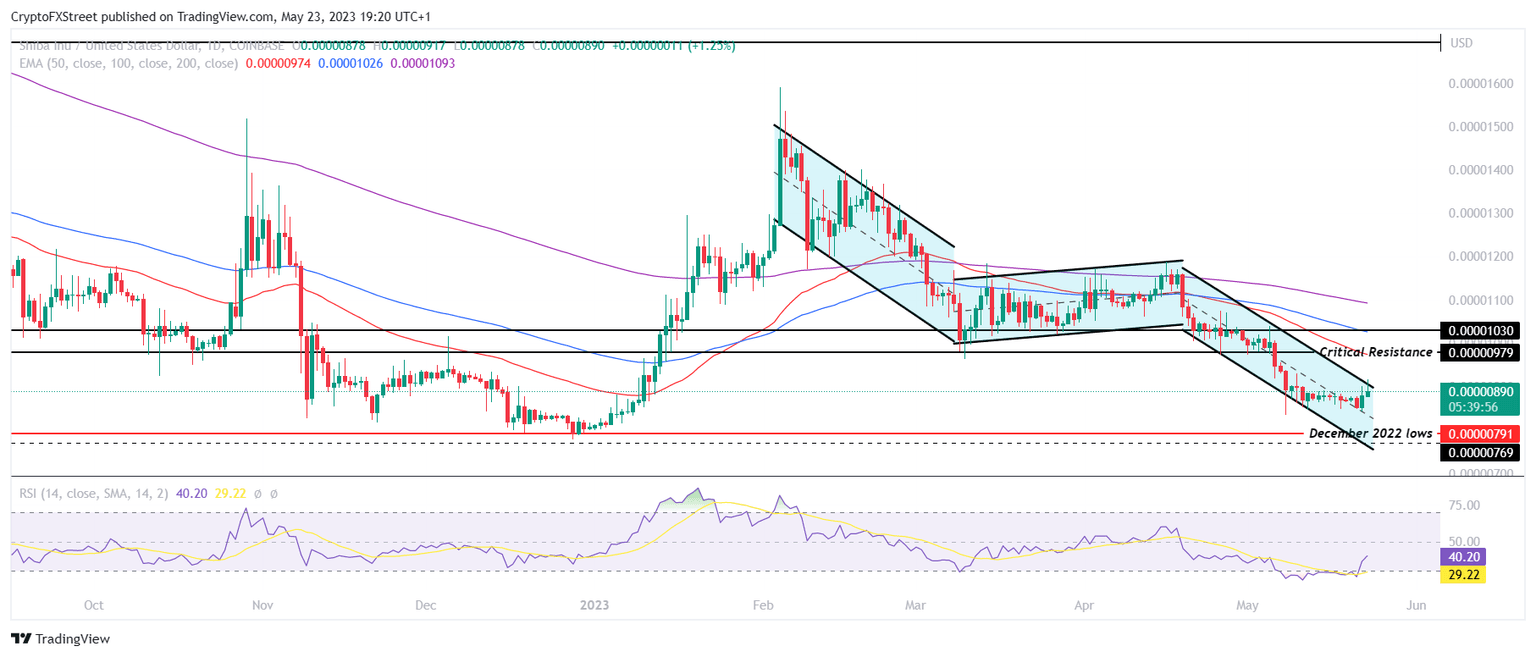

Shiba Inu price, trading at $0.0000089, has noted a 4.22% rise in the last 24 hours. The cryptocurrency nearly missed the December 2022 lows of $0.0000079 and is now potentially charting a path to recovery.

The Relative Strength Index (RSI), which slipped into the oversold zone below the 30.0 mark in the past couple of days, is now climbing back up, nearing the neutral line at 50.0. This is bringing SHIB closer to the critical resistance at $0.0000097.

This price level also coincides with the 50-day Exponential Moving Average (EMA), which is a key barrier to breach.

Furthermore, flipping the critical resistance into a support floor would enable Shiba Inu price to also rise to $0.00001030. The completion of a potential Measured Move pattern observed on the charts since early February further suggests a conclusion of the downtrend. Legs A and C of the three-wave pattern are of similar length, and the price is recovering.

A decisive break above the May highs of $0.00001030 would act as the confirmation of a bullish reversal.

SHIB/USD 1-day chart

This potential increase in price is expected to lure investors back towards the network, which has been losing their interest for a long time now. This bearishness peaked over the last week as network growth fell to a two-year low.

This indicator highlights the rate at which new addresses are formed on the network, and a decline in the same suggests that the cryptocurrency is losing traction. It is a warning that more downside cannot be completely ruled out.

Shiba Inu network growth

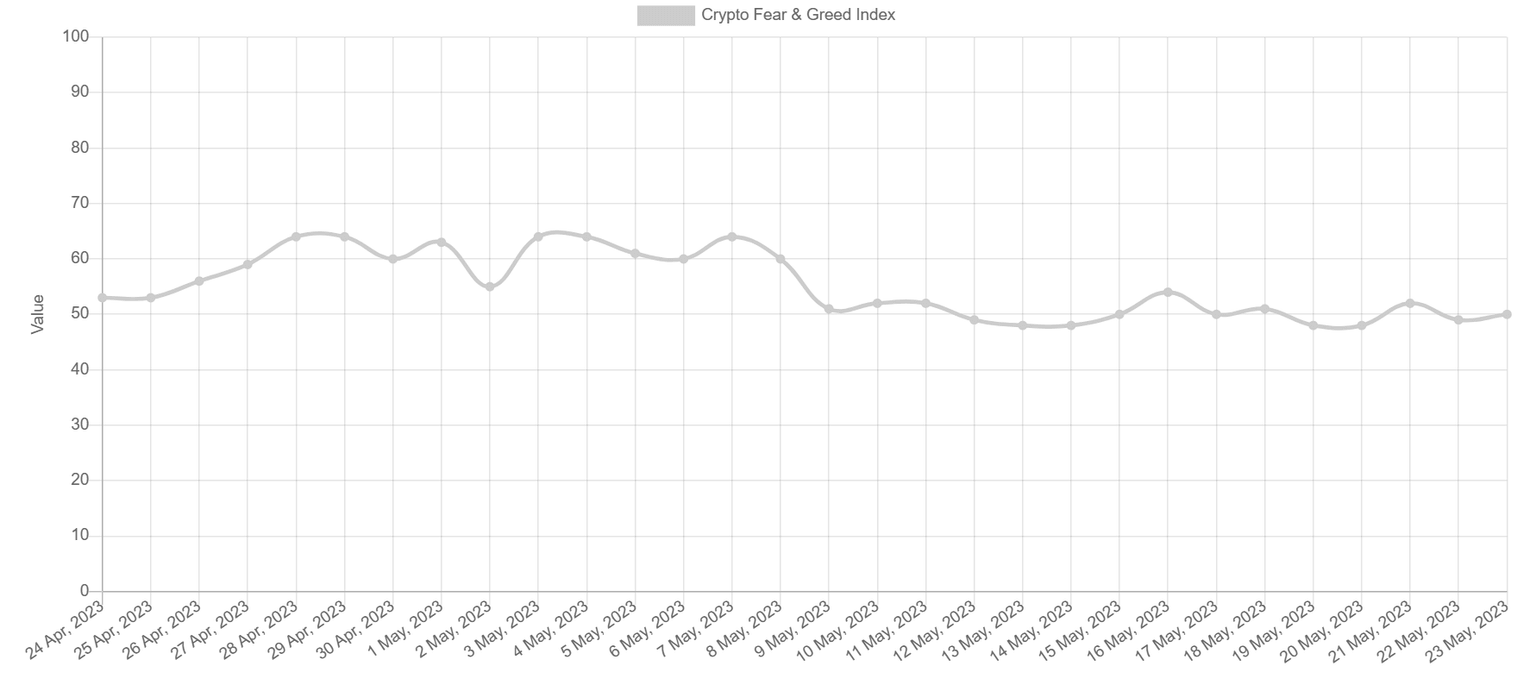

But given that the broader market is not experiencing extreme fear at the moment, a reversal of the aforementioned bearishness looks likely. The Crypto Fear and Greed Index is currently at the Neutral mark and has not slipped into Fear since early May, which is a positive sign.

Crypto Fear and Greed Index

In the unlikely event that Shiba Inu price fails to recover, investors must maintain caution as a dip below the December 2022 lows could lead to severe losses.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B22.59.50%2C%252023%2520May%2C%25202023%5D-638204651114889307.png&w=1536&q=95)