Shiba Inu price lacks momentum but eyes 35% ascent

- Shiba Inu price showed an inability of the buyers as it briefly slipped below $0.00000811.

- A resurgence of bullish momentum could push SHIB to slice through resistance barriers and tag $0.00001120.

- If the $0.00000727 support level is breached, it will invalidate the bullish thesis.

Shiba Inu price faced a minor blockade as it pierced a crucial resistance level. However, due the corrective nature of the cryptocurrency market, SHIB experienced a pullback, delaying its upswing.

Shiba Inu price awaits a trigger

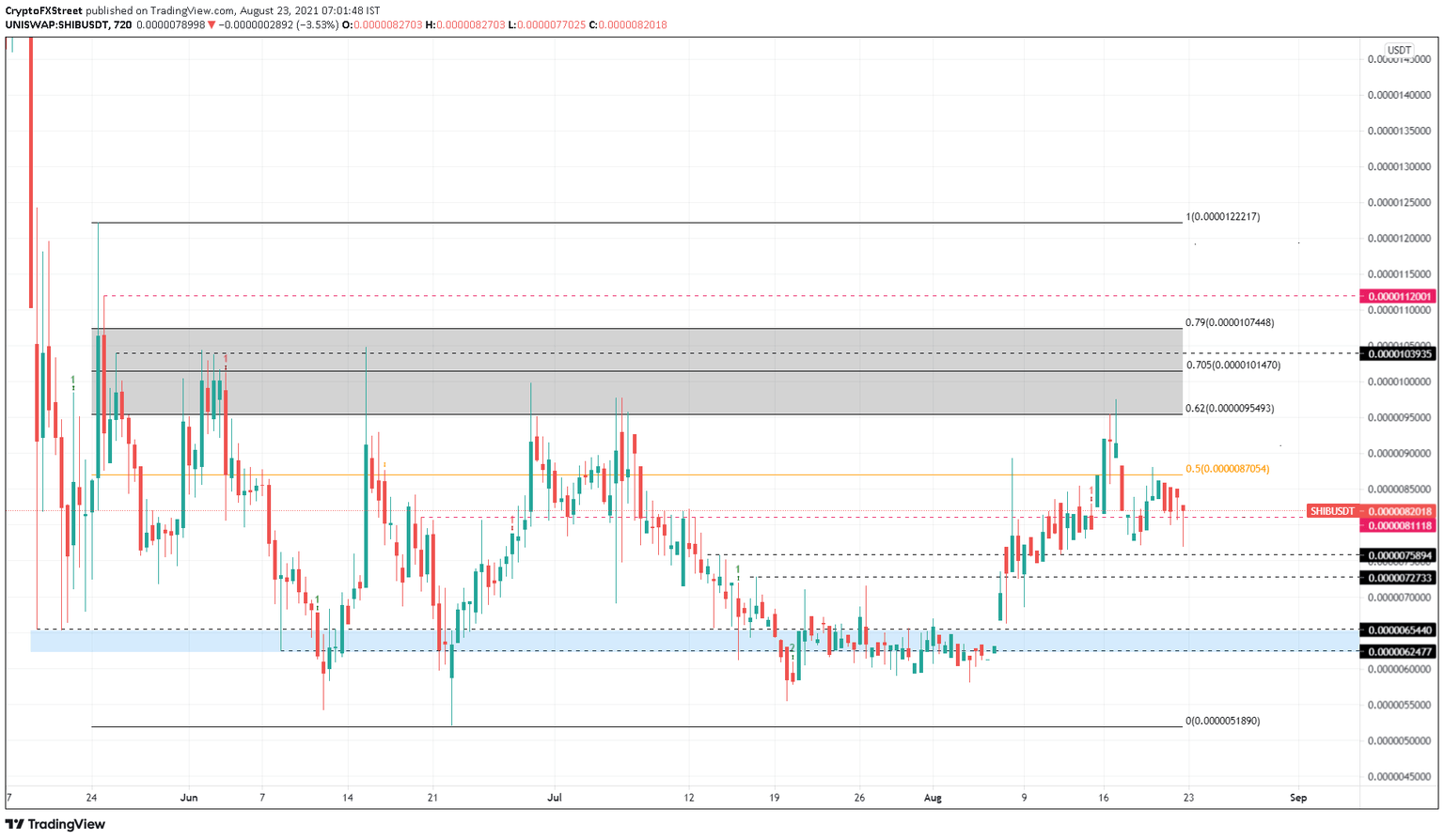

Shiba Inu price came close to testing the $0.00000759 and is currently hovering above the $0.00000811. While this recovery is impressive, SHIB is still below the 50% Fibonacci retracement level at $0.00000871.

If the buyers band together, pushing the meme coin above the said level, it will confirm the start of a second leg-up. In such a case, Shiba Inu price is likely to make another run at the high probability reversal zone ranging from $0.00000955 to $0.00001070.

The August 17 upswing pushed SHIB to tag the lower limit but failed to follow through. The second run-up needs to set up a higher high around the 70.5% Fibonacci retracement level at $0.00001010, which will serve as a secondary confirmation of the bullish momentum.

In an optimistic scenario, Shiba Inu price might shatter the high probability reversal zone and tag $0.00001120, a roughly 38% upswing from the current position, $0.00000820.

SHIB/USDT 12-hour chart

On the other hand, if the buying pressure fails to push Shiba Inu price to shatter the 50% Fibonacci retracement level at $0.00000871, it will indicate weakness and trigger a downswing to the immediate support barrier at $0.00000759.

A breakdown of the subsequent demand level at $0.00000727 will set up a lower low, invalidating the bullish thesis.

In such a case, Shiba Inu price might drop to $0.00000654.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.