Shiba Inu price holds the line but is an 80% upswing still on the cards

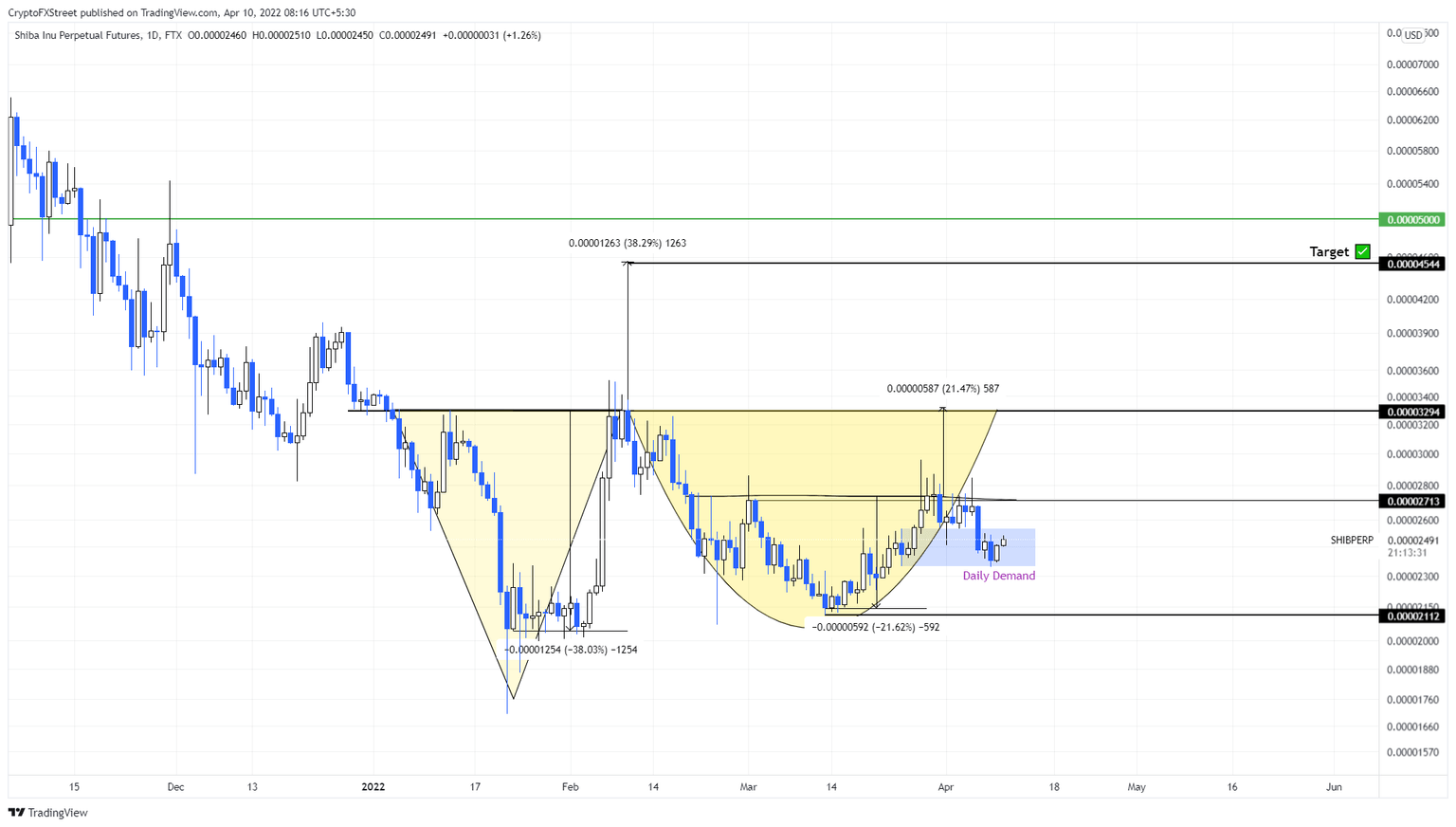

- Shiba Inu price action has set up an Adam and Eve pattern that forecasts a 38% upswing.

- A decisive flip of the $0.0000329 resistance barrier into a support level is the key to kick-starting this run-up to $0.0000454.

- A daily candlestick close below the $0.0000211 support level will invalidate the bullish thesis for SHIB.

Shiba Inu price action over the past three months has set up a bottom reversal pattern. A breakout from this setup, although far away, hints at an exponential move to the upside.

Also read: Dow Jones futures move lower as China CPI soars, yields rise again and oil falls

Shiba Inu price sets up the launchpad

Shiba Inu price action since January 4 has created two distinctive valleys knowns as Adam and Eve. From January 4 to February 9, SHIB formed a V-shaped valley known as “Adam,” following this is a rounded bottom formation referred to as “Eve.” The Eve is yet to complete, and SHIB is hovering around a crucial support area.

If SHIB retests the $0.0000329 hurdle, the Adam and Even setup will be complete. In such a case, this formation forecasts a 38% upswing to $0.0000454, determined by measuring the valley's depth and adding it to the breakout point at $0.0000329.

As mentioned above, SHIB is hovering around $0.0000249 and is far from completing the setup. However, since Shiba Inu price is trading inside the $0.0000235 to $0.0000255 demand zone, the chances of an uptrend are high.

Therefore, accumulating now could provide investors with higher gains. If SHIB flips the $0.0000329 hurdle into a foothold, it will kick-start a 38% upswing to $0.0000454. This move would constitute an 83% gain from the current position.

SHIB/USDT 1-day chart

While things are looking up for the dog-themed cryptocurrency, a daily candlestick close below the $0.0000211 support level would invalidate the bullish thesis by creating a lower low.

This development will favor the bears and open the possibility of a crash to $0.0000094.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.