Shiba Inu price distils bullish signals out of Russia-Ukraine talks, eyes return to $0.000024

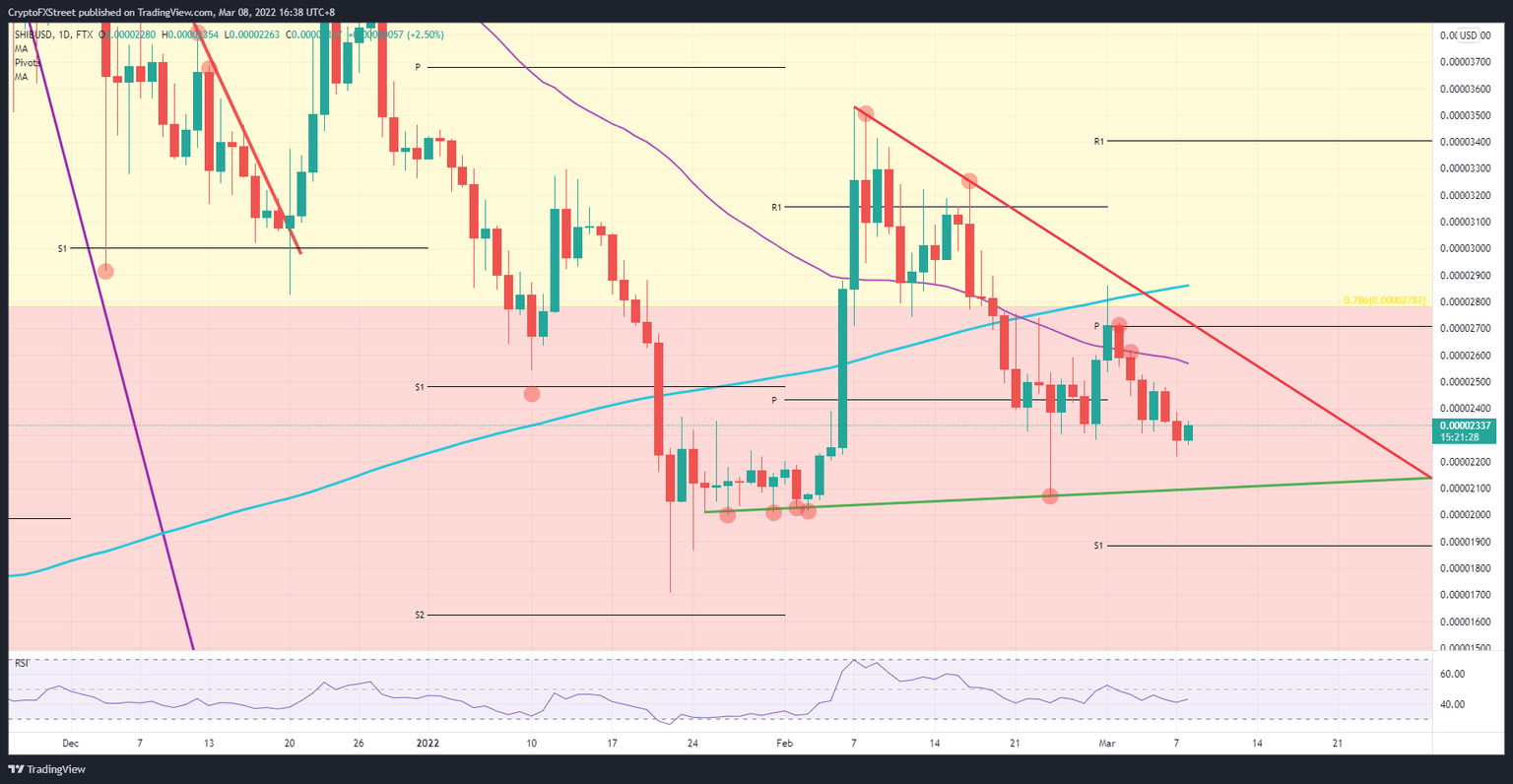

- Shiba Inu price action is still trading in the broader term triangle with support at $0.00002100 and $0.00002700 to the topside.

- SHIB price performs knee-jerk recovery as positive peace talks between Russia and Ukraine set a tone of hope and relief.

- Expect to see short-term returns to $0.00002400, with an upside target at $0.00002600, holding 11% gains.

Shiba Inu (SHIB) price action was on the back foot these past few days with some firm rejections last week at the monthly pivot and the 55-day Simple Moving Average (SMA) – providing bears with two entry points . Add to that equation a stronger dollar as a safe-haven, and SHIB price was under double pressure from two bearish forces. With the announcement of the third round of peace talks, markets are optimistic and triggering a relief rally that could tick $0.00002400 intraday, and could even go all the way to $0.00002700 should further relief signals emerge from global markets.

Shiba Inu price looks ready to jump

Shiba Inu price action is rallying into the European session after announcing that Ukraine and Russia are entering the third round of peace talks, and human corridors will be installed throughout Tuesday. Bulls use these headlines for diving into the price action and using the low of February 28 at $0.00002280 as an entry point. The bull army is being reflected in the Relative Strength Index’s knee-jerk reaction higher as the RSI shifts back up towards 50 but is still ultimately subdued at the moment.

SHIB price looks set to take out yesterday's high and try to tick $0.00002400. Key will be to see where the daily close ends up and how sticky positive headlines prove to be. Going into the U.S. session and tomorrow’s ASIA PAC price needs to stay above $0.00002400 to relay to traders that the rally is viable. Expect to see more inflows tomorrow with SHIB set to tick either $0.00002600 at the 55-day SMA or around the monthly pivot at $0.00002700.

SHIB/USD daily chart

This rally hangs on the lips of any new headlines coming out and hitting the wires. A negative headline could easily trip it up and see bulls falling flat on their belly against the opening price at $0.00002280. Other negative headlines could quickly accelerate the drop towards the green baseline of the triangle, taking out $0.00002200 to the downside and looking for support at $0.00002100. Although negative, the loss would be pretty contained, amounting to an 8% or 9% loss against today's opening price.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.