Shiba Inu due for +10% revaluation as US Dollar weakens substantially

- Shiba Inu price moves remain limited this week, although the US Dollar is firmly weakening.

- SHIB traders do not need to do anything but keep buying as a recalibration should bring SHIB to $0.00001000.

- Expect a squeeze to the upside with a break above the psychological barrier near New Year.

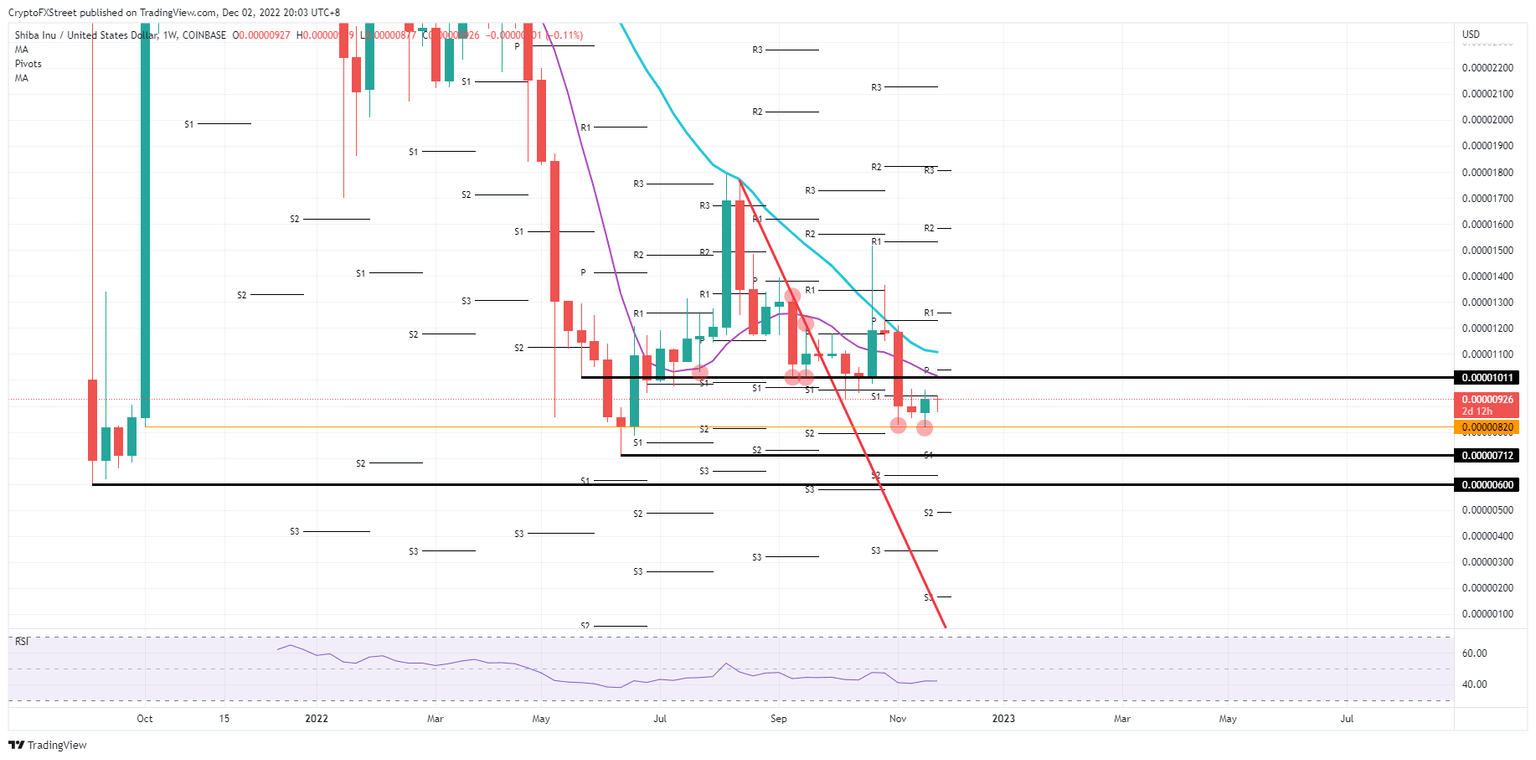

Shiba Inu (SHIB) price action is moving away from the supportive level near $0.00000820, which has been key for November. The level held support and refrained bears from making more lows. As the US Dollar is weakening substantially for the month, that repricing has not happened yet accordingly for SHIB, thus it is a given that this recalibration is set to kick in sooner or later and squeeze quite a lot of bears out of their positions for 2022.

SHIB set to start 2023 with a fresh, clean sheet

Shiba Inu price action has been much battered for 2022 as its staggering decline or meltdown since April has left many traders in despair on what to do with their positions. The favourite trade for 2022 was not only being long USD but also short cryptocurrencies all around. That trade seems to be coming to the end of its lifecycle as already the US Dollar has been weakening substantially off its strongest point for 2022, and several cryptocurrencies are on the cusp of reclaiming important levels higher up from the lows for 2022.

SHIB still has that catching up to do as it is still trading near the low of 2022 for that matter. Considering the US Dollar weakness, SHIB should be trading at $0.00001000. Adding the small recovery story, cryptocurrencies would see it even trade around $0.00001100. With this, SHIB would be set to start its recovery path in 2023 as the 55-day Simple Moving Average (SMA) and the 200-day SMA would be broken to the upside and see a massive inflow of traders for a long position,

SHIB/USD weekly chart

Technically, there is a topside risk in SHIB as that mentioned $0.00001000 comes with a warning sign. Currently, that level holds psychological importance due to the 55-day SMA and has been pivotal since June. A firm rejection against that would see SHIB quickly fade and trade back toward $0.00000820 in search of support, making it the third time and questionable it will hold.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.