SHIB Price Prediction: Shiba Inu looks to rally 30% as markets recover

- Shiba Inu price shows a bullish reaction as it bounces off a demand zone that extends from $0.0000117 to $0.0000168.

- SHIB has surged 33% so far and looks to continue this uptrend to a supply barrier’s lower boundary at $0.0000286.

- A breakdown of $0.0000117 will result in invalidation of the upswing narrative and kick-start a new downtrend.

SHIBA price suffered a fatal fall after Ethereum creator Vitalik Buterin removed liquidity for the token on Uniswap. However, Shiba Inu seems to be holding up fine as it bounced off a demand barrier.

SHIB Price eyes a comeback

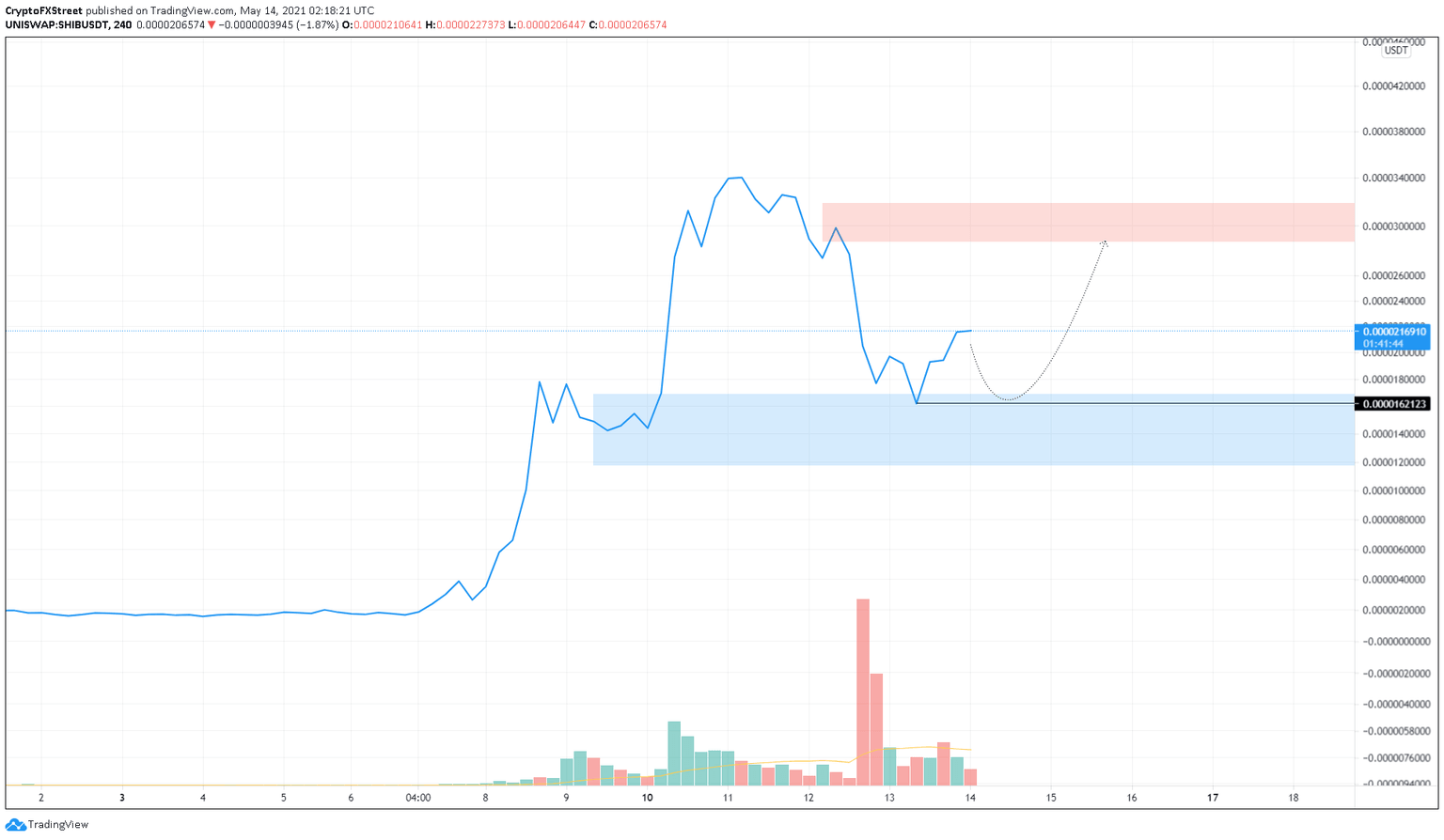

SHIB price has dropped nearly 45% in the past 24 hours and roughly 52% since May 11. However, the meme token seems to have seen a bullish reaction from the demand zone that stretches from $0.0000117 to $0.0000168, pushing SHIB price up by 33%.

Although unlikely, Shiba Inu price could retest this area of support before it seals its upswing narrative and rallies toward the lower boundary of the supply zone extending from $0.0000286 to $0.0000318.

Investors can expect SHIB price to rally 30% from its current position, but a retest to the floor mentioned above could result in a 60% rise.

SHIB/USDT 4-hour chart

While SHIB price seems likely to head higher, investors should note that a sudden crash in the market could affect this bullish thesis. Regardless, if Shiba Inu price fails to surge higher due to underwhelming buying pressure or a potential spike in bearish momentum, market participants can expect the meme-themed cryptocurrency to slide 22% to $0.0000162.

However, a breakdown of the demand zone’s lower trend line at $0.0000117 would invalidate the bullish outlook and kick-start a new downtrend. Under these circumstances, SHIB price could crash 70% to tag the next meaningful support level at $0.00000360.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.