Shiba Inu price is on track to appreciate 15% if this happens

- Shiba Inu price has a similar movement to Dogecoin and hints at a 15% upswing.

- Investors should consider booking profits at the retest of the $0.0000106 resistance level.

- A daily candlestick close below the $0.0000074 level will create a lower low and invalidate the bullish outlook for SHIB.

Shiba Inu price has breached its tight consolidation range after two weeks, indicating a shift in the narrative. The resurgence of buyers is evident with the direction of the recent move. This outlook will likely persist, pushing SHIB higher as the month-end volatility starts to kick in.

Shiba Inu price primed for more gains

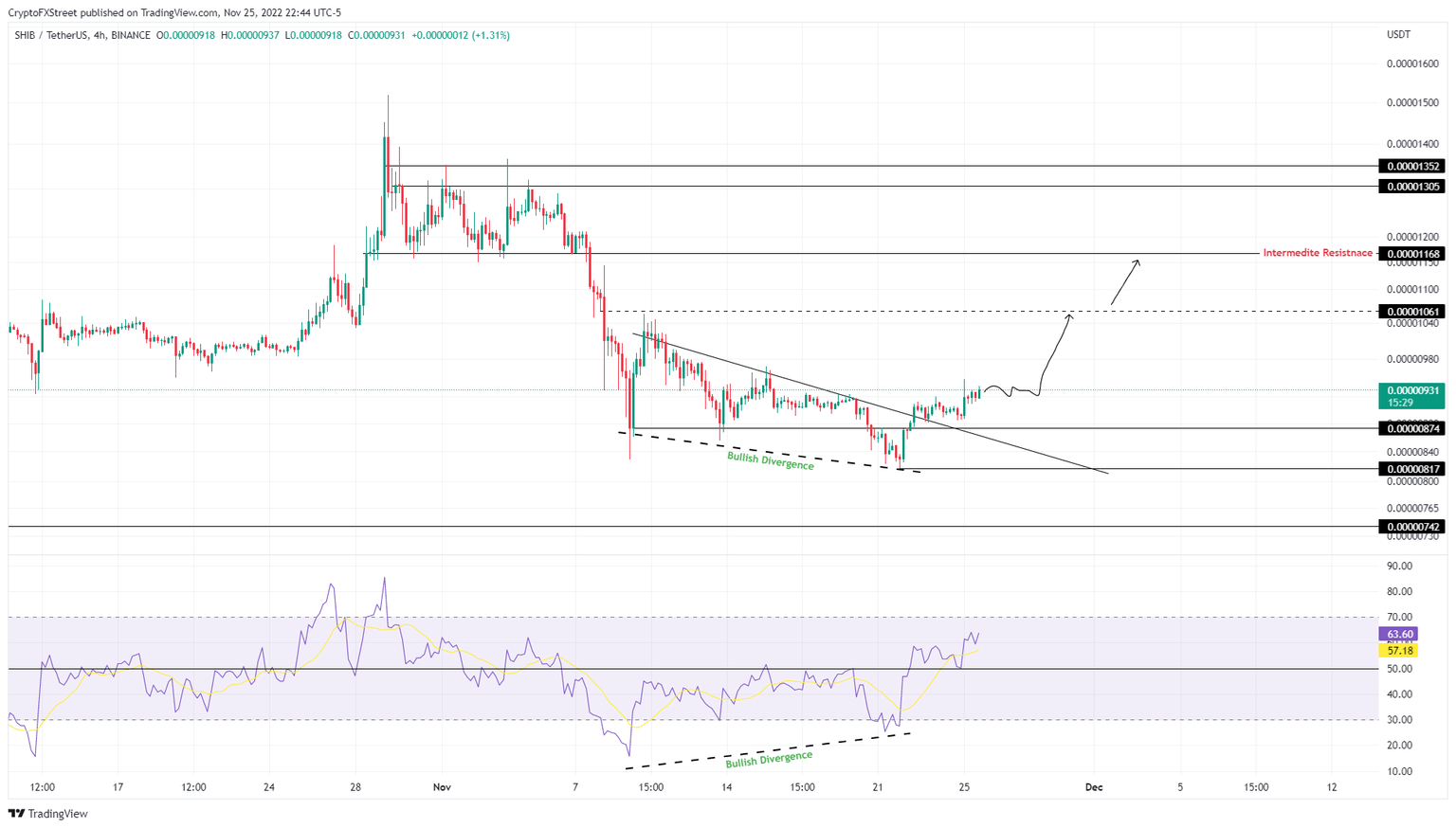

Shiba Inu price set up three lower highs and lower lows since November 9, depicting a downtrend. However, on November 22, SHIB pierced the trend line connecting the said swing lows, denoting a breakout.

The Dogecoin-killer noted a 7% upswing after it confirmed a bullish resurgence.

Furthermore, the Relative Strength Index (RSI), the 11% run-up on November 22, seems to directly result from the bullish divergence. This technical formation is formed when the Shiba Inu price produces lower lows while RSI produces higher lows, denoting a rising bullish momentum.

This non-conformity suggests that a trend reversal is likely for Shiba Inu price.

Investors can expect SHIB to retest the $0.0000106 hurdle, denoting a 15% upswing for bulls. However, a flip of this level will extend the run-up to $0.0000116, bringing the total gain to 25%.

SHIB/USDT 4-hour chart

While the bullish outlook is apparent, investors need to pay close attention to the $0.0000081 support level. A breakdown of this barrier will invalidate the bullish thesis for Shiba Inu price by producing a lower low.

In such a case, SHIB could slide 9% before approaching a stable support level at $0.0000074.

Here's how Bitcoin's moves could affect Shiba Inu price

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.