SafeMoon price will gladly benefit patient bulls with massive breakout

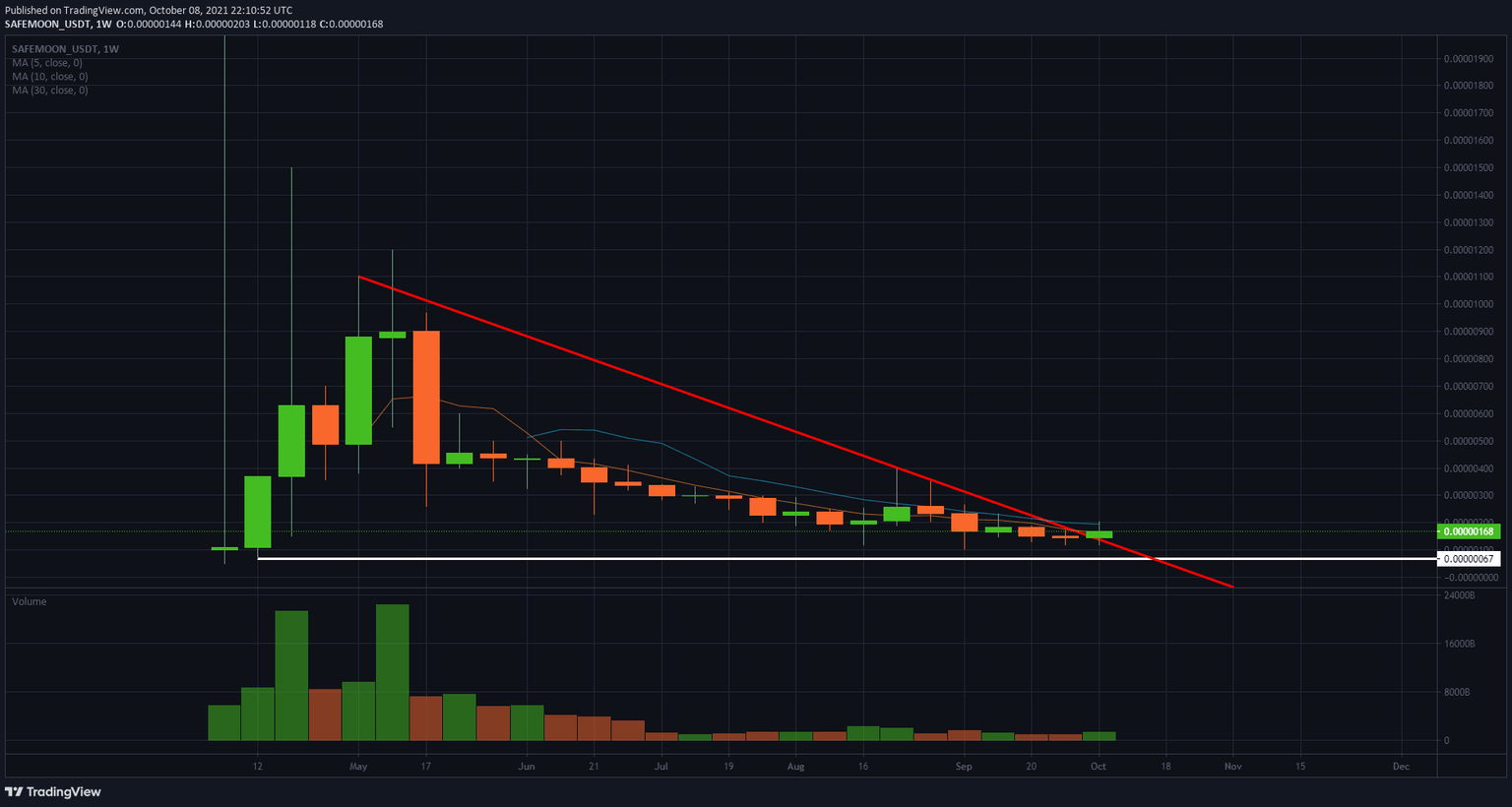

- SafeMoon price was on the verge of dipping towards $0.00000067 before the bullish outbreak finally happened this week.

- SAFEMOON price action has seen a significant volume acceleration, with bulls joining the scene after a long absence.

- SAFEMOON bulls got rejected this week at the 10-weeks SMA at $0.00000194.

SafeMoon (SAFEMOON) price action has managed to break out of the downtrend that lasted several months. The bullish breakout came as cryptocurrencies gained new attention, with Bitcoin hitting $50.000. The favorable tailwind got translated into added volume and price action in SAFEMOON breaking above $0.00000200.

SafeMoon price in an uptrend as long favorable tailwinds underpin price action

SafeMoon price action was able to break out of the downtrend it got stuck into since mid-May. As price action was unable to get back above $0.00000400. In that downtrend, the volume started to wear thin by the weeks and almost showed a complete absence of bulls being present. But with Bitcoin pulling cryptocurrencies back on the forefront, bulls have reemerged in SafeMoon price action and quickly pushed quite some bears out of their short positions.

SAFEMOON price was in favor of bulls that were able to break above the red descending trend line. It will be critical going forward that bulls stay above this trend line. If the trend line acts as an entry point for more buying volume in SafeMoon, that will spell green lights for more gains soon.

SAFEMOON/USD weekly chart

Expect buyers to try and reclaim the 10-weeks Simple Moving Average (SMA) at $0.00000194. The following profit taking level is around $0.00000400, which was the high from August. But that would only be possible if favorable tailwinds keep price action underpinned.

Should those favorable tailwinds start to fade in SafeMoon, expect bears to quickly regain control and ramp price action first back below the red descending trend line. This would add further negative attention and invite more bears into SAFEMOON price action. A retest of $0.00000067 would then be inevitable.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.