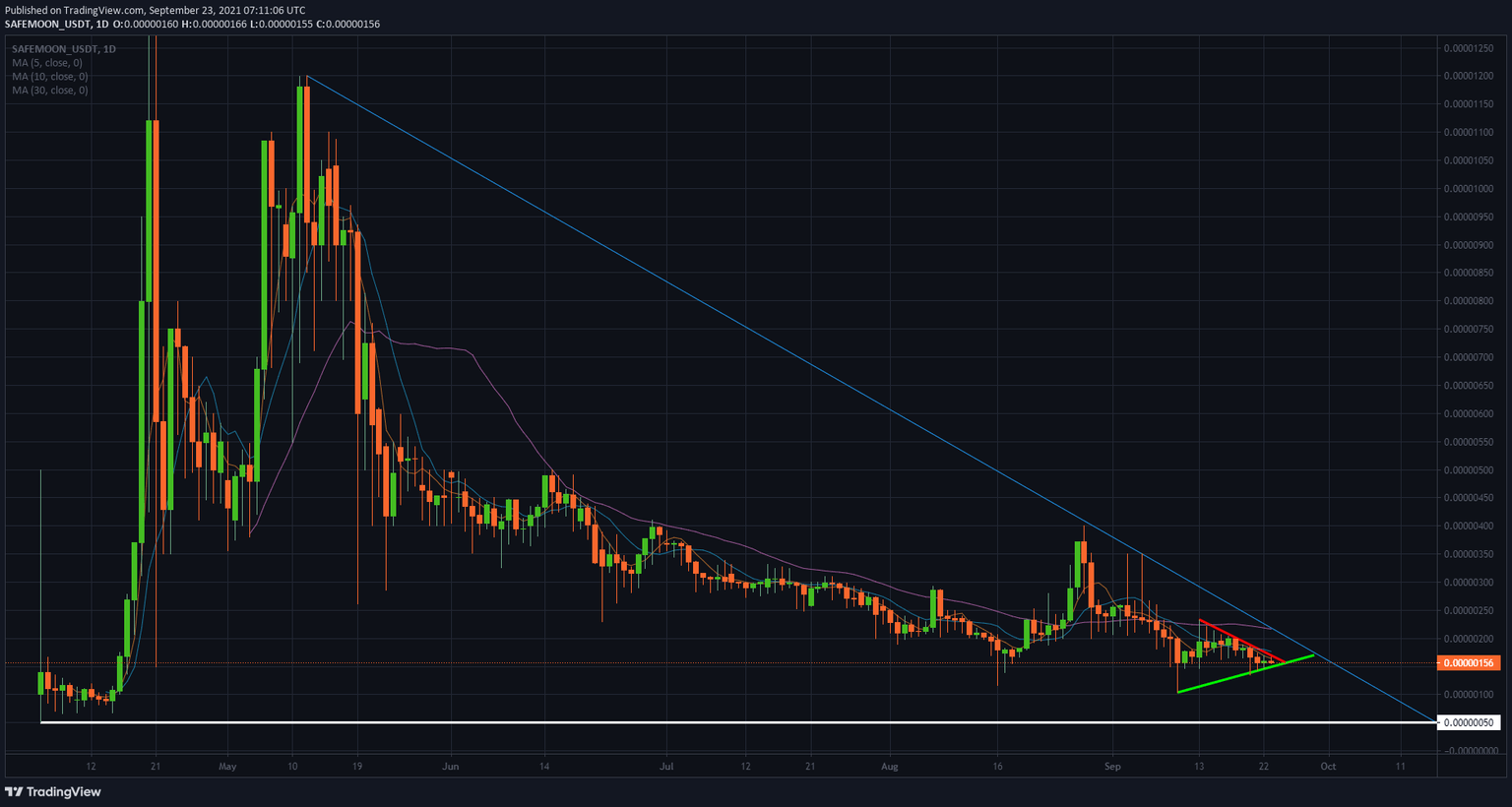

SafeMoon price favors bears with downswing to $0.00000050

- SafeMoon price is still stuck in a pennant around $0.00000150.

- Price action looks to be immune to any significant headwinds or tailwinds in the cryptocurrency markets.

- With the downtrend still intact, expect a break to the downside, favoring the bears.

SafeMoon price (SAFEMOON) has been stuck in a pennant for almost two consecutive weeks now. With the downtrend still very much in play and no accurate signals from bulls trying to make a breakout attempt, expect the unfolding of the pennant to be in favor of the bears. SAFEMOON price could dip to $0.00000050.

SAFEMOON price is targeting $0.00000050 on the downside

SafeMoon price action stays muted with minimal movements. While other crypto and alt-currencies are seeing much more volatility and volume, SafeMoon is one of the outliers, with little swings and volume fading little by little.

SAFEMOON technical setup with the pennant breakout looks to be going either way in favor of bulls or bears. But several elements look to be in favor of the bears. The overall trend is to the downside. Several Simple Moving Averages (SMAs) are spelling more downturn, and any attempt from bulls to try to break out is being matched and reversed the next trading day. Bears are dictating the little volume that is left in SafeMoon.

SAFEMOON/USD daily chart

SafeMoon price favors the downside, which can only result in a retest of $0.00000050, which falls in line with the historical low.

Should SAFEMOON bulls succeed in finding some additional buyers and volume for a squeeze on the short-sellers, expect the first resistance to be the blue descending trend line around $0.00000220. With that said, buyers will need to face many hurdles to get to that level, with all the SMAs and the red descending top line from the pennant as the first issues to be overcome.

Like this article? Help us with some feedback by answering this survey:

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.