Ripple Price Prediction: XRP targets $0.60 after crucial rebound

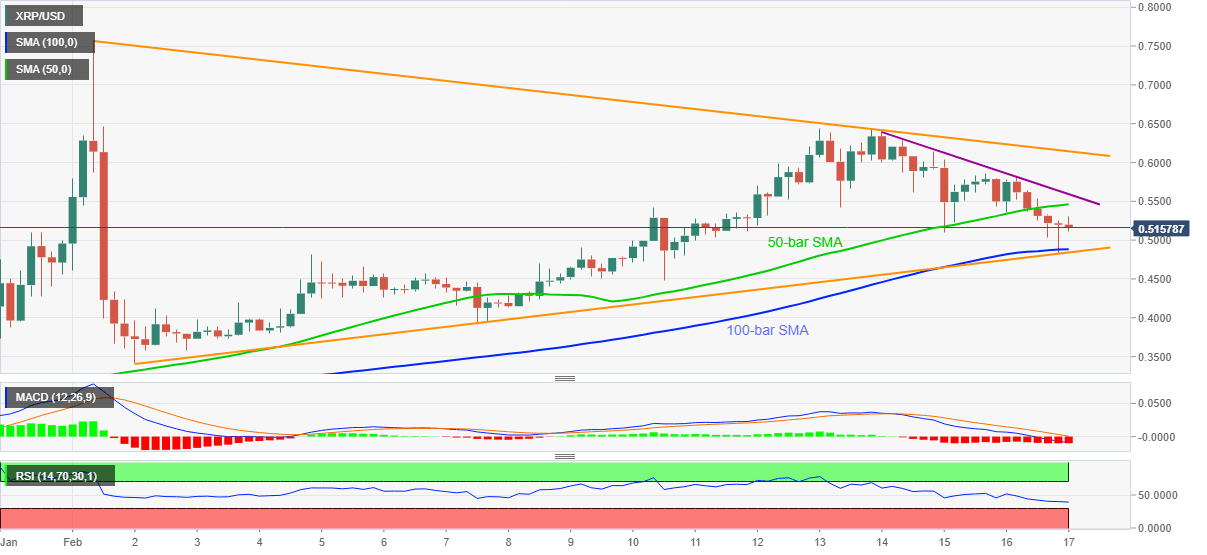

- XRP/USD eases from intraday high, fades bounce off key support confluence.

- Bearish MACD, weak RSI suggests sluggish moves but no harm to the corrective pullback.

- 50-bar SMA, weekly resistance line guard immediate upside.

Ripple consolidates recent gains while witnessing a pullback from the day’s high of $0.5305 to currently down 1.25% near $0.5130 during early Wednesday. It’s worth mentioning that the latest weakness accompanies downbeat MACD and RSI conditions.

Even so, the XRP/USD prices keep the previous day’s recovery moves from $0.4880-40 support confluence comprising 100-bar SMA and an ascending support line from February 02.

As a result, XRP/USD buyers should stay hopeful to clear the immediate hurdles marked by 50-bar SMA and a downward sloping trend line from Sunday, respectively around $0.5460 and $0.5600.

During the quote’s run-up beyond the $0.5600 resistance, the monthly falling trend line near $0.6150 will lure the bulls.

Meanwhile, a downside break of $0.4880-40 support-zone will not hesitate to attack the $0.4000 threshold before directing XRP/USD sellers toward the monthly low of $3405.

XRP/USD four-hour chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.