XRP price rally stalls reflecting potential profit-taking

- XRP hits $2.65, but pares gains amid a crypto rally fuelled by a US-China trade deal.

- Under Paul Atkins's leadership, the SEC will develop a rational regulatory framework for crypto asset markets.

- Atkins said during the Crypto Task Force roundtable that policymaking will not depend on ad hoc enforcement actions.

- XRP drops to test $2.40 support as RSI nears midline, signaling increased bearish momentum.

Ripple (XRP) price trims gains to exchange hands at $2.44 at the time of writing on Tuesday, as the crypto market puts the brakes on the rally triggered by the trade deal between the United States and China, on top of last week's limited bilateral trade agreement with the United Kingdom (UK). The sudden pullback from Monday's highs triggered massive liquidations totaling $35 million in the last 24 hours, according to CoinGlass data. Longs accounted for the lion's share of the liquidations at $22.82 million, hinting at declining trader interest in XRP's short-term price action.

Meanwhile, Securities and Exchange Commission (SEC) Chair, Paul Atkins, said during the Crypto Task Force roundtable on Monday that the Commission needs to keep pace with innovation, calling for regulatory changes to position the United States (US) as the "crypto capital of the planet," as envisioned by President Donald Trump.

SEC to create rational digital asset regulations under Atkins' leadership

The Crypto Task Force roundtable with SEC Chair Paul Atkins discussed varying issues, including the transition of securities from off-chain to on-chain systems, President Trump's commitment to elevating the US as a global cryptocurrency hub, and policymaking and digital assets-focused regulations.

Atkins said that the agency has for a long time suffered due to "policymaking siloes," a situation he is keen on changing to ensure regulations are on par with innovation. With the help of the Crypto Task Force, Atkins believes the "Commission can establish clear and sensible guidelines for distributions of crypto assets that are securities or subject to an investment contract."

Chairman Paul Atkins' remarks at the Crypto Task Force roundtable on tokenization:

— U.S. Securities and Exchange Commission (@SECGov) May 12, 2025

The topic of this afternoon’s discussion is timely as securities are increasingly migrating from traditional (or “off-chain”) databases to blockchain-based (or “on-chain”) ledger systems.

Atkins revealed his intentions for the Commission, promising that "policymaking will no longer result from ad hoc enforcement actions." Instead, the agency will focus on developing fit-for-purpose standards for market participants.

The Chair's remarks come after Ripple and the SEC agreed to settle the longstanding lawsuit. Ripple will pay $50 million in penalties to the agency, significantly lower than the $125 million fine imposed by the court last year. The two parties also agreed to drop their respective appeals in the case, effectively resolving the lawsuit that began in December 2020.

XRP uptrend stalls as profit-taking ramps up

XRP's price extended the previous week's uptrend, reaching highs of $2.65 on Monday before correcting to trade at $2.44 at the time of writing. The cross-border money remittance token gained traction amid renewed risk-on sentiment, as investors welcomed trade talks between the US and China.

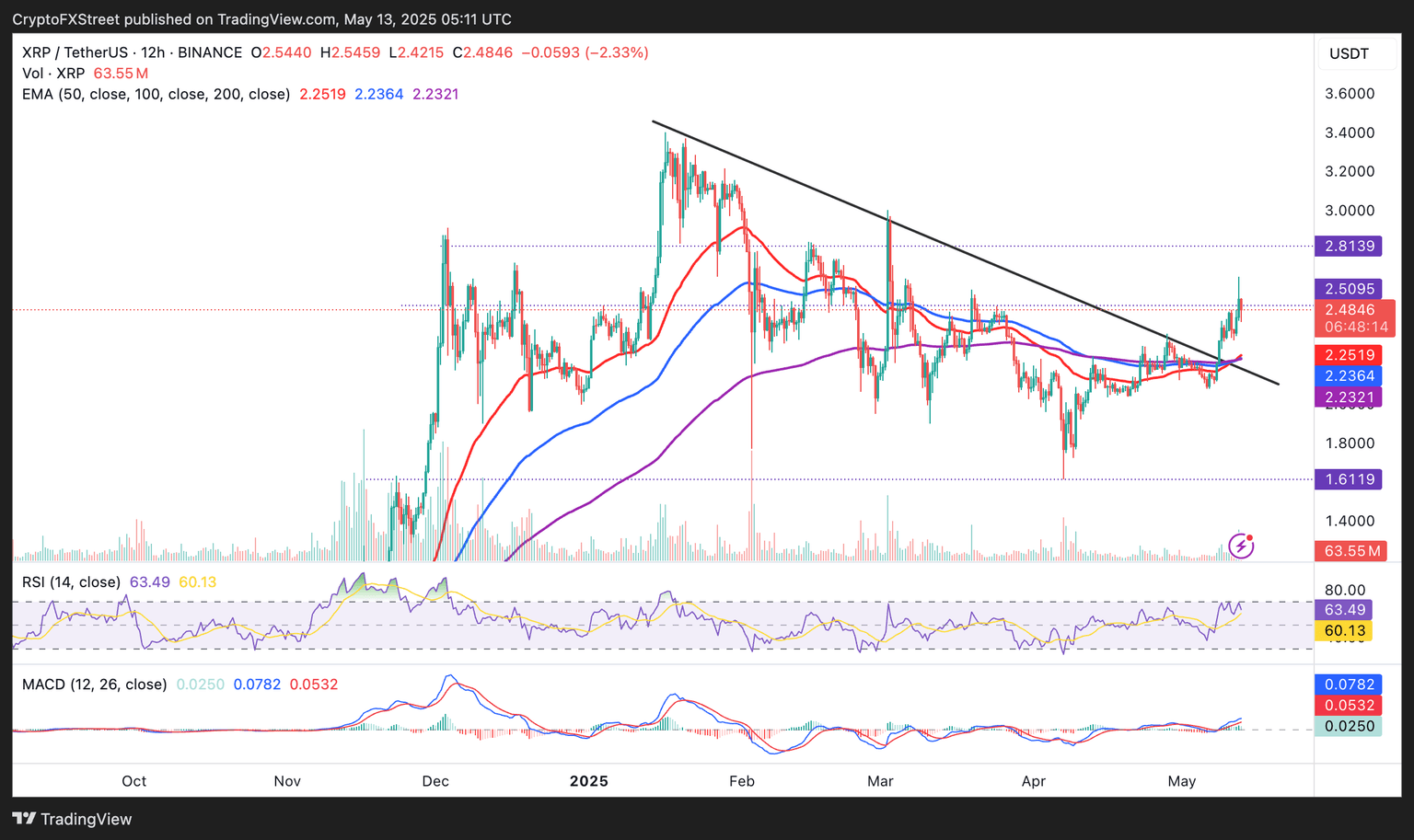

Based on the 12-hour chart, XRP sits significantly above key moving averages, including the 50-, 100- and 200 Exponential Moving Average (EMA), forming a confluence support around $2.23.

The Relative Strength Index (RSI) indicator's rejection from near overbought territory to 63.17 exemplifies a strong bearish momentum. If the indicator slides toward the midline, the path with the least resistance could stay downwards, risking the progress made over the last week.

Beyond the immediate support at $2.40, the confluence area around $2.23, and the critical level at $2.20 would come in handy to absorb the potential selling pressure as traders adjust positions due to changing dynamics.

XRP/USDT 12-hour chart

Notably, the Moving Average Convergence Divergence (MACD) indicator upholds the buy signal sent on Thursday. This, along with the MACD line (blue) divergence above the signal (red) and the green histograms, suggests that it's not over for the bulls as they could still push for a trend continuation above the short-term support at $2.40. Targets on the upside include the supply zone at $2.80, tested as resistance in February and the psychological level at $3.00, tested last in March.

Ripple (XRP) price trims gains to exchange hands at $2.44 at the time of writing on Tuesday, as the crypto market puts the brakes on the rally triggered by the trade deal between the United States and China, on top of last week's limited bilateral trade agreement with the United Kingdom (UK).

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren